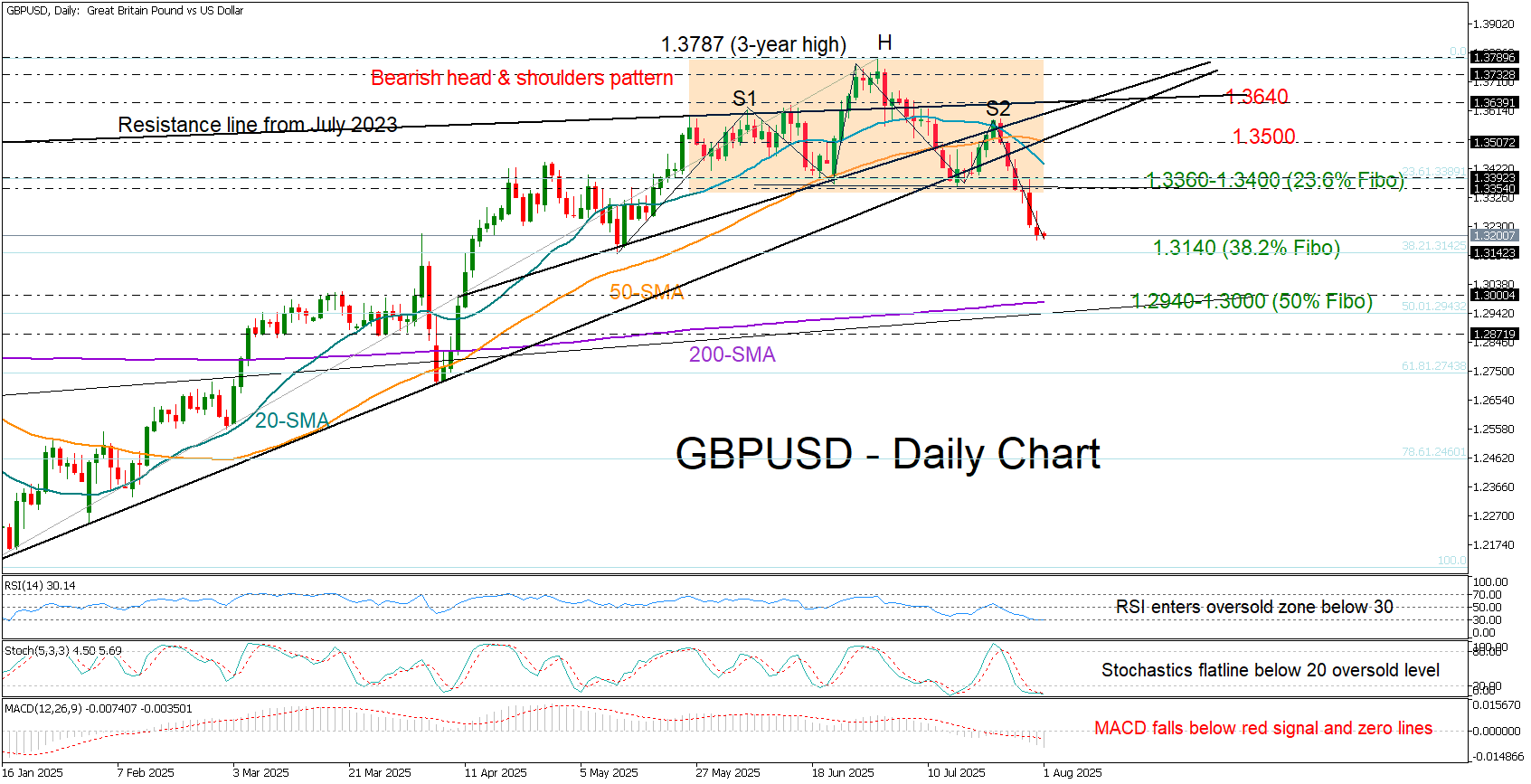

GBP/USD confirms bearish trend reversal

GBP/USD raised alarms over a negative trend reversal after its slide below the 1.3360–1.3400 region confirmed a bearish head and shoulders pattern and cemented a bearish crossover between the 20- and 50-day simple moving averages (SMAs).

With the US dollar roaring back – bolstered by President Trump’s apparent success in recent trade deals and stronger-than-expected US economic data – the British pound succumbed to bearish pressure.

The pair’s six-day losing streak is now flirting with May’s low of 1.3140, where the 38.2% Fibonacci retracement of the 2025 uptrend is located. A move lower could open the door for an aggressive decline toward the 200-day SMA near 1.3000 and the 50% Fibonacci level at 1.2943. Further losses could target the 61.8% Fibonacci retracement at 1.2743, if the 1.2870 barrier fails to hold.

Technically, the bearish cycle could soon take a breather as both the RSI and the stochastic oscillator hover in oversold territory. However, for a positive shift, the bulls would need to push the price back above the neckline at 1.3360–1.3500, reclaim the broken support trendline near 1.3500, and then print a new higher high above the key resistance zone at 1.3640.

In brief, GBP/USD has reversed to a bearish trajectory in the short-term picture, with sellers aiming for a new lower low near May’s floor of 1.3140. A drop below this level could trigger fresh selling pressure.

.jpg)