A Clearer Shape of a Long-Term Dollar Decline

While Trump’s rise to power is widely seen as a positive for the dollar, the dollar index hit a one-month low on Monday as it continues to rebound from the Fed’s latest softening tone and inflation slowdown.

The impact of Trump’s policies on the dollar is largely based on the experience of his previous presidential term. As president, he imposed tariffs on imports and cut corporate taxes. Both elements are on his economic agenda again. Tariffs potentially reduce imports to curb trade deficits. Tax cuts encourage capital inflows.

However, both factors began to affect the dollar only after these policies kicked in. In addition, lawmakers effectively blocked these changes in the early months, making an early bet on the fundamental trend counterproductive.

Among the fundamentals, speculation around expectations for a Fed rate cut is now more influential. By the end of last week, markets were factoring in 3 consecutive cuts this year, starting in September, as the most likely scenario. Quite a bearish turn for the dollar, as only a couple of months ago, one of the working scenarios was ‘no cuts’ until the end of 2024.

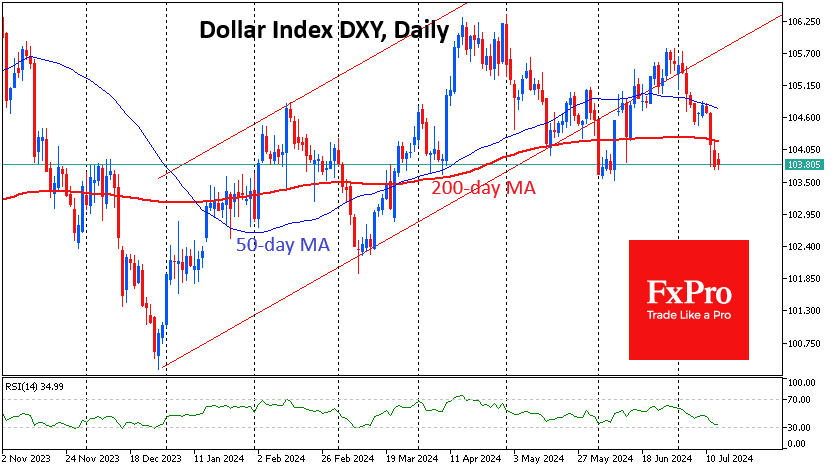

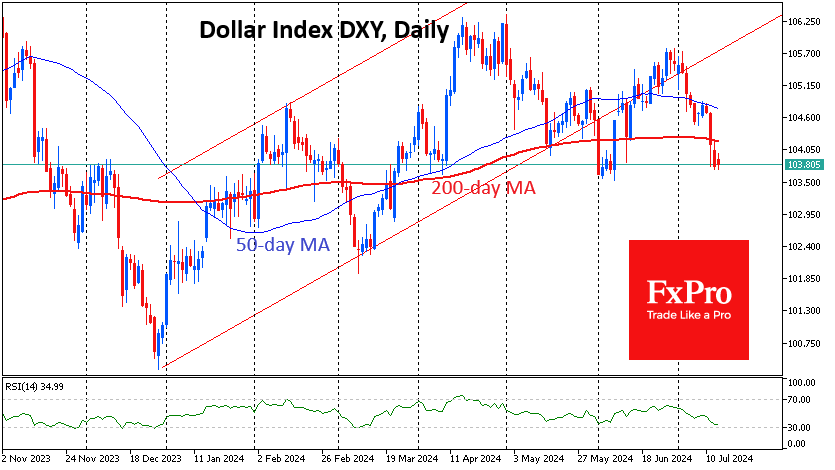

Technical factors are as much a determinant of the dollar’s momentum as anything else, in our view. This July, the dollar index has been under a sell-off, falling out of an upward corridor from the lows of late last year. The downward impulses came on important news: NFP pushed the dollar index through support; Powell's speech broke it under the 50-day MA; reaction on the CPI resulted in a dive below the 200-day MA.

The most cautious bears may wait for a failure under 103.70, where the DXY has found support in early June and April. This opens the way for the index to 100, close to the area of last year's lows. A leg below would activate a deeper dollar decline scenario with a potential target at 90-92.50, where the lower boundary is the area of 2018 and 2021 lows, and the upper one is 161.8% of the downside momentum from the September 2022 peak to the 2023 support area.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)