EBC Markets Briefing | Aussie struggles on less hawkish RBA

The Australian dollar languished near its 13-month low on Monday amid risk-aversion mood. Two new rate-setters have been appointed to the RBA, which sparks some concerns of a change in the outlook for interest rates.

Considering a softened hawkish stance last week, the central bank is getting closer to joining its peers in interest rate cuts, but much will depend on the data to decide when it can begin to act.

Its chief economist, Sarah Hunter, said in a speech that there would be two key uncertainties to take into account – household income and consumption and Chinese fiscal stimulus.

Deputy Governor Andrew Hauser said policymakers are ready to respond "with force" should potential US tariffs hit global trade and threaten growth at home - the scenario of an all-out global trade war.

In spite of all the challenges, China's GDP is expected to grow by about 5% this year, the deputy director of the country's central financial and economic affairs commission said on Saturday.

Han Wenxiu noted there was a need to boost consumption and view domestic demand expansion as a long-term strategic move that would become the main driving force for economic growth.

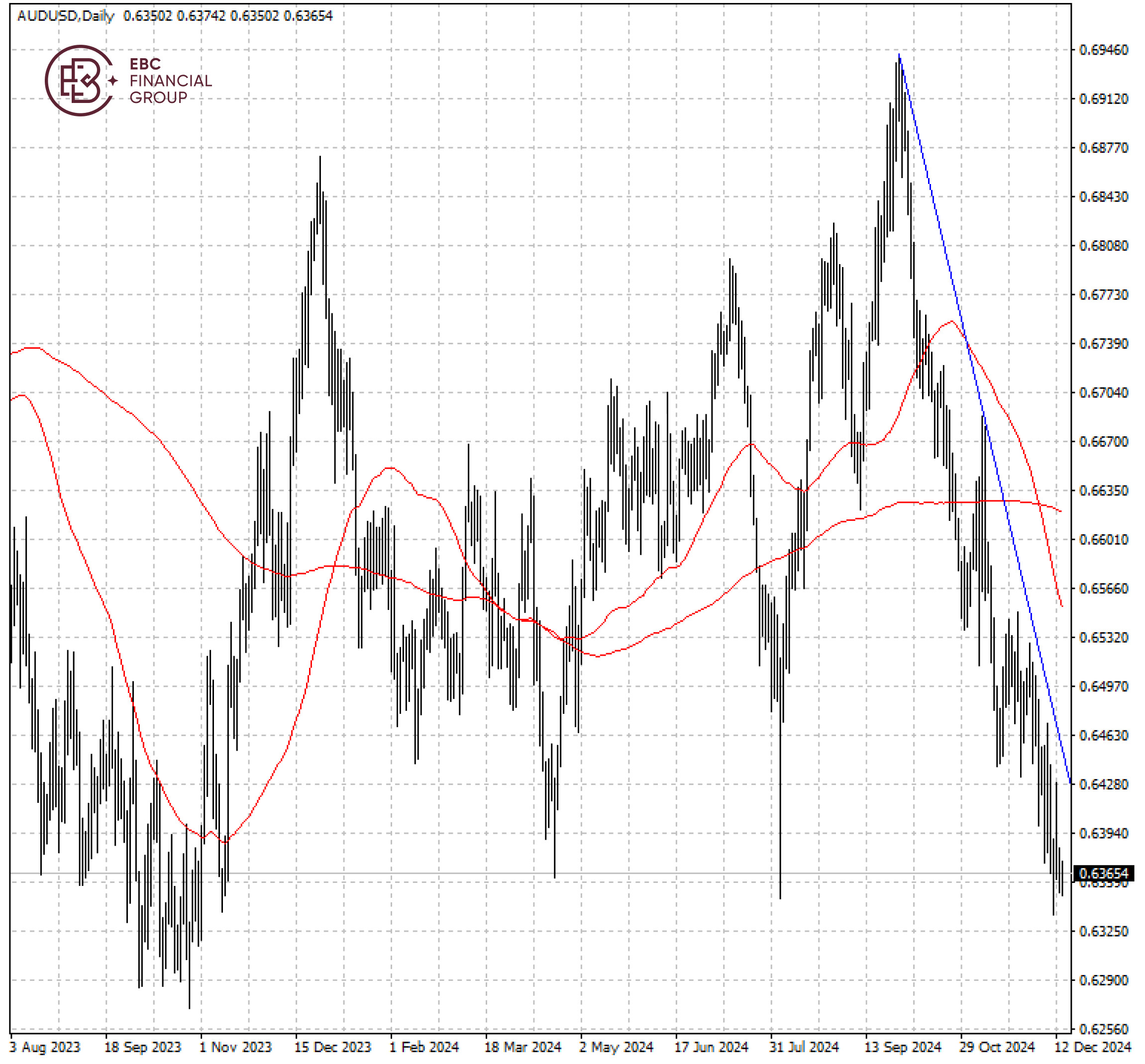

The Aussie dollar kept going down after a dead cross was formed. Below its descending trendline, the currency showed few signs of a rally and a decline towards the low of 0.6330 hit last year cannot be ruled out.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.