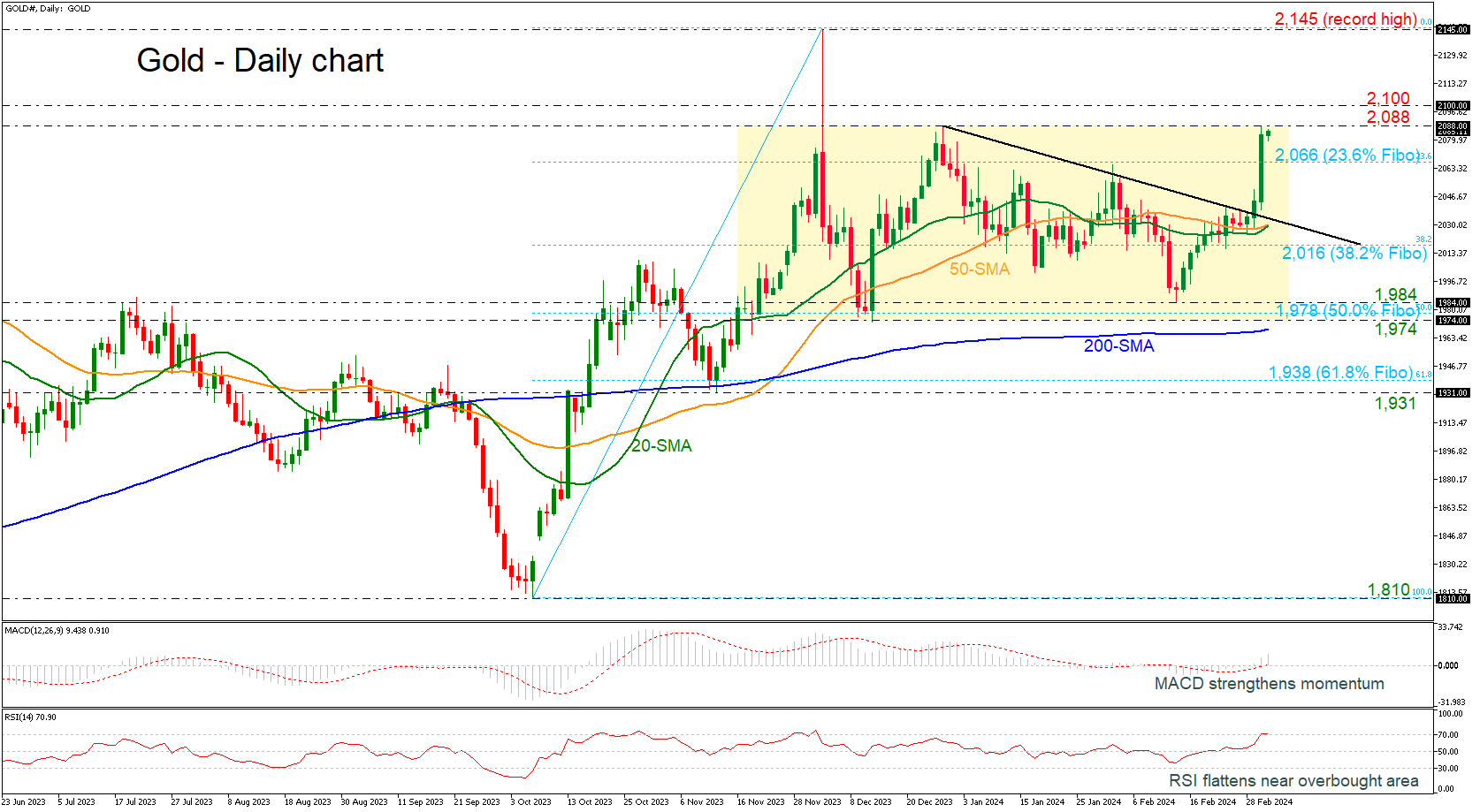

Gold rally pauses at 2,088 after strong bullish move

Gold prices posted an impressive bullish rally in the preceding week, touching the upper boundary of the medium-term trading range at 2,088 and penetrating the downtrend line to the upside.

The technical oscillators are confirming this view. The MACD is strengthening its momentum above its trigger and zero lines, while the RSI is holding near the overbought area, indicating that after the upside move, a bearish correction may be on cards.

In case the pair extends its short-term direction to the upside, the bulls will probably challenge the 2,100 resistance level. Further up, the area around the previous all-time high of 2,145 could be another potential obstacle for upward movements towards the next psychological numbers such as 2,200 and 2,300.

Alternatively, any declines may drive the price towards the immediate support of the 23.6% Fibonacci retracement level of the up leg from 1,810 to 2,145 at 2,066 before the 20- and the 50-day simple moving averages (SMAs) comes into view. Beneath the latter, the 38.2% Fibonacci of 2,016 could be another level in focus ahead of the 1,974-1,984 region, which encapsulates the lower boundary of the channel.

Summarizing, the precious metal maintains a neutral bias in the medium-term picture, despite the latest strong upside move.

.jpg)