EBC Markets Briefing | Dollar treated differently from US equities

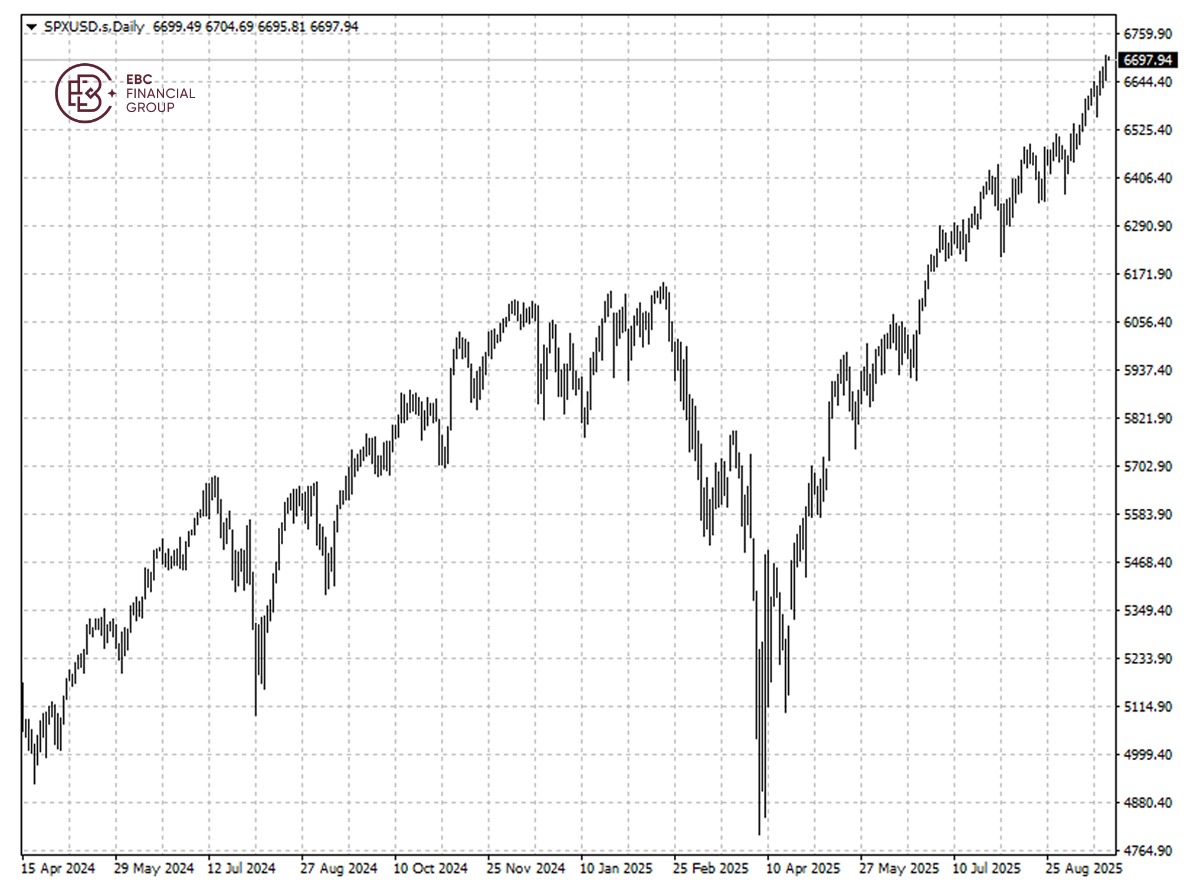

US stocks has been on a record-breaking stretch, led by gains in technology shares following Fed's latest decision. Policymakers will cut interest rates by as much as 1.5 ppts by the end of next year, said CitiBank.

Nvidia will invest up to $100 billion in OpenAI as the AI lab sets out to build hundreds of billions of dollars in data centres based around the chipmaker's AI processors, the companies said on Monday.

Despite stronger-than-expected Q2 earnings, the bullish tone was tempered by confirmation that Nvidia recorded no H20 sales to China during the quarter. It shares have seen gains of roughly 37% this year.

The Russell 2000 has outperformed the S&P 500 over the past six months, reflecting improved fundamentals. Morgan Stanley predicted a transition of the economy to a so-called "early cycle" stage.

Softening labour market casts a shadow on blueprint to make America great again. The 106,000 posts added from May to July marked a plunge from the 380,000 added in the previous three months.

The OECD in its latest report forecast US growth would slow to 1.8% in 2025 before easing to 1.5% in 2026, adding the full brunt of the US import tariff shock is still to be felt worldwide.

Last month, 71% of manufacturers questioned by the Dallas branch of the Fed said the tariffs had already had a negative impact on their business, raising the cost of resources and hurting profits.

Herd effect

UBS Global Wealth Management strategists lifted its year-end target to 6,600 for the S&P 500, betting on corporate earnings strength, easing trade tensions and expectations of interest-rate cuts.

However, they maintained their "neutral" stance on the market, given "the market may be pricing in a lot of optimism already on trade developments, lack of near-term catalysts, and elevated valuations".

HSBC raised its forecast to 6,50 earlier this month with an especially bullish view on technology and financials, on the back of stronger-than-expected Q2 corporate earnings and a 'modest' impact from tariffs.

The S&P 500 could exceed 7,100 for the second half of 2026 as historical patterns showing "reset cuts" (those after a long pause within a cutting cycle) have a median 12-month-forward return of 13%, RBC Capital Markets said.

The bank also observed "slippage in the rate of upward EPS estimate revisions for the S&P 500," noting that momentum is concentrated in the top 10 market-cap names – a sign of divergence.

Goldman Sachs raised its year-end target to 6,800 as it cited a dovish Fed and resilient corporate earnings. Earlier this year, major brokerages had cut their targets below 6,000, which turned out to be a fiasco.

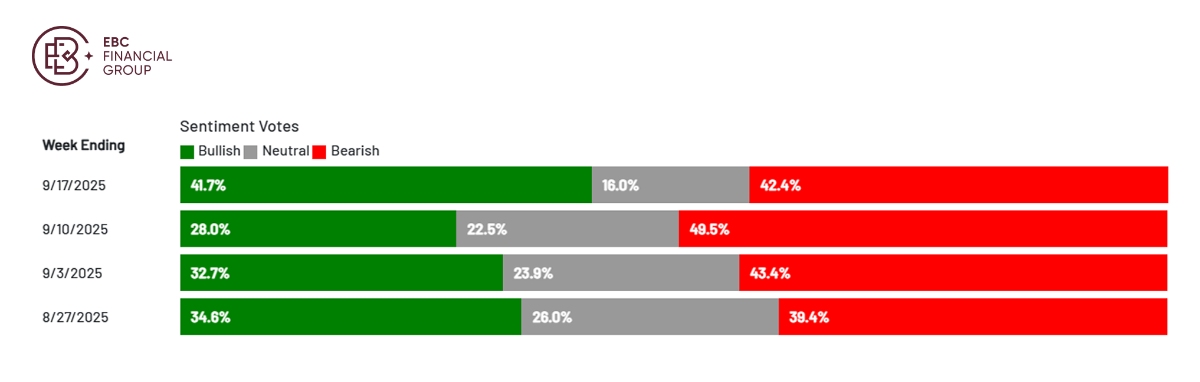

Bullish sentiment among individual investors surged to the level not seen since 2 July, according to the latest AAII Sentiment Survey. Still there were slightly more bearish respondents.

Short dollar

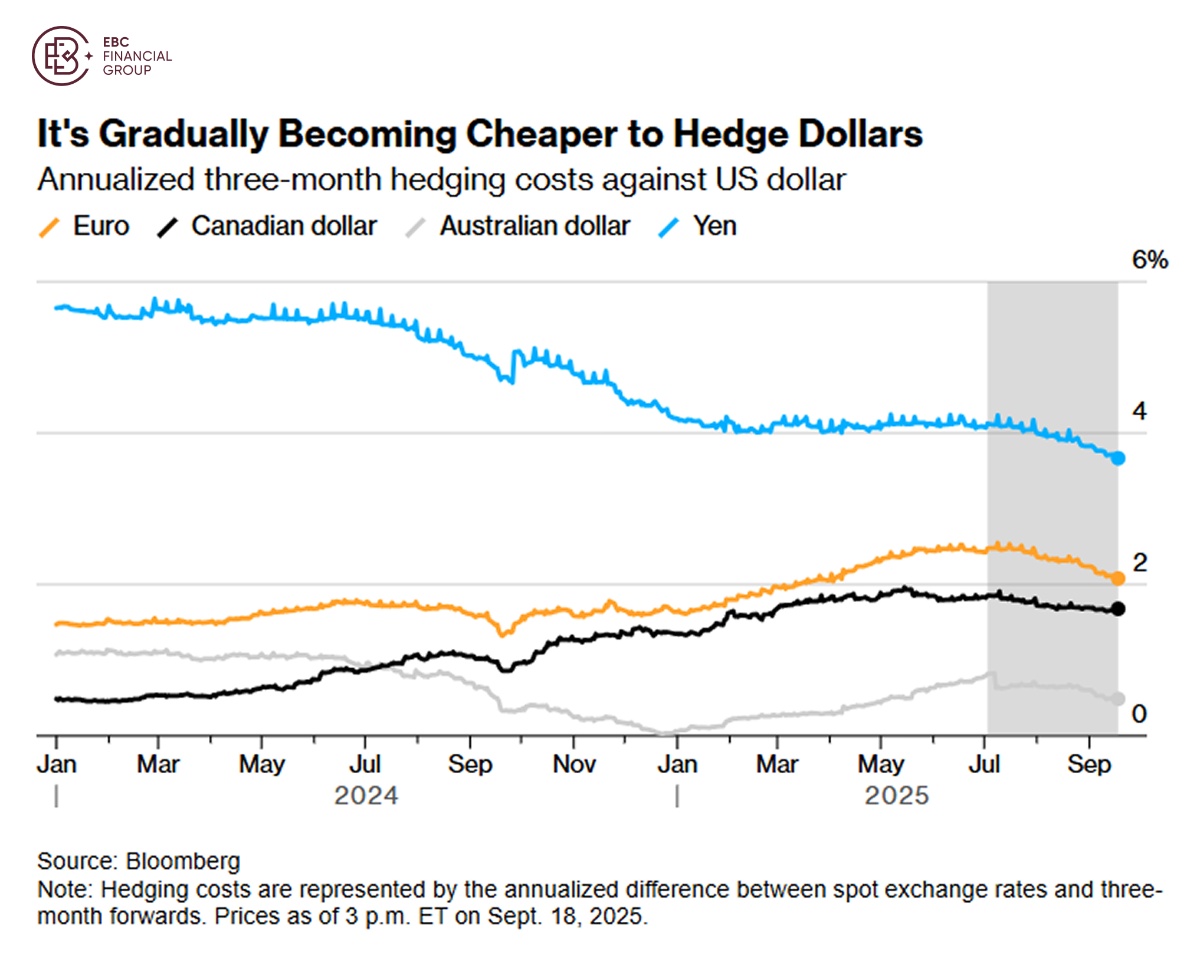

While individuals and professional have shifted ground, "Hedge America" are deemed necessary now. The strategy involves protecting portfolio against any further declines in the dollar.

Starting around mid-year, and for the first time this decade, flows into dollar-hedged ETFs that buy US assets have outpaced those into unhedged funds, according to Deutsche Bank.

A chorus of banks anticipate the hedging will weigh on the dollar heading into next year. Money managers are actively seeking shelter elsewhere, like in the Swiss franc, and the yen and gold.

A BofA survey this month of 196 global fund managers overseeing about $490 billion showed that 38% of respondents said they're looking to increase the currency hedge— the highest level since June.

"Foreigners are unlikely to sell US assets — they are most likely to increase the hedge ratio," said Lee Ferridge, a strategist at State Street. "The hedge ratio is crucial for the dollar story."

At EBC, you can replicate the strategy by long positions in a major US stock index and short positions in the greenback against local currency. By that means, the return will be less impacted by forex move.

The Trump's administration is pushing for more rate cuts. Apart from an apparent intention of lowering funding costs across the board, he could be conceiving the idea of prompting trade balance by reducing export prices.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.