USDCAD steadies as markets brace for US jobs report impact

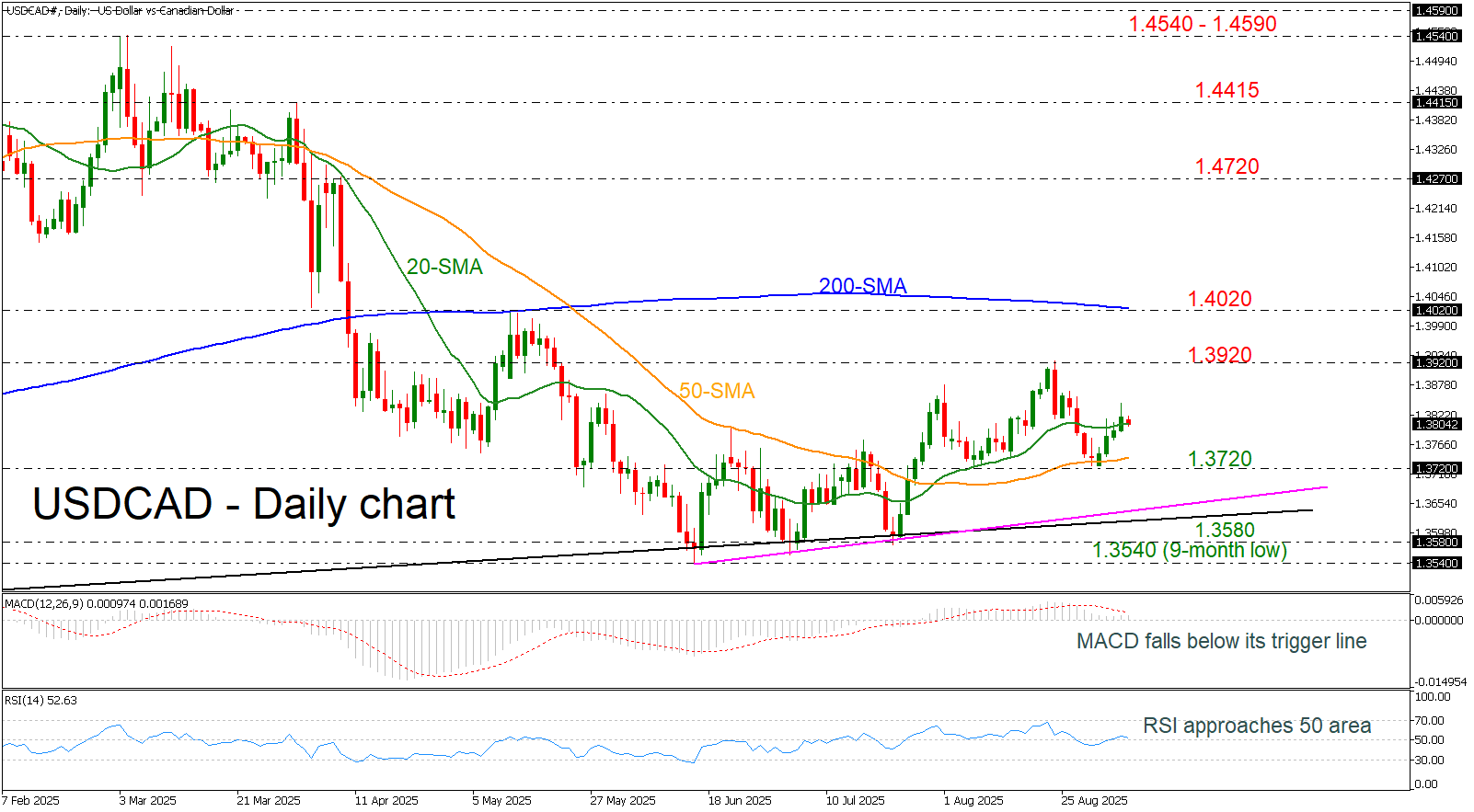

USDCAD has rebounded from the 1.3720 support level, climbing above both the 50-day and 20-day simple moving averages (SMAs). The price action remains comfortably above both the short- and long-term ascending trendlines, reinforcing the broader bullish structure. Market participants are now turning their attention to the upcoming US jobs report for August, which could influence expectations around a potential Federal Reserve rate cut later this month.

Despite the recent upside, technical indicators are signaling a possible short-term pullback. The MACD is trending lower beneath its signal line, while the RSI is edging down toward the neutral 50 level, suggesting waning bullish momentum.

Should the pair retreat, initial support is likely to emerge at the 50-day SMA near 1.3720. A deeper correction could bring the price toward the confluence of trendlines around 1.3630, a level that may act as a critical pivot for the medium-term outlook.

On the upside, sustained bullish momentum could drive the pair toward the recent high of 1.3920. A break above this level would open the door to the 200-day SMA, which aligns with the 1.4020 resistance zone. A successful breach of this area would confirm a renewed bullish wave and potentially signal a continuation of the broader uptrend.

Summarizing, USDCAD remains technically supported above moving averages and trendlines, but momentum indicators suggest a possible near-term pause or retracement. The upcoming US employment data may be pivotal in shaping short-term direction.

.jpg)