Equity rally loses steam, dollar slips too; Powell eyed for fresh cues

Stocks struggle as trade euphoria fades

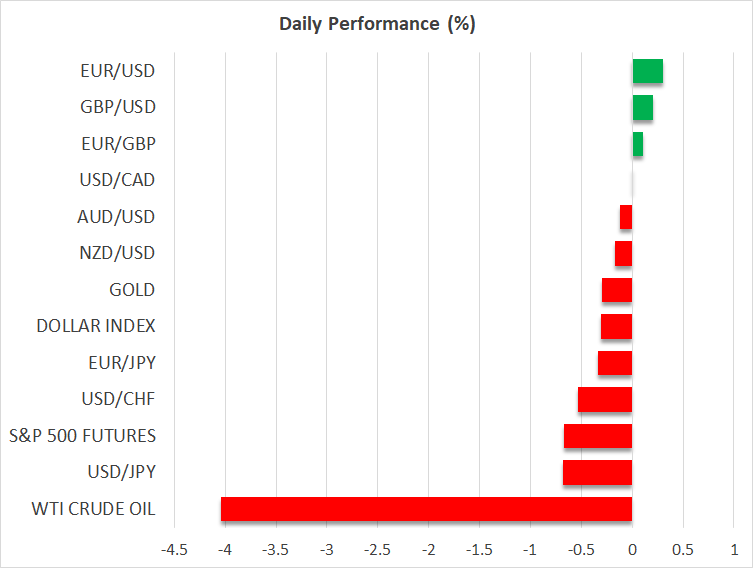

Equity markets were mostly in the red on Thursday, as the euphoria over the US-China tariff truce faded somewhat. Nevertheless, most stock indices have recouped all or nearly all of their post-Liberation Day losses and some consolidation is in order as investors await further updates on the trade front.

With the earnings season also drawing to a close, there’s been a marked drop in new catalysts in the second half of the week, although there are some exceptions. Several chip stocks were lifted on Wednesday from the deals secured by President Trump on his trip to the Middle East.

Nvidia and AMD are among the biggest beneficiaries, while separately, Super Micro Computer signed a $20 billion deal with a Saudi data centre firm. Nvidia and AMD stocks jumped by more than 4%, and Super Micro Computer surged 15.7%. Boeing was another winner as it was awarded a $96 billion deal by Qatar Airways, but its stock could only manage modest gains at the close.

The boost to the broader markets was also limited, with the Nasdaq 100 rising just 0.6% and the S&P 500 ending more or less flat. E-mini futures are in the red today, with shares across Europe and Asia also falling.

Focus shifts to US data and Powell speech

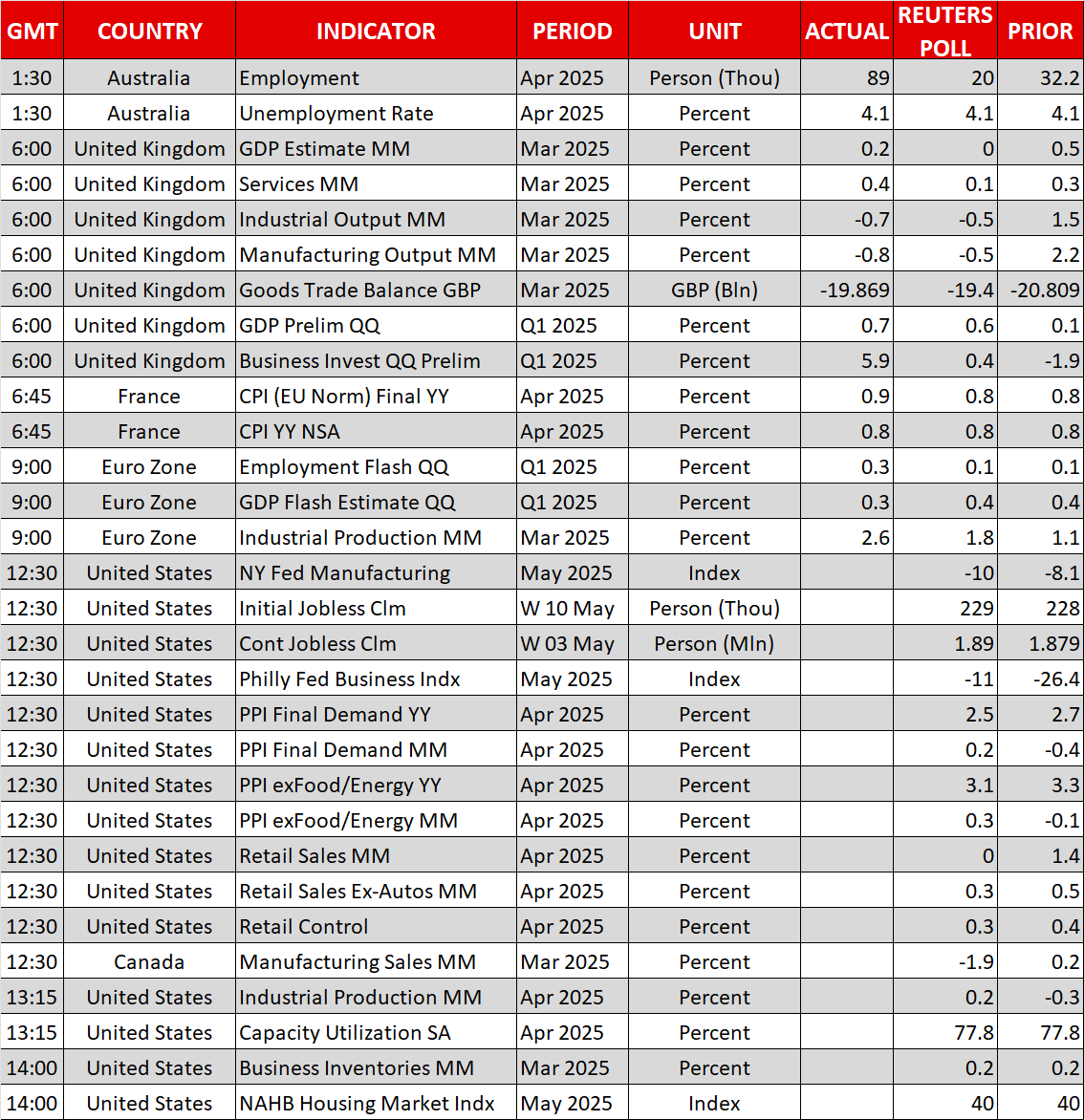

Retailers will likely be taking the spotlight today as Walmart will report its quarterly earnings before the market open, while US retail sales figures will be watched ahead of that. US consumers are thought to have cut back on their spending in April amid all the tariff havoc. April producer prices are also on the agenda.

However, the main focus will be on any remarks on monetary policy by Fed Chair Jerome Powell, as he’s due to speak at 12:40 GMT. The latest commentary from other Fed policymakers suggests there’s no change to the central bank’s neutral stance despite last week’s soft CPI report.

Dollar back under pressure

Meanwhile, the US dollar has come under pressure again today, maintaining a downward rollercoaster trajectory following Monday’s bump up. The dollar’s performance lately has been at odds with Treasury yields, which climbed near their pre-trade war levels on the back of the receding expectations about aggressive Fed rate cuts.

But the greenback remains mired in all the Trump-related uncertainty, the latest one being speculation that the White House prefers a weaker currency. It comes after it emerged that US and South Korean officials met last week to hold discussions on the exchange rate between the dollar and won as part of the ongoing trade negotiations between the two countries, although US sources have sought to disprove this.

Euro and pound edge up, but aussie down

The euro is one of the better performing currencies today, edging back above $1.12, which may seem questionable given that it’s unlikely that the EU and US will be able to reach a trade deal quickly. The pound is up too, receiving only a modest boost from stronger-than-expected Q1 GDP numbers out of the UK today.

But the Australian dollar is on the backfoot, with investors shrugging off an upbeat employment report. April’s solid jump in new jobs is unlikely to deter the Reserve Bank of Australia from cutting rates next week but policymakers may not sound as dovish.

Gold’s losses deepen, oil turns lower too

Gold is extending its weekly slide today after breaking below $3,200 yesterday. The halt in the dollar’s bounce back is not of much support to the precious metal this week amid the significant de-escalation in trade tensions in recent days. However, there may be some boost for gold should talks between Russia and Ukraine due to take place in Turkey later today not make much progress.

Oil prices are not bucking the trend either and are currently trading down by around 4.0%. Growing optimism that the US and Iran are close to reaching a deal on the latter’s nuclear ambitions is weighing on oil futures on the expectation that it would lead to a lifting of sanctions on Tehran’s oil exports.

.jpg)