- Strona główna

- Społeczność

- Doświadczeni handlowcy

- Technical & Fundamental Analysis by Sold ECN Securities

Advertisement

Edit Your Comment

Technical & Fundamental Analysis by Sold ECN Securities

Uczestnik z Dec 08, 2021

330 postów

Feb 15, 2022 at 07:37

Uczestnik z Dec 08, 2021

330 postów

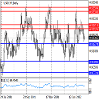

USDJPY market insight by Solid ECN Securities

The US dollar holds its previous positions.

The yen continues to be a shelter asset as the situation in Eastern Europe remains tense and forces investors to look for alternatives to their traditional portfolios, which have recently been characterized by high-risk demand. In turn, the US dollar is also quite attractive for market participants, given the prospects for an increase in the US Federal Reserve interest rate this year.

The macroeconomic statistics provides moderate support for the yen on Tuesday. Thus, Japan's Q4 GDP grew after a decline of 0.9% last month, although analysts expected the national economy to grow by 1.4%.

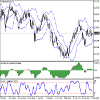

Support and resistance

On the daily chart, Bollinger bands reverse in the horizontal plane: the price range remains practically unchanged, indicating an ambiguous nature of trading in the short term. MACD falls, showing a poor sell signal (the histogram is below the signal line). Stochastic keeps a confident downward trend but is rapidly approaching its lows, indicating that the dollar may become oversold in the ultra-short term.

Resistance levels: 115.67, 116, 116.34, 117.

Support levels: 115, 114.5, 114, 113.5.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 15, 2022 at 08:33

Uczestnik z Dec 08, 2021

330 postów

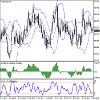

Gold market insight by Solid ECN Securities

Investors build up positions in gold again

Gold is trading near the three-month high due to increased demand for shelter assets. At the moment, the metal quotes have broken the level of $1,850 per ounce and are trying to consolidate above it.

The upward dynamics in the asset is the reaction of investors to the likelihood of an imminent increase in the US Federal Reserve interest rate against the backdrop of rising annual inflation, which last month rose to a record high for 40 years and amounted to 7.5%.

Traders fear that instead of the expected 0.25%, the agency will immediately increase the figure by 0.50% or even more to prevent the continuation of negative dynamics with consumer prices in the country. Experts note that this could lead to a sharp drop in the bond and stock markets, which will turn into even more problems for the regulator. The bond market is at its peak in 2019, and the yield on 10-year US Treasuries is already close to 2%, amounting to 1.960%. Investors no longer believe in the further growth of securities and opt for gold, noting that the US Federal Reserve cannot stop the emerging negative trend, and as a result, the agency will again resort to measures to stimulate the economy.

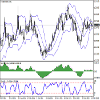

Support and resistance

On the daily chart, the price has left the global sideways channel and is now trying to renew the high of the last year. Technical indicators keep a buy signal: fast EMAs on the Alligator indicator are above the signal line, and the AO oscillator histogram is confidently trading in the buy zone, forming new rising bars.

Support levels: 1861, 1830.

Resistance levels: 1890, 1940.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 16, 2022 at 08:04

Uczestnik z Dec 08, 2021

330 postów

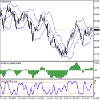

EURUSD market insights by Solid ECN Securities

Correction after lowering geopolitical risks

The EURUSD pair slightly declines during the Asian session, correcting after strengthening positions yesterday, which was due to positive signals about the return of some Russian military personnel to their places of deployment after conducting exercises on the borders with Ukraine, so the risks of further escalation of political tension in the region have noticeably decreased.

Investors follow the macroeconomic statistics, which set the dynamics of the movement of the trading instrument earlier. In particular, data on employment and economic sentiment were published yesterday. Thus, the EU Q4 employment rate corrected from 1.0% to 0.5%, only 0.1% better than market expectations!

At the same time, the ZEW study recorded a milder decline in economic sentiment in the EU for February, while market forecasts suggested a sharp decline. In turn, the sentiment index in the German business environment in February increased from 51.7 to 54.3 points.

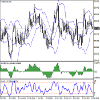

Support and resistance

Bollinger Bands show a moderate increase on the daily chart: the price range narrows, reflecting the ambiguous nature of trading in the nearest time intervals. MACD is falling, keeping a poor sell signal (the histogram is below the signal line). Stochastic rebounded from the level of 20 and reverses into an upward plane, indicating the risks of corrective growth in the ultra-short term.

Resistance levels: 1.1367, 1.14, 1.145, 1.15.

Support levels: 1.13, 1.1255, 1.122, 1.1185.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 16, 2022 at 08:24

Uczestnik z Dec 08, 2021

330 postów

GBPUSD Market insights by Solid ECN Securities

Development of flat dynamics in the short term.

GBPUSD has shown a poor upward trend against the US currency during the morning session, holding near the level of 1.355. Since the beginning of the month, it has been developing a generally flat dynamic in the short term. The instrument reacted insignificantly due to the improvement in the geopolitical situation in Eastern Europe after there were signs of a resolution of the tense situation solely from the standpoint of diplomacy.

Yesterday, the market focused on macroeconomic statistics from the UK. Thus, the indicator of average wages for December, excluding bonuses, slightly corrected which is better than market forecasts. In turn, wages, taking into account bonuses for the same period, increased, contrary to analysts' expectations of a slowdown to 3.9%. Jobless claims fell by 31.9K for January, while the unemployment rate for December was unchanged.

Support and resistance

Bollinger Bands show a moderate increase on the daily chart: the price range narrows, indicating an ambiguous nature of trading in the short term. MACD falls, keeping a poor sell signal and below the signal line. Stochastic shows similar dynamics and rapidly approaches its lows, indicating that GBP may become oversold in the ultra-short term.

Resistance levels: 1.3565, 1.36, 1.365, 1.37.

Support levels: 1.35, 1.346, 1.3435, 1.34.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 16, 2022 at 09:20

Uczestnik z Dec 08, 2021

330 postów

Gold market insight by Solid ECN Securities

Price retreated from all-time highs

Gold quotes are consolidating near the level of 1850 after a noticeable decline yesterday, when the XAUUSD pair retreated from its all-time highs since June 2021. On Tuesday, demand for safe assets declined noticeably after forecasts of upcoming hostilities in Eastern Europe did not come true. The Russian authorities announced the withdrawal of part of the troops to their places of deployment after military exercises in Belarus and diplomatic negotiations with interested parties. Against this background, investors switched their attention to other drivers, particularly to macroeconomic statistics from the United States.

Thus, traders monitor the dynamics of retail sales and industrial production. It is assumed that the figure may increase by 2% from 1.9% last month. Forecasts for the dynamics of industrial production are also positive and suggest an increase of 0.4% from the December value of 0.1%.

Support and resistance

On the daily chart, Bollinger Bands show a steady growth: the price range changes slightly but remains quite spacious for the current level of activity for the instrument. MACD grows, keeping a weakening buy signal (the histogram is above the signal line). Stochastic retreats from its highs, signaling in favor of the development of corrective dynamics in the ultra-short term.

Resistance levels: 1860, 1868, 1879, 1890.

Support levels: 1847, 1840, 1831, 1823.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 16, 2022 at 13:39

Uczestnik z Dec 08, 2021

330 postów

AUDUSD Market insight by Solid ECN Securities

There is neutrality between the currencies in the pair

The AUDUSD pair corrects within a sideways trend amid the stabilization of the American currency and is currently trading around 0.7152.

The Australian dollar shows relative stability, which was reinforced by yesterday's monetary policy report from the Reserve Bank of Australia (RBA). According to the regulator, the outbreak of the Omicron coronavirus strain affected the pace of economic recovery but did not undermine its growth.

The USD Index currency also does not show a directional trend, and for the third day, it has been trading within a new narrow range near the level of 96, reached after an unscheduled meeting of the US Federal Reserve last Monday. As for macroeconomic data, the dollar was locally supported by the January report on the producer price index, which rose by 1.0% MoM and reached 9.7% YoY. The core producer price index, which excludes food and energy, added 8.3% YoY, better than the 7.9% expected by the market.

Support and resistance

On the global chart, the price moves within the local channel. Technical indicators are in a state of uncertainty: indicator Alligator's EMA fluctuations range narrowed almost completely, and the AO histogram, being in the sell zone, continues to form rising bars.

Resistance levels: 0.719, 0.7295.

Support levels: 0.7092, 0.698.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 17, 2022 at 06:50

Uczestnik z Dec 08, 2021

330 postów

USDCAD market insight by Solid ECN Securities

The instrument develops flat dynamics

The US dollar is again trading with upward dynamics against the Canadian currency during the Asian session, testing 1.27 for a breakout.

Considerable support for the US currency is provided by macroeconomic statistics from the US on consumer inflation published the day before.

Support and resistance

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is changing slightly, but remains rather spacious for the current level of activity in the market. MACD is trying to reverse upwards keeping a previous sell signal (located below the signal line). Stochastic keeps a fairly strong downward direction and does not yet react to the resumption of growth of the US currency.

Resistance levels: 1.27, 1.275, 1.2786, 1.2812.

Support levels: 1.265, 1.26, 1.2558, 1.25.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 17, 2022 at 07:22

Uczestnik z Dec 08, 2021

330 postów

Silver market update by Solid ECN Securities

Silver prices are consolidating near 23.5

The instrument still cannot recover to the local highs renewed on February 15. Then the reason for the wave of sales was the weakening of geopolitical tensions in Eastern Europe when it became clear that the forecasts and assumptions about possible military operations on the territory of Ukraine did not materialize.

Although investors have turned their attention to the usual macroeconomic background and started predicting the actions of world regulators, certain geopolitical risks remain, and therefore the demand for safe assets is not completely reduced. Also, despite the further growth of inflationary risks, the US Federal Reserve is in no hurry to adjust its monetary policy vector.

On Thursday, American investors focus on the Initial Jobless Claims release. It is expected that the value for the week of February 11 will decrease from 223K to 219K.

Support and resistance

On the daily chart, Bollinger bands grow moderately. The price range narrows slightly but remains quite spacious for the current level of activity in the market. MACD tries to reverse downwards and prepares to form a sell signal (the histogram should be below the signal line). Stochastic shows a more confident decline and signals further development of downward dynamics in the nearest time intervals.

Resistance levels: 23.6, 24, 24.37, 24.67.

Support levels: 23.32, 23, 22.7, 22.4.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 17, 2022 at 07:41

Uczestnik z Dec 08, 2021

330 postów

EURUSD market insight by Solid ECN Securities

The market consolidates to remain neutral

The EURUSD pair moves sideways around the level of 1.1346, correcting after the growth in the previous two trading sessions, which led to the renewal of local highs of February 11 due to positive macroeconomic statistics. Today, the European Central Bank (ECB) will publish its monthly report, which may positively impact the dynamics of the euro.

The USD Index is at the week's beginning, around 96. Investors are reacting to the minutes of the January meeting of the US Federal Reserve, published yesterday. The majority of the regulator's representatives are set for a faster increase in interest rates than previously thought.

Support and resistance

The asset is moving within a wide sideways range. Technical indicators are in a state of uncertainty: indicator Alligator's EMA fluctuations range narrowed almost completely, and the histogram of the AO oscillator forms downward bars, approaching the transition level.

Resistance levels: 1.148, 1.169.

Support levels: 1.1279, 1.1116.

The market consolidates to remain neutral

The EURUSD pair moves sideways around the level of 1.1346, correcting after the growth in the previous two trading sessions, which led to the renewal of local highs of February 11 due to positive macroeconomic statistics. Today, the European Central Bank (ECB) will publish its monthly report, which may positively impact the dynamics of the euro.

The USD Index is at the week's beginning, around 96. Investors are reacting to the minutes of the January meeting of the US Federal Reserve, published yesterday. The majority of the regulator's representatives are set for a faster increase in interest rates than previously thought.

Support and resistance

The asset is moving within a wide sideways range. Technical indicators are in a state of uncertainty: indicator Alligator's EMA fluctuations range narrowed almost completely, and the histogram of the AO oscillator forms downward bars, approaching the transition level.

Resistance levels: 1.148, 1.169.

Support levels: 1.1279, 1.1116.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 17, 2022 at 08:13

Uczestnik z Dec 08, 2021

330 postów

USDCHF market update by Solid ECN Securities

The US dollar updates local lows

The US dollar showed a moderate decline against the Swiss franc during the morning trading session, again poised to test the strong support at 0.92. The day before, the instrument also made attempts to approach this level, but then the "bearish" momentum was not enough.

It is worth noting that investors practically ignored the strong macroeconomic statistics from the US that appeared yesterday. In particular, the volume of Retail Sales in the country showed a strong growth. The dynamics of Industrial Production were also positive. In January, production volumes increased.

Today, during the day, investors expect the publication of statistics on the dynamics of Imports and Exports for January from Switzerland. The US, in turn, will publish data on the Jobless Claims for the week ended February 11.

Support and resistance

On the D1 chart Bollinger Bands are sharply reversing downwards. The price range is narrowing actively, reflecting the emergence of ambiguous dynamics of trading in the short term. MACD is going down, keeping a fairly stable sell signal (located below the signal line). Stochastic keeps a confident downward direction but is already approaching its lows, which indicates the descending risks of oversold USD in the ultra-short term.

Resistance levels: 0.922, 0.925, 0.9276, 0.93.

Support levels: 0.92, 0.9177, 0.9157, 0.9125.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 17, 2022 at 09:29

Uczestnik z Dec 08, 2021

330 postów

FTSE 100 Market update by Solid ECN Securities

Positive reporting pushes quotes up

The FTSE 100 index is trading near annual highs at around 7570 on the back of positive reports from commodity companies.

The world's largest supplier of commodities and rare earths, Glencore Plc, released a strong report, according to which EBITDA increased by 84% for the year to 21.3B dollars, while the company's net income was 5.0B dollars. In turn, net debt decreased by almost 2 times to 6.0B dollars. On the back of positive results, the issuer announced the launch of a new 550M dollar share buyback program.

Royal Gold Inc., another large precious metals and royalty trading company in the sector, reported quarterly revenue of 168.03M dollars, beating analysts' forecast of 165.4M dollars. Earnings per share were 1.04 dollars, with market estimates of 0.9 dollars.

Support and resistance

The index quotes are traded within the global ascending channel, still holding within it. Technical indicators are in a weakening buy signal state: the fluctuation range of the Alligator indicator EMAs is narrowing and the histogram of the AO oscillator is forming new descending bars, while approaching the transition level.

Support levels: 7510, 7330.

Resistance levels: 7620, 7800.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 17, 2022 at 10:22

Uczestnik z Dec 08, 2021

330 postów

GBPUSD market update by Solid ECN Securities 😄

GBPUSD prerequisites for a trend change

The GBPUSD pair continues the upward trading dynamics, trying to break the resistance level of 1.361 at the moment, which will allow quotes to continue rising to their January highs.

Yesterday's UK macroeconomic statistics supported the pound's position, as it supported the further tightening of monetary policy by the Bank of England at its regular meeting in March. Thus, the annual inflation rate was fixed at a new 30-year high of 5.5% (the indicator is growing for the fourth month in a row). The negative trend indicates a rising cost of living and will only worsen this year as electricity bills rise 54% and taxes rise in April.

The Bank of England expects inflation to peak at 7.25% by then, more than the 2% target.

However, the difficult situation in the economy, observed at the moment, supports the quotes of the national currency, as investors are looking forward to the moment when the British regulator moves to tighten monetary policy and raise interest rates decisively. Against this background, the GBPUSD pair may change the downtrend to an uptrend and renew the January highs around 1.3710.

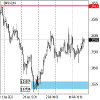

Support and resistance

The long-term trend in the GBPUSD pair remains downwards. The key trend resistance is at 1.371. Now, buyers are testing the level of 1.361. If it is held, a decline to 1.351 is likely to follow.

The medium-term trend is upwards. At the end of January, market participants tested the key support 1.3404–1.337. The level was kept, which led to the growth of the GBPUSD rate. The first growth target is the January high of 1.3740 The second target is zone 2 (1.3883–1.3848).

Resistance levels: 1.361, 1.371, 1.382.

Support levels: 1.351, 1.3418, 1.3365.

GBPUSD prerequisites for a trend change

The GBPUSD pair continues the upward trading dynamics, trying to break the resistance level of 1.361 at the moment, which will allow quotes to continue rising to their January highs.

Yesterday's UK macroeconomic statistics supported the pound's position, as it supported the further tightening of monetary policy by the Bank of England at its regular meeting in March. Thus, the annual inflation rate was fixed at a new 30-year high of 5.5% (the indicator is growing for the fourth month in a row). The negative trend indicates a rising cost of living and will only worsen this year as electricity bills rise 54% and taxes rise in April.

The Bank of England expects inflation to peak at 7.25% by then, more than the 2% target.

However, the difficult situation in the economy, observed at the moment, supports the quotes of the national currency, as investors are looking forward to the moment when the British regulator moves to tighten monetary policy and raise interest rates decisively. Against this background, the GBPUSD pair may change the downtrend to an uptrend and renew the January highs around 1.3710.

Support and resistance

The long-term trend in the GBPUSD pair remains downwards. The key trend resistance is at 1.371. Now, buyers are testing the level of 1.361. If it is held, a decline to 1.351 is likely to follow.

The medium-term trend is upwards. At the end of January, market participants tested the key support 1.3404–1.337. The level was kept, which led to the growth of the GBPUSD rate. The first growth target is the January high of 1.3740 The second target is zone 2 (1.3883–1.3848).

Resistance levels: 1.361, 1.371, 1.382.

Support levels: 1.351, 1.3418, 1.3365.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 17, 2022 at 15:20

Uczestnik z Dec 08, 2021

330 postów

WTI Crude Oil market update by Solid ECN Securities

Pending nuclear deal decision

The North American WTI Crude Oil price corrects within a sideways trend, trading around the level of 90.5.

While investors are monitoring the situation around political tensions on the borders of Eastern Europe, new drivers that can determine the movement of energy prices have appeared on the market. Yesterday, Iran's chief negotiator Ali Bagheri Kani said that dialogue with Western countries on the "nuclear deal" is close to completion. The process will probably end in a few days after some "political decisions" from Iran are presented.

Most experts believe that Iran is in dire need of oil revenues. If the deal is concluded, the inflow of Iranian crude to the market will be very fast and voluminous – from 0.5 to 1.0M barrels per day in the second half of the year, which can correct asset price by $10-$15.

Support and resistance

The price moves within the long-term Expanding formation pattern on the global chart. Technical indicators maintain a weakening global buy signal: indicator Alligator's EMA fluctuations range narrows, and the histogram of the AO oscillator forms downward bars in the buying zone.

Resistance levels: 93, 96.

Support levels: 88, 82.5.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 18, 2022 at 07:19

Uczestnik z Dec 08, 2021

330 postów

NZDUSD market update by Solid ECN Securities 🙄

New Zealand currency develops "bullish" momentum

The New Zealand dollar shows a moderate growth in pairing with the US currency in trading in Asia, testing 0.67 for a breakout. NZDUSD has been developing a "bullish" momentum since February 15 and is currently preparing to renew local highs from February 10.

The instrument was supported yesterday by rather weak data from the US on the dynamics of jobless claims. The number of Initial Jobless Claims for the week ended February 11 increased by 23K to 248K, while the market expected a moderate decline to 219K. Also, investors are somewhat disappointed by the lack of a clear understanding of the pace of a possible increase in interest rates by the US Federal Reserve at the March meeting.

In turn, the Reserve Bank of New Zealand (RBNZ) is pursuing a more transparent policy, although here everything depends on the current economic situation. Meanwhile, manufacturing inflation in New Zealand showed a marked slowdown. The Producer Price Index in Q4 2021 slowed from 1.6% to 1.1%, which turned out to be worse than the neutral market forecasts.

Support and resistance

Bollinger Bands in D1 chart show moderate growth. The price range is expanding, but hardly conforms to the activity of the "bulls" in recent days. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic keeps its upward direction but is rapidly approaching its highs, which reflects the risks of overbought instrument in the ultra-short term.

Resistance levels: 0.6732, 0.6761, 0.6800, 0.6840.

Support levels: 0.6700, 0.6650, 0.6600, 0.6568.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 18, 2022 at 08:32

Uczestnik z Dec 08, 2021

330 postów

GBPUSD, UK economy shows stability

Due to the strengthening of the British currency, the GBPUSD pair is trading in an uptrend around 1.3608.

The recent report on consumer prices contributes to the positive dynamics of the pound. In January, the indicator fell by 0.1% MoM, which significantly slowed down the growth of the annual value, which as a result rose slightly to 5.5% from 5.4% a month earlier. These data indicate that the measures taken by the Bank of England at the end of last autumn are having the desired effect, and the UK is perhaps the only one of the world's leading economies that has managed to stabilize inflation and bring it under control.

As for the US dollar, the next week ends with almost zero dynamics. All the positive caused by the statements of US Federal Reserve officials about the imminent increase in rates was leveled by macroeconomic statistics, which indicates the growth of problems in the national economy. Thus, the number of initial applications for unemployment benefits rose to 248K from 225K a week earlier, although analysts expected a decrease to 219K. The volume of construction of new houses in January decreased to 1.638M from 1.708M in the previous period, and the construction volume index was –4.1% compared to an increase of 0.3% in December.

Support and resistance

The asset moves within the global downward channel, forming a local wave of growth. Technical indicators maintain an increasing buy signal: fast EMAs on the Alligator indicator are above the signal line, and the AO oscillator histogram trades above the transition level.

Support levels: 1.3566, 1.3421.

Resistance levels: 1.3686, 1.3825.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 18, 2022 at 11:05

Uczestnik z Dec 08, 2021

330 postów

Solid ECN Market Analysis

USDCHF, waiting for a fundamental growth driver

This week, the USDCHF pair falls to the level of 0.92 against the backdrop of the publication of the minutes of the US Federal Reserve's Open Market Committee, which generally reflected the "dovish" rhetoric.

Regulatory officials agreed that it would be appropriate to lift monetary easing faster than expected if inflation does not ease, but meeting minutes did not reinforce investor expectations for a 50 basis point rate hike at the upcoming March meeting. Also, the global outflow of capital into shelter assets due to the escalating Russian-Ukrainian conflict led to a decrease in the yield of US bonds and, as a result, a downward correction in the US dollar.

Economic data increased the dynamics of sales of the US currency. The volume of New Homes Sales for January decreased. Initial Jobless Claims unexpectedly increased and amounted to 248K. Philadelphia Fed manufacturing index was worse than expected and amounted to 16.0 points.

Today, investors expect the publication of US Existing Home Sales for January. The indicator may decrease by 1.0% compared to the previous month. Negative statistics from the US, together with disappointing reports from the regulator, are pushing the pair to February lows in the 0.9177 area. If traders break through this support level, a deep decline in quotations down to 0.9089 is possible in the medium term.

Support and resistance

The long-term trend remains upwards. The key support is at 0.9177, and holding it will allow the rate to rise to 0.9270. A breakdown of the level of 0.9177 will allow sellers to lower the price to 0.9089.

Resistance levels: 0.9250, 0.9270, 0.9339, 0.9360.

Support levels: 0.9177, 0.9089, 0.9033.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 21, 2022 at 09:10

Uczestnik z Dec 08, 2021

330 postów

Market update by Solid ECN Securities

USDCHF, the US dollar remains under pressure

The US dollar shows a moderate decline against the Swiss franc during the Asian session, again testing 0.92 for a breakdown. USDCHF is close to its local lows of February 3, updated last Thursday.

American markets are closed today on the occasion of the President's Day, but investors are still taking a lead from moderately optimistic signals from last Friday. Statistics from the US pointed to an increase in Existing Home Sales. Meanwhile, statistics from Switzerland are somewhat more restrained. At the end of last week, data appeared indicating a slowdown in industrial production in Q4 2021.

The instrument's quotes are under pressure from the threat of a military conflict on the borders of Ukraine. It is worth noting that the authorities are trying to resolve the situation through diplomacy. Representatives of the US State Department announced on Thursday that they had sent a letter to the head of the Russian Foreign Ministry, Sergei Lavrov, with a proposal to hold a face-to-face meeting in Europe "to resolve the crisis without conflict".

Support and resistance

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is narrowing from below, pointing at the multidirectional nature of trading in the short/middle term. MACD is going down preserving a stable sell signal. The indicator is trying to consolidate below the zero level. Stochastic keeps a confident downward direction but is approaching its lows, which indicates the risks of oversold USD in the ultra-short term.

Resistance levels: 0.922, 0.925, 0.9276, 0.93.

Support levels: 0.9175, 0.9157, 0.9125, 0.91.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 21, 2022 at 10:25

Uczestnik z Dec 08, 2021

330 postów

Market update by Solid ECN Securities

NZDUSD, an upward correction in the asset is intensifying

The NZD/USD pair corrects within an uptrend, trading near the level of 0.6717.

Today it became known that the renewed version of the free trade agreement with China will finally enter into force on April 7, 2022. Also to the main points, the new document pays great attention to the regulation in e-commerce and environmental protection. This Wednesday, the Reserve Bank of New Zealand will hold its regular meeting on monetary policy, and until this date, serious fluctuations in the national currency are not expected.

The USD Index is moving without pronounced dynamics around the level of 96. The situation in the US economy remains extremely uncertain, and the fact that the budget for 2022 has not yet been adopted speaks volumes. Yesterday, US President Joe Biden signed another project on temporary funding of the federal government until March 11, but the likelihood that the budget will be adopted before that time is small. As for macroeconomic statistics, the January report on sales in the secondary housing market surprised investors. Net sales rose for December, and the sales index was 6.7%, with an expected decline of 1.0%.

Support and resistance

The asset moves within the global downtrend, correcting upwards within the local wave. Technical indicators maintain a weakening global sell signal: fast EMAs on the Alligator indicator are approaching the signal line, and the AO oscillator histogram forms upward bars in the sell zone.

Resistance levels: 0.6742, 0.686.

Support levels: 0.6679, 0.659.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 21, 2022 at 15:19

Uczestnik z Dec 08, 2021

330 postów

Market update by Solid ECN Securities

Nasdaq 100, correction in the bond market puts pressure on the index.

At the moment, the Nasdaq 100 quotes are showing a downtrend against the background of the ongoing correction in the bond market, trading at around 14000.

The day before, analysts at JPMorgan Chase & Co. in their 2022 forecasts, announced a projected possible 10% drop in revenue for the financial markets division in Q1. According to the company, the geopolitical pressure on financial markets is now so great that the risks far exceed the possible income.

The downward correction in the US bond market also continues. The yield on 10-year Treasuries has declined since Thursday, and the downtrend continues. Conservative 20-year bonds are also declining rapidly.

Support and resistance

Index quotes are traded as part of a correction to the global uptrend, declining as part of a local wave. Technical indicators are in a quite strong sell signal state: the range of EMA fluctuations on the Alligator indicator is wide enough and the AO oscillator histogram, trading in the sales area, is actively forming descending bars.

Support levels: 13800, 13000.

Resistance levels: 14430, 15150.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

330 postów

Feb 22, 2022 at 07:25

Uczestnik z Dec 08, 2021

330 postów

Market update by Solid ECN Securities

Nasdaq 100, correction in the bond market puts pressure on the index.

At the moment, the Nasdaq 100 quotes are showing a downtrend against the background of the ongoing correction in the bond market, trading at around 14000.

The day before, analysts at JPMorgan Chase & Co. in their 2022 forecasts, announced a projected possible 10% drop in revenue for the financial markets division in Q1. According to the company, the geopolitical pressure on financial markets is now so great that the risks far exceed the possible income.

The downward correction in the US bond market also continues. The yield on 10-year Treasuries has declined since Thursday, and the downtrend continues. Conservative 20-year bonds are also declining rapidly.

Support and resistance

Index quotes are traded as part of a correction to the global uptrend, declining as part of a local wave. Technical indicators are in a quite strong sell signal state: the range of EMA fluctuations on the Alligator indicator is wide enough and the AO oscillator histogram, trading in the sales area, is actively forming descending bars.

Support levels: 13800, 13000.

Resistance levels: 14430, 15150.

Solid ECN, a True ECN Broker

*Komercyjne wykorzystanie i spam są nieprawidłowe i mogą spowodować zamknięcie konta.

Wskazówka: opublikowanie adresu URL obrazu / YouTube automatycznie wstawi go do twojego postu!

Wskazówka: wpisz znak@, aby automatycznie wypełnić nazwę użytkownika uczestniczącego w tej dyskusji.