Crypto market reversal saves XRP & Litecoin from collapse

Crypto market reversal saves XRP & Litecoin from collapse

Market picture

The crypto market is recovering faster than it was falling, adding another 2.4% in 24 hours to $2.4 trillion. Bitcoin has rallied 15% since Saturday, now testing $66K. Ethereum is trying to cross $3500. Among the top coins, XRP stands out, soaring 12% in a day and 38% in 7 days, taking out Solana with its more modest 3.4% rise in a day.

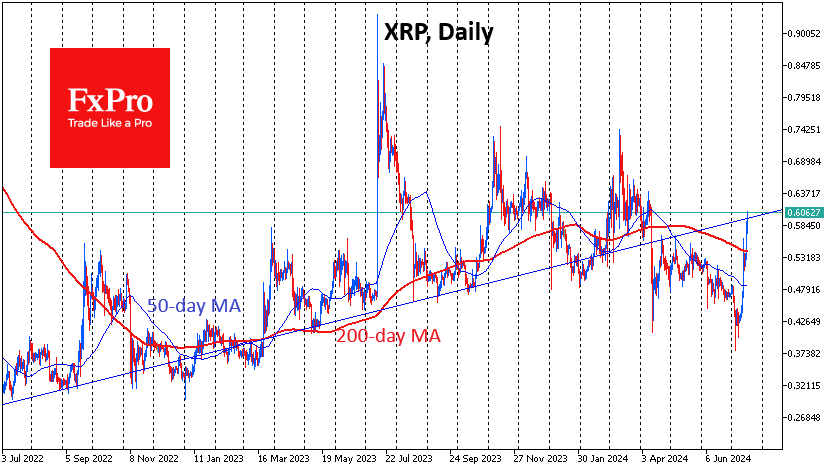

The move in XRP is truly outstanding, proving once again the importance of global support at $0.4. The coin has been performing worse than the market for a long time, but the reversal of sentiment in crypto has sparked a rise on steroids in the once-largest altcoin. On the latest bounce, the price rose to $0.6, its highest since April. This is an attempt to jump back into the uptrend of the past two years. However, it may well turn out that XRP needs to rest after the climb. And this high is appropriate, as we saw prolonged consolidations here in November-December and March.

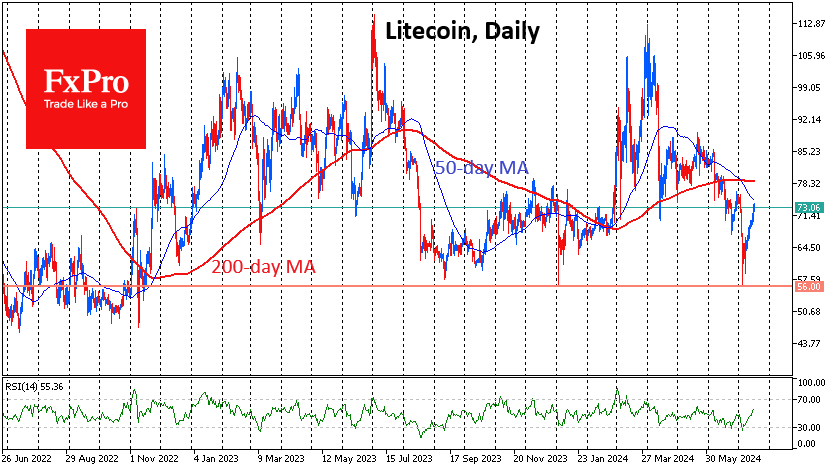

Another mature altcoin, Litecoin, gained persistent buyers’ interest, recording its ninth consecutive day of growth. At the start of the month, its price fell to $56 - a historically important support area. The sentiment in the crypto market changed at a critical moment for Litecoin. However, the same can be said about XRP.

News background

According to SoSoValue, on 15 July, inflows into spot bitcoin ETFs totalled $301.4 million, surpassing $300 million for the second day in a row. The positive trend continued for the seventh consecutive day at $1.49 billion, and it has increased to $16.11 billion since BTC-ETFs were approved in January.

The market was shaken up by Mt.Gox's withdrawal of $6.1bn worth of bitcoins, which led to a short-term drop in BTC below $63,000. According to Arkham data, the bankrupt Mt. Gox exchange transferred nearly 96,000 BTC to unidentified addresses. Later, the Kraken exchange reported receiving some of Mt. Gox's assets in BTC and BCH. Their distribution may take 7-14 days. In total, Mt.Gox will distribute 138,985 BTC worth ~$8.74bn.

Bloomberg analyst Eric Balchunas said spot ETH-ETF trading in the US will begin on 23 July. According to him, "The SEC finally asked issuers to return final Forms S-1 on Wednesday."

Stripe, a payment service, now allows EU residents to purchase Bitcoin, Ethereum, and Solana using credit and debit cards. In 2018, Stripe abandoned digital assets, citing Bitcoin's high volatility.

Jack Dorsey's Block firm, the developer of the BitKey hardware wallet, has enabled users to buy BTC using credit cards, bank transfers and fintech solutions like Apple Pay, Google Pay and PayPal.

Announced in February, the Chrome browser extension for leading non-custodial exchange Uniswap became available to all users. Market participants can create a new wallet or import an existing one. The extension works with 11 networks - Arbitrum, Avalanche, Base, Blast, BNB Chain, Celo, Ethereum, Optimism, Polygon, ZKsync and Zora Network.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)