USD/CAD recovery faces hurdles

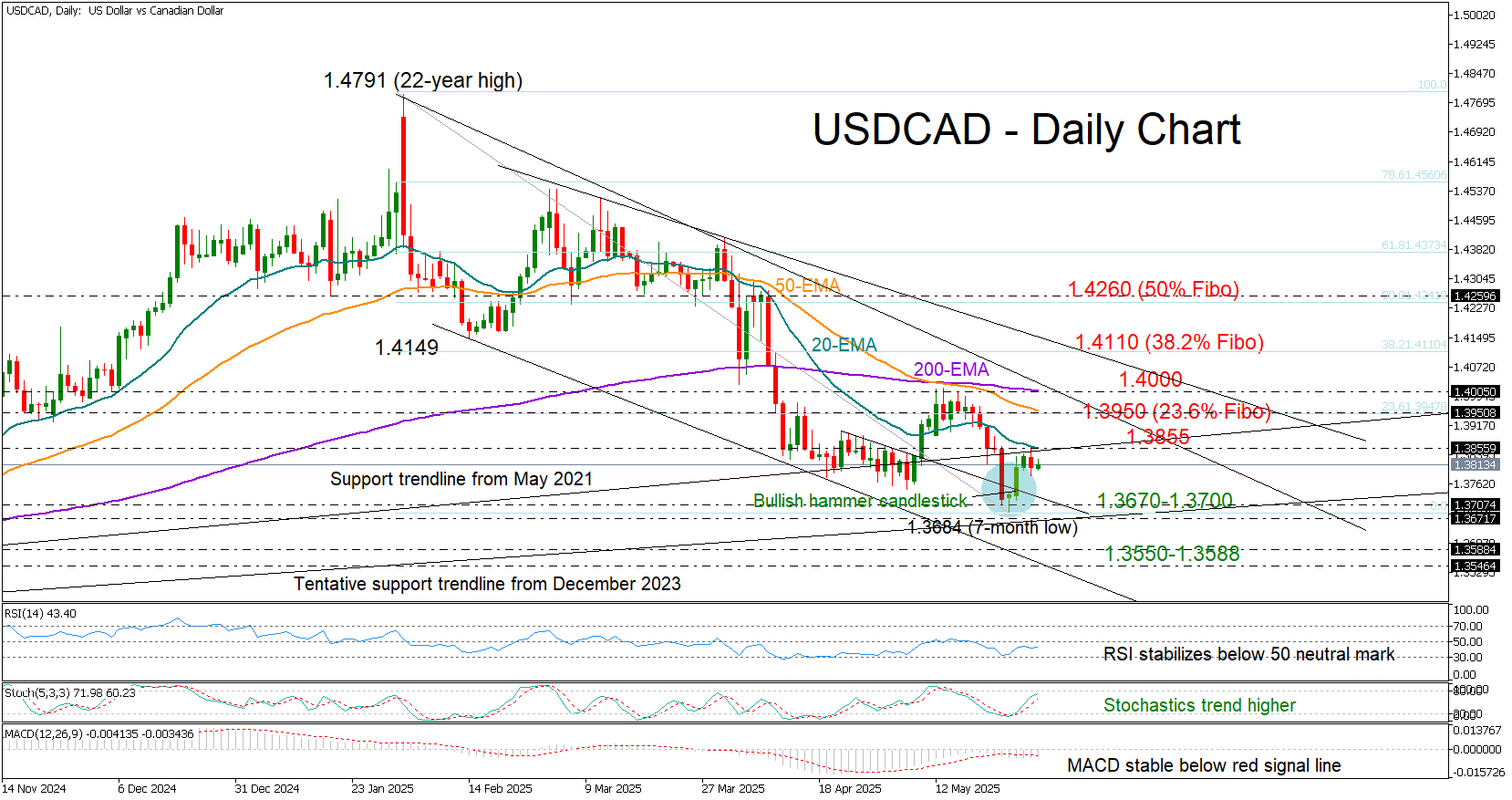

USD/CAD started the week with a bullish hammer candlestick pattern, raising hopes that the recent bearish cycle that dragged the price down to a seven-month low of 1.3684 has bottomed out.

However, the 20-day exponential moving average (EMA) halted the rebound immediately near 1.3850, indicating that the pair is not out of the woods yet. Indeed, the RSI has yet to move into positive territory above 50, signaling persistent selling pressure. That said, the indicator is still following a positive trajectory, and the stochastic oscillator continues to slope upwards, keeping some optimism alive.

Later today, the Fed’s preferred inflation gauge, the core PCE index, is expected to ease slightly to 2.5% y/y, while Canadian Q1 GDP growth (annualized) could slow significantly to 1.7% from 2.6% previously. The former may trigger stronger volatility if the result surprises, as investors remain uncertain about the timing—or even the likelihood—of Fed rate cuts this year. A press conference between President Trump and Elon Musk will also be closely watched too for any tariff signals.

If the bulls manage to break above the 1.3855 level, the price could advance toward the 50-day EMA, which aligns with the 23.6% Fibonacci retracement level of the February–May downtrend at 1.3950. The 1.4000 area, where the 200-day EMA intersects with the resistance line drawn from January’s peak, may serve as a stronger barrier. A decisive close above this zone could bolster buying interest, targeting the 38.2% Fibonacci level at 1.4110.

Conversely, if the bears regain control, the pair could retreat toward the 1.3700 support zone. The outlook would deteriorate further if the sell-off extends below the ascending trendline from 2021, currently near 1.3670, potentially exposing the 1.3550–1.3588 region. A deeper decline may prompt a drop toward the key 1.3400–1.3420 support band, which ignited the notable rally to 22-year highs last September.

In a nutshell, USD/CAD is currently sending mixed signals. A sustained break above 1.3855 is needed to revive bullish momentum. Otherwise, the bears may reassert control and push for a deeper continuation of the downtrend.

.jpg)