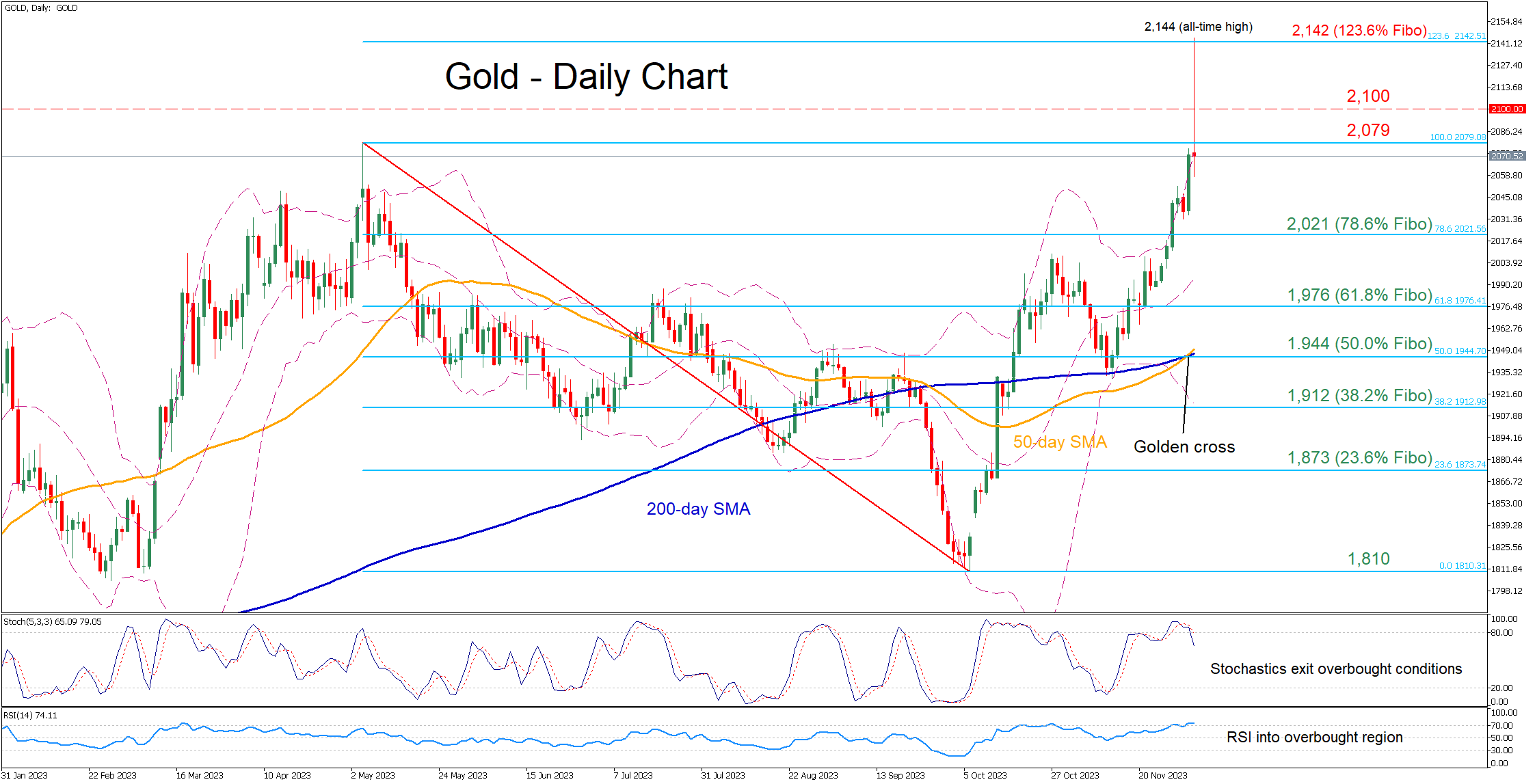

Gold storms to record high before surrendering intraday gains

Gold has been in a steep uptrend since November 10, when the price bounced off the crucial 200-day simple moving average (SMA). On Monday, bullion recorded a fresh all-time high of 2,144 before erasing all its intraday rally, with the price reversing back below its previous record peak.

Given that the momentum indicators are starting to ease from overbought conditions, gold could pull back towards 2,021, which is the 78.6% Fibonacci retracement of the 2,079-1,810 downleg. Sliding beneath that floor, the price may challenge the 61.8% Fibo of 1,976. Even lower, the 50.0% Fibo of 1,944 could provide downside protection.

On the flipside, should the bulls attempt to propel the price higher, the April peak of 2,079 could act as the first line of resistance. A violation of that zone could set the stage for the 2,100 psychological mark. Failing to halt there, the price could revisit its recent all-time high of 2,144, which lies very close to the 123.6% Fibonacci extension.

In brief, gold surged to an all-time high in today’s session, but has already surrendered all its daily gains. Can the recent completion of a golden cross between the 50- and 200-day SMAs refuel the rally?