Chinese disinflation

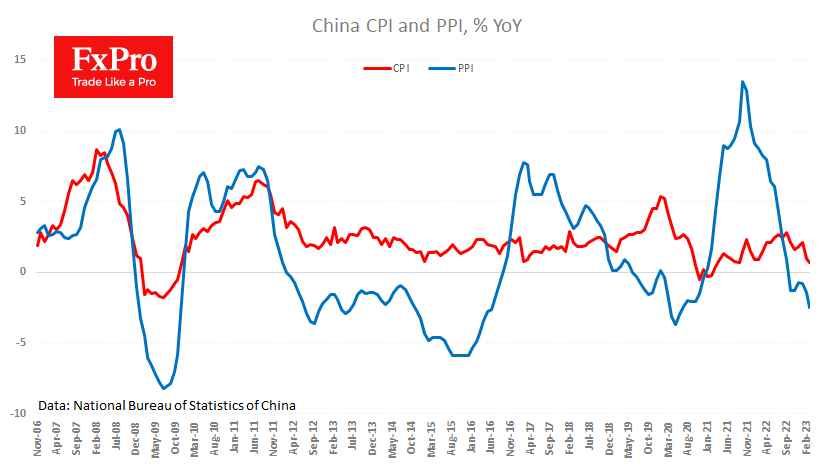

Consumer inflation in China fell to 0.7% YoY in March from 1.0% in the previous month. Last month's producer price index was 2.5% lower than a year earlier, accelerating its decline from 1.4% in February.

The hypothesis that China's move away from a 0-covid policy is driving down prices rather than pushing them up, as has been the case in the developed world, remains valid. In this case, we are seeing a normalisation of the economy, which in turn is normalising prices after the spike of previous years.

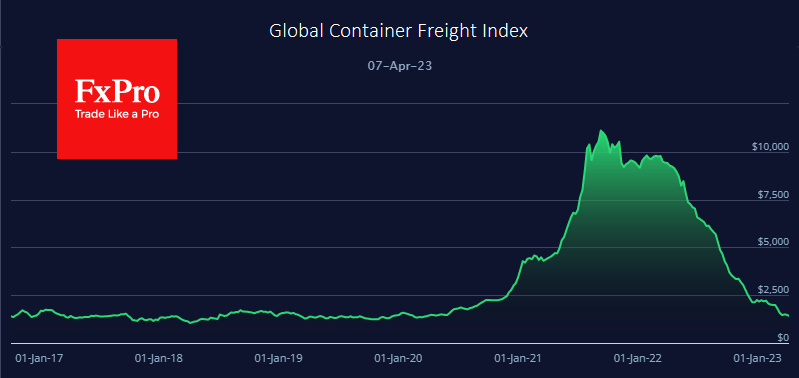

The stabilisation of supply chains is also evident in the stabilisation of container prices, which have returned to the region of $1,500 (the norm, at least from October 2016 to April 2020) after spiking above $10,000 in the last quarter of 2021.

The normalisation of logistics complements the fall in producer prices, taking inflationary pressure off the developed world. And this is good news for risk demand, as it will allow the world's biggest central banks to stop tightening policy more quickly.

However, falling producer prices may also signal a sharp contraction in demand in the developed world. Although it signals the end of the interest rate hike cycle in Europe and America, it promises more negativity. In this case, things will get worse before they get better.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)