The crypto market gets a boost from stocks

Market Picture

The crypto market has gained 2.1% in the last 24 hours to reach $2.08 trillion. The rise in the stock market has brought buyers back to Bitcoin, which has positively impacted cryptocurrencies. The sentiment index is still in the fear zone, but at 45, it is already close to neutral territory. This shows that it is lagging stocks where sentiment has shifted to 'greed'.

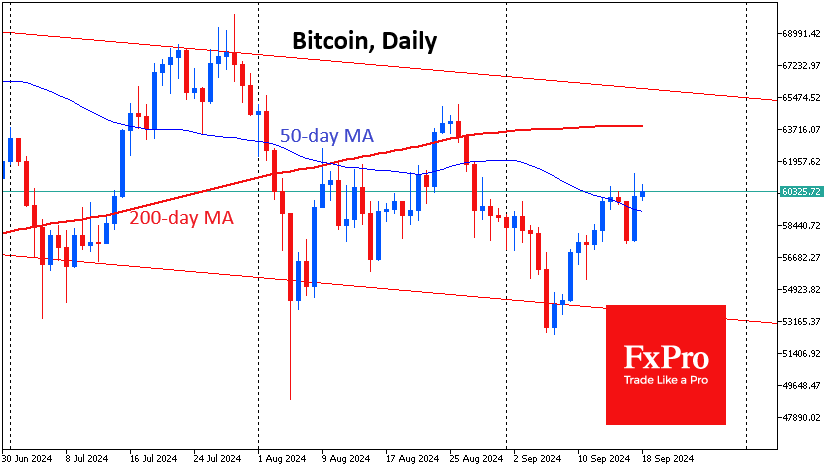

Bitcoin surpassed $60K, accelerating sharply at the start of the US session. The price peaked at $61.3K before retreating to $60.4K at the time of writing. Despite some pullback, bitcoin has broken above its 50-day moving average, suggesting significant upside potential. However, it isn't easy to rely on today's technical picture ahead of the Fed's interest rate decision on Wednesday evening. The next important level is likely to be around the $64K, where the late August high and the 200-day average are located.

News Background

JPMorgan sees bitcoin hash rate growth slowing as miner revenues remain at historic lows. Meanwhile, US Bitcoin miners' share of the network hash rate rose for the fifth consecutive month to 26.7%, an all-time high.

MicroStrategy will place $700 million in four-year unsecured convertible notes to acquire additional bitcoins and fund general corporate purposes.

According to Arkham, the Bhutanese government's bitcoin holdings amount to 13,036 BTC ($770 million), almost three times El Salvador's reserves. The country has the world's fourth-largest stockpile of BTCs, derived from mining by a sovereign wealth fund.

The crypto industry is no longer able to provide 'dopamine' to either developers or traders. That is why it is in crisis, said CryptoQuant CEO Ki Young Ju. According to him, the crypto industry is gradually turning into a 'gambling den'.

Developers Curve Finance and TON Foundation will create a platform for trading stablecoins on the TON blockchain. The new initiative will meet the growing demand for stablecoins and increase the liquidity and popularity of the network's Web3 ecosystem.

The Trump family officially announced their cryptocurrency project, World Liberty Financial, which has been talked about for two months, and announced the upcoming WLFI token sale.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)