GBPUSD retreats after spike; BoE Steady, Fed cuts

GBPUSD experienced a sharp two-month spike, reaching 1.3725 during Wednesday’s session, before swiftly retracing its gains. This volatility comes amid diverging central bank actions, with the BoE widely expected to maintain its key interest rate today, following the Federal Reserve’s decision to cut borrowing costs for the first time since December.

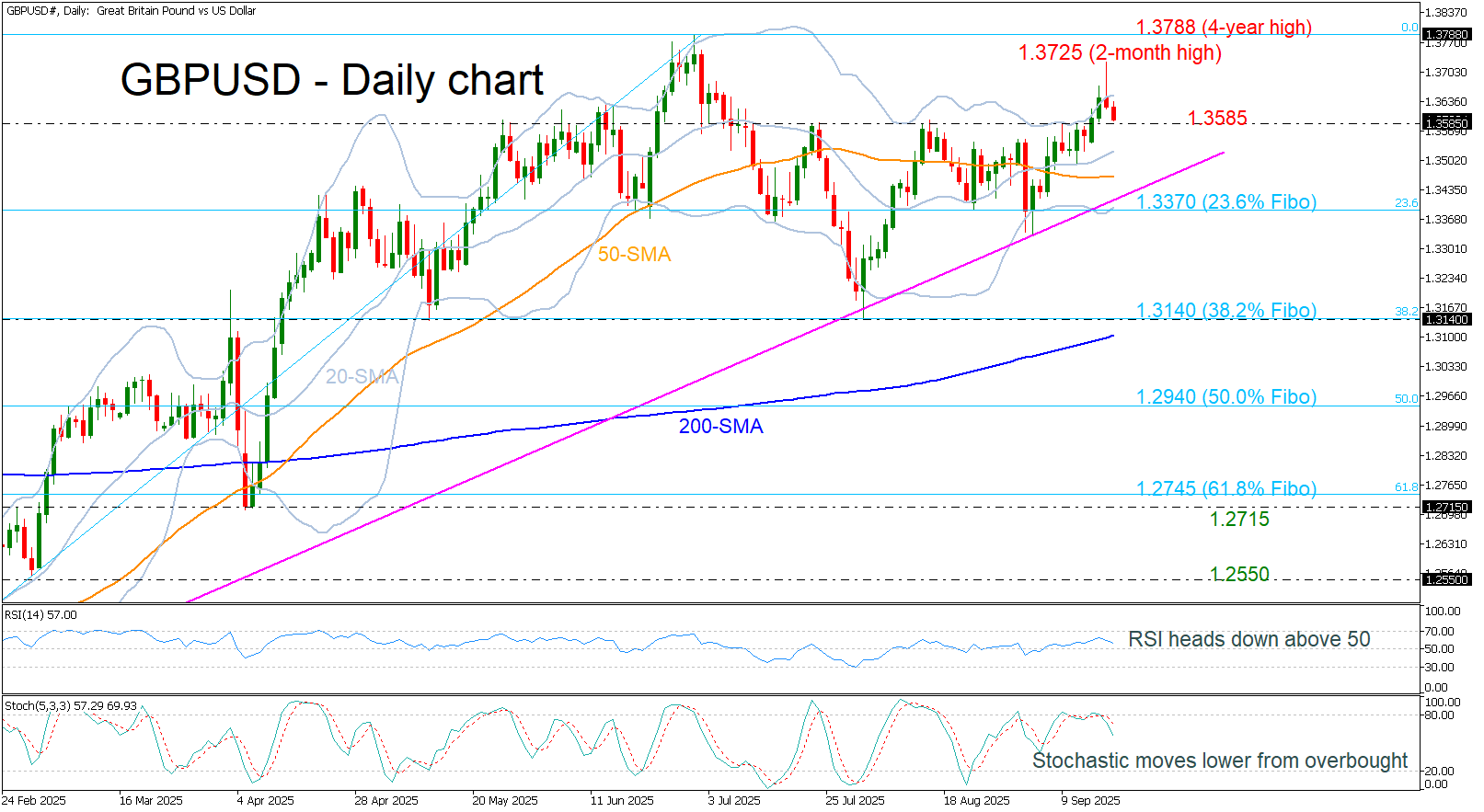

The pair briefly surged above the upper Bollinger Band but failed to secure a daily close above it, indicating potential exhaustion in bullish momentum. The immediate support level at 1.3585 is now in focus. A break below this could expose the mid-Bollinger Band at 1.3525, followed by the 50-day simple moving average (SMA) at 1.3465, both of which may act as buffers against further downside.

On the upside, a rebound from 1.3585 could re-ignite bullish interest, targeting the recent four-year high of 1.3788. However, the July 2021 peak at 1.4000 remains a significant resistance level and may prove difficult to overcome without a strong catalyst.

Momentum indicators suggest a weakening bullish bias. The RSI is trending lower but remains above the neutral 50 threshold, while the stochastic oscillator has formed a bearish crossover in the overbought zone, reinforcing the likelihood of a near-term pullback.

Summarizing, GBPUSD retains a bullish undertone in the broader trend, but the failure to close above key resistance and emerging bearish signals from momentum indicators suggest caution. Traders should monitor the 1.3585 support level closely, as a decisive move below it could shift the very short-term bias to bearish.

.jpg)