Aussies signal interest rate pause

OVERNIGHT

Asian equity market performance is mixed today but in most cases the moves are relatively small. The oil price has continued to climb after OPEC’s announcement of a cut in production. However, so far the bounce has only taken prices back to their level of early March. As expected, the Australian central bank left interest rates unchanged at today’s policy update in the first ‘no hike’ announcement since last April. The RBA said that it would assess the impact of previous hikes but warned that more tightening “may well be needed”.

THE DAY AHEAD

Today’s European Central Bank’s consumer expectations survey will provide an update on how inflation trends are perceived. The last survey showed a decline in both 12 month and longer-term expectations and given the recent weakening in energy prices expectations may have fallen further this time. The ECB is likely to see that as evidence that their interest rate hikes are proving effective. Nevertheless, they will still be mindful that the March CPI data for the region showed a further rise in core inflation despite the decline in headline inflation. So, it remains unlikely that interest rates have peaked.

US factory orders are forecast to have fallen by 0.3% in February. Already released data for durable goods orders, which is about 40% of the total, showed a decline of 1.0% due to another fall in the volatile transport sector. However, non-durable orders are likely to have risen for the second month in a row. The US manufacturing sector, more broadly, continues to underperform other areas of the economy.

There is no data of note in the UK today. However, a couple of Bank of England policymakers are due to speak. One of these is Silvana Tenreyro, who voted against each of the last three interest rate hikes, and so seems likely to point to downside risks for growth and inflation. The other is the BoE’s Chief Economist Pill who has always voted with the majority. Any comments they make on recent developments in the banking sector are likely to command particular attention. Two US Federal Reserve policymakers are also scheduled to speak.

Early Wednesday, the New Zealand central bank will give its latest monetary policy update. Unlike its Australian equivalent it is expected to raise interest rates again (by 25 basis points). Markets are also expecting another 25bp hike at the next update so the RBNZ’s forward guidance will also be interesting. Meanwhile, in Australia RBA Governor Lowe will follow up on today’s policy announcement with some comments on why they stood pat. MARKETS

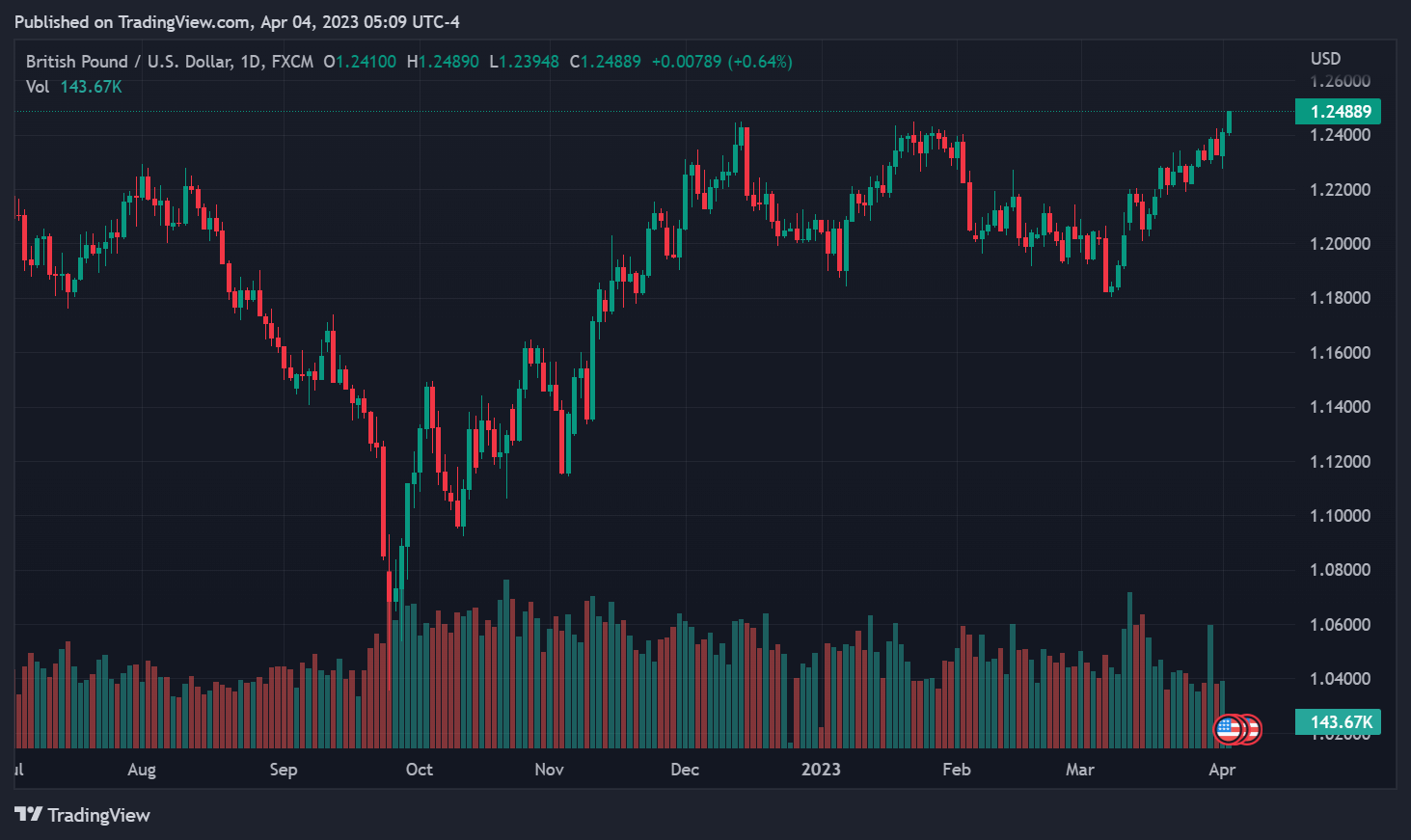

US Treasury and UK gilt yields fell on Friday after the lower-than-expected US inflation news. However, US yields have rebounded this morning following the OPEC announcement. In currency markets, sterling, after moving up slightly against the euro on Friday is again higher this morning, but it has slipped against a generally firmer US dollar.