Bitcoin Continues Downtrend

Market Picture

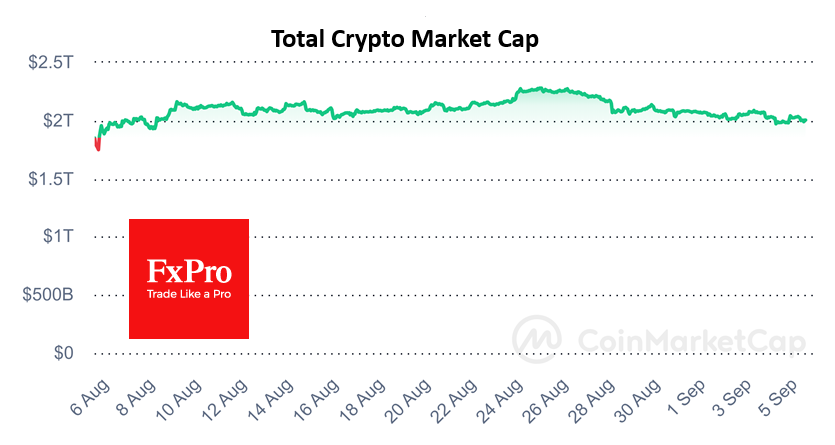

The Asian session continues to be tough for cryptocurrencies. The total market capitalisation had risen to $2.05 trillion the previous evening, recovering from a drop earlier in the day. Still, selling prevailed again at the start of the new day on Thursday, bringing the capitalisation back to $2.0 trillion (+0.8% in 24 hours).

Bitcoin is down for the ninth day out of the last 11 as its attempt to consolidate above the 200-day average triggered an intensified sell-off. This pattern persists into Thursday morning as the price continues to test the lows of the last four months. Rising financial markets and a weaker dollar did not help Bitcoin gain strength. It is possible that the weakness in cryptocurrencies is a manifestation of a very limited risk appetite, and the rest of the markets may soon follow the lead of cryptocurrencies.

News Background

Kaiko noted a significant oversupply of Bitcoin in the crypto market amid a sell-off in government stocks and forced asset sales by bankrupt exchange MtGox.

Former BitMEX CEO Arthur Hayes acknowledged the continuation of Bitcoin's correction to $50,000 ahead of the Fed's September meeting. According to him, the pressure factor will remain the situation in the money market, where yields on overnight reverse repos with the central bank remain higher than on US Treasury bills.

The negative dynamics of BTC after the halving in April have 'buried' the four-year cycle previously associated with this event. Outlier Ventures reached this conclusion after analysing previous periods from a similar distance.

Based on an analysis of 5,000 collections and 5 million transactions of non-fungible tokens (NFTs), the NFT Evening specialists concluded that 96% of them are dead. The average lifespan of NFTs is 1.14 years, which is 2.5 times less than traditional crypto projects.

CoinDesk reported that Donald Trump's sons announced the World Liberty Financial protocol, which will focus on credit and be built on the Ethereum blockchain and the Aave platform.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)