Crypto's unconvincing rebound

Crypto's unconvincing rebound

Market Picture

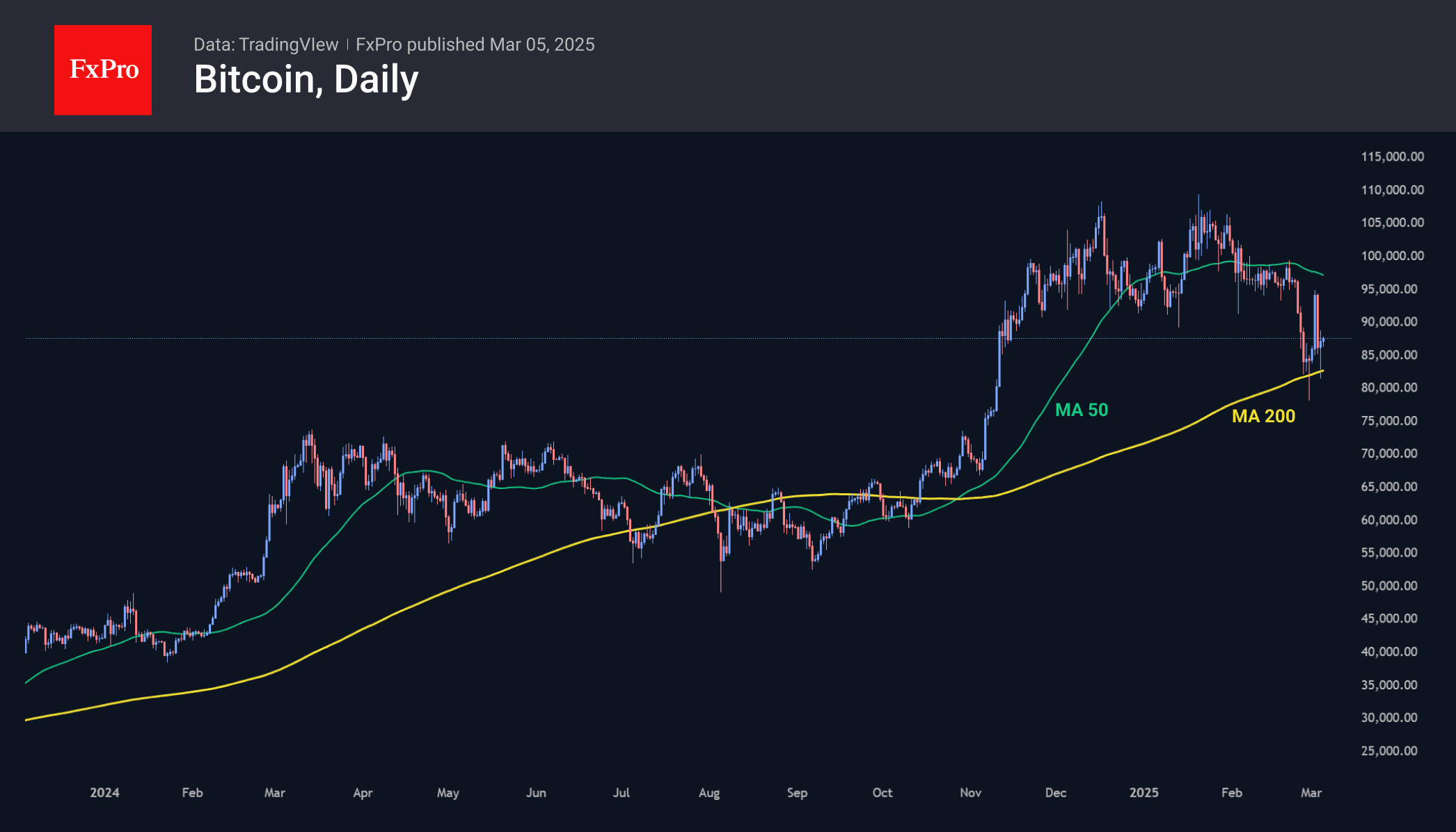

The crypto market has gained 4% in cap in 24 hours, but this looks more like a wild swing than the start of a recovery. The $2.87 trillion market remains below the long-term trend line of the 200-day moving average, near $3 trillion, and the initiative has shifted back to Bitcoin.

Bitcoin's share of the crypto market exceeds 60%, which is typical in periods of fear. This time, we also note the decline in Ethereum's share to 9%, a low in almost five years. This negative trend has been maintained for the last two years with brief spikes.

Bitcoin's share of the crypto market exceeds 60%, which is typical in periods of fear. This time, we also note the decline in Ethereum's share to 9%, a low in almost five years. This negative trend has been maintained for the last two years with brief spikes.

Bitcoin continues to flirt with the 200-day MA, popping out on Tuesday shortly after touching that level below $83,000. Wednesday morning's market dynamics reflect cautious attempts to form a bottom. A return to the area above the 50-day at $97,000 is a marker of bullish success.

Ethereum is trading below $2200. Earlier in the week, it dipped below $2000 at the peak of the decline but stabilised near the support line in early 2024. This dangerous proximity to the lower end of the trading range keeps our focus on ETH as the market's canary, which is having a tough time right now.

Ethereum is trading below $2200. Earlier in the week, it dipped below $2000 at the peak of the decline but stabilised near the support line in early 2024. This dangerous proximity to the lower end of the trading range keeps our focus on ETH as the market's canary, which is having a tough time right now.

News Background

News Background

Net outflows from spot Ethereum-ETFs in the US fell to $12.1 million on 3 March, a negative trend for the eighth consecutive trading session. Total inflows since the product launch on 23 July fell to $2.81bn.

President of Euro Pacific Capital and bitcoin critic Peter Schiff called on Congress to launch an investigation into US President Donald Trump's actions in the field of cryptocurrencies. He said the politician's posts on the Truth Social platform, which led to a sharp rise in cryptocurrencies and then their fall, could have been part of a pump-and-dump scheme.

Affiliates of the collapsed FTX and Alameda addresses unlocked 3.03 million SOLs worth $431 million, Lookonchain said. This is the largest withdrawal since November 2023. Most of the tokens were sold through Binance and Coinbase at an average price of $125.8 per coin.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)