Altcoins are gaining strength by joining Bitcoin

Altcoins are gaining strength by joining Bitcoin

Market Picture

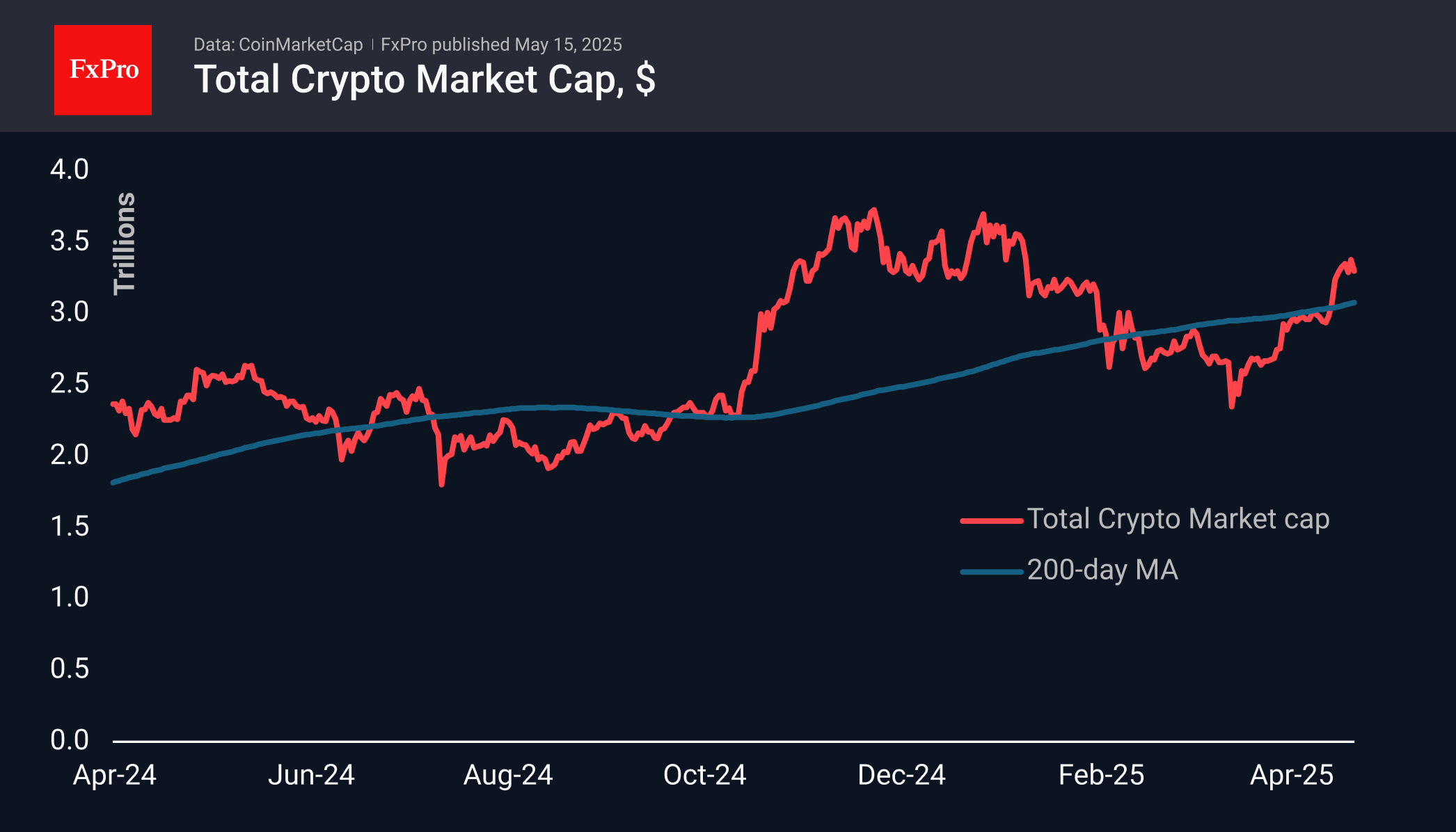

Market capitalisation has fallen 2% in the last 24 hours to $3.30 trillion. Bitcoin, stuck near past highs, quickly spoiled the market's mood, triggering a local profit correction after the rally. An active correction in gold may also be playing a role.

The crypto market sentiment index rolled back from 73 to 70, while remaining at an ‘elevated level’, implying positive sentiment and sufficient risk appetite.

Bitcoin retreated 1.5% to $102.0k, having been smoothly forming a top for the past seven days. This is a signal of an impending correction, which is reasonable near previous peaks and against the backdrop of slippage in the equity market.

Ethereum and Solana have stalled near their 200-day moving averages. Optimists may look at this as a stop to gain strength before a further hike upwards. Pessimists, on the other hand, may point out that BTCUSD took its 200-day MA last month in a strong move, with confidence that the leading altcoins are lacking right now.

News Background

Bitcoin's current growth, unlike previous ones, is driven by strong demand on the spot market rather than leveraged speculation, according to K33 Research. This sets the stage for a renewal of historical highs. Experts do not expect unpleasant surprises from May, which is a weak month.

CryptoQuant noted that retail investors are increasingly active despite Bitcoin's consolidation above $100,000. Such a resurgence is often a sign of renewed confidence and could be an additional catalyst for the next price move.

Wealthy UBS clients in Asia are shifting their focus from dollar assets to gold, cryptocurrencies and Chinese markets. Switzerland's largest bank cites growing geopolitical uncertainty and persistent volatility as the main reasons.

Tether reported to the SEC that it bought 4,812 BTC worth more than $458 million for Twenty One Capital's pending SPAC merger with Cantor Equity Partners.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)