US housing market slowdown as a recession harbinger

US housing market slowdown as a recession harbinger

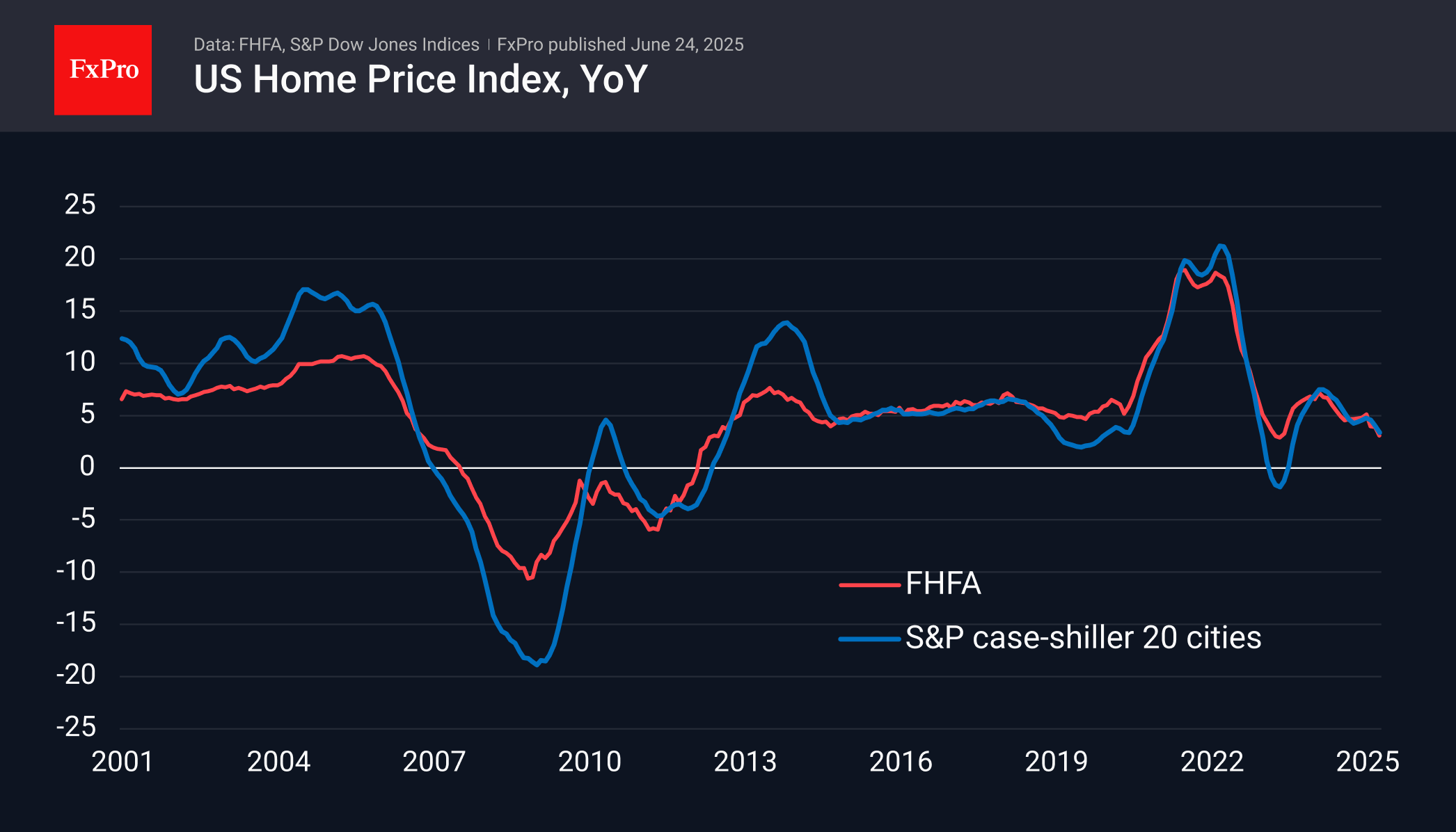

The pace of housing price growth in the US slowed in April, according to lagging but broad data from S&P Global. Annual price growth slowed to 3.4% y/y, the lowest in nearly two years. More importantly, the last two months have seen an actual decline, not just a slowdown in growth, indicating a cooling of demand.

Beyond the price volatility associated with the effects of lockdowns, such a slowdown was only seen before the global financial crisis, but before that, the market had been overheating for years. The situation is different now, and we can talk about a dangerous slowdown in the market. This is a consequence of economic uncertainty, which has sent consumer sentiment into a tailspin, or overly tight monetary policy, and looks like a threatening sign of a looming broad recession that will not be so easy to fix with money.

Interestingly, Trump is calling on the Fed to ease its policy, which would be good for the economy and the housing market. At the same time, Powell hints that the uncertainty caused by the US president's administration is the main threat. While they argue and stick to their policies, the housing market suffers, and by the end of this year, the situation promises to degenerate into a recession that will require much more than a couple of key rate cuts.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)