German business quickly recovers from the shock

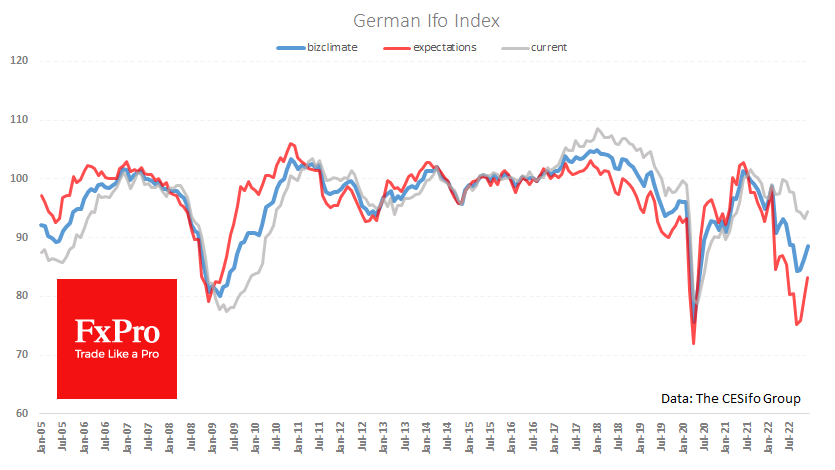

Germany's business sentiment index rose in December for the third month, returning to August levels on the back of more optimistic expectations, while assessment of the current situation has improved just slightly. Ifo Business Climate Index for Germany jumped from 86.4 to 88.6 in December, better than the 87.6 expected. In a commentary on the publication, the President of the ifo Institute notes that “business is entering the holiday season with a sense of hope”.

Market participants closely follow the Ifo index because of its strong predictive power for the economy. But even more interesting is that the strong reversal from decline to growth coincided with the turnaround in the German indices.

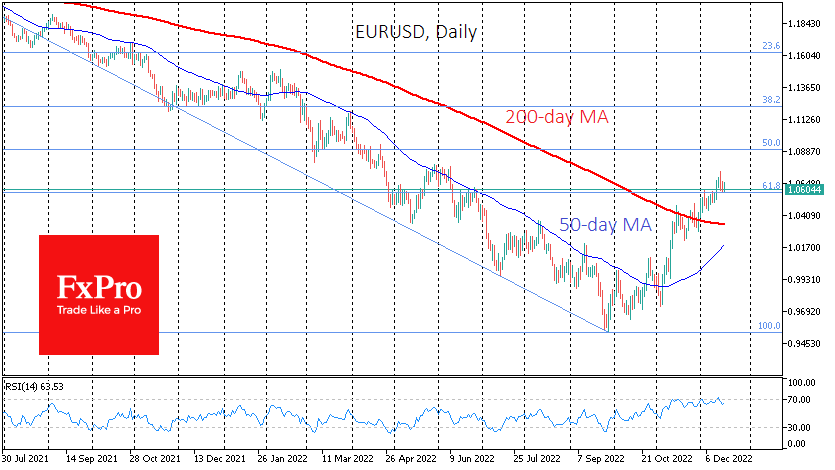

The rise in German business sentiment may also be good news for EURUSD buyers. In 2020 and 2009, EURUSD accompanied the index’s recovery for the first several months. However, breaking the multi-year downtrend may take a significant fundamental change, which is too early to tell.

The EURUSD appears locally tired after its two-and-a-half-month rally and in a tactically overbought condition. The Euro has been losing ground against the USD during the last two trading sessions, retracing from 1.0730 to 1.0600. Still, it is the only major currency that has managed to break above the 200-day MA, which many consider a technical change in the long-term trend.

The bullish trend in the single currency might continue if the ECB's decisiveness in fighting inflation does not negatively impact business sentiment.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)