EBC Markets Briefing | Nikkei sluggish on fears of Trump

Japanese stocks were flat on Friday in early Asian hours. Japan was seeking exclusion from his fresh tariffs on steel and aluminium, before Trump threatened to impose a 25% levy on car imports

Japan does not impose tariffs on cars, but Washington said during Trump's first term that a variety of non-tariff barriers impeded access to Japan's market.

Almost 90% Japanese companies expect Trump's policies to negatively affect business, a Reuters survey showed, the clearest sign yet of mounting worry in the US' top foreign direct investor.

Trump said it would be possible to reach a fresh trade deal with China, signalling he is open to heading off a brewing trade fight between Washington and Beijing. It could involve the acquisition of TikTok.

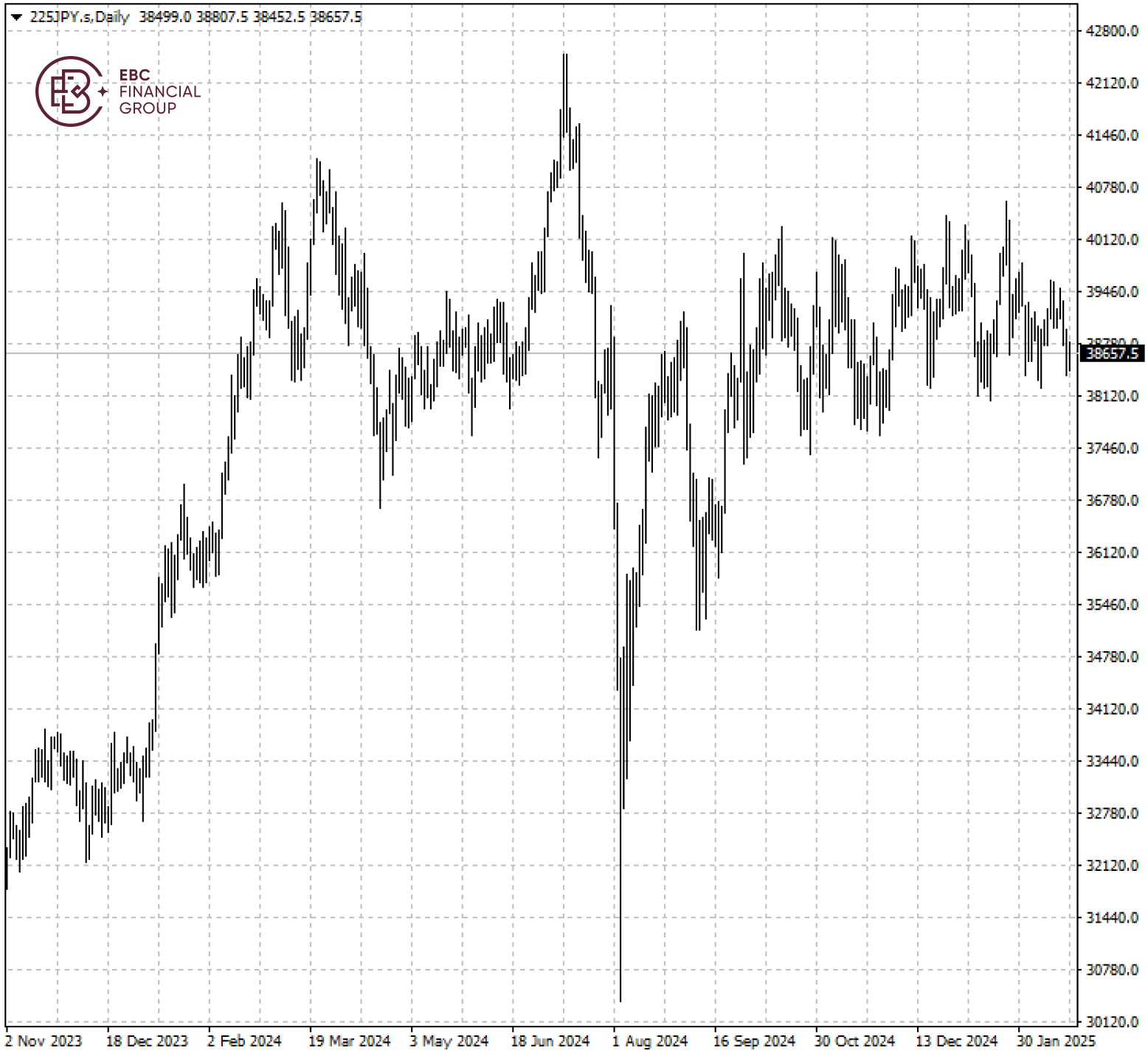

The Nikkei 225 has been in the red in 2025, among the worst performers in major indices, partly drive by outflow to the Chinese markets benefiting from optimism about AI development.

Analysts’ forecasts for Japanese stocks show little correlation with their actual performance, according to an analysis of 20 years of data from a former chief strategist at Nomura Holdings Inc.

Benchmark index has been bound by 38,000 and 40,000 for months. It looks neutral at the moment, so it could ease slightly to the lower end of the trading range later.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.