EBC Markets Briefing | Euro on the back foot on wider spreads

The dollar held firm and near recent peaks on Tuesday, while the euro was trading close to its yearly low. The gas between 10-year Treasury and Bund yield has widened nearly 70 bps in three months.

The Atlanta Fed's GDPNow indicator is running at 3.3% for Q4 and the strength of the economy has been supporting the greenback as the Fed could pause for a while following this week's expected rate cut.

France’s new PM Francois Bayrou works on forming a new cabinet, push a stopgap budget bill and seek support for longer-term budget legislation to tackle the country’s fiscal woes.

French have flooded the streets in recent months over agricultural imports and other issues. That casts a pall on the EU that is already struggling with weak growth and fiscal restraints.

ECB president Christine Lagarde said “the darkest days of winter look to be behind us” and that further interest rate cuts were likely. The contraction in Eurozone business activity eased at the end of the year.

The central bank’s main concern is that a dramatic and uncontrolled widening of bond spreads between Eurozone member states could make monetary policy less effective.

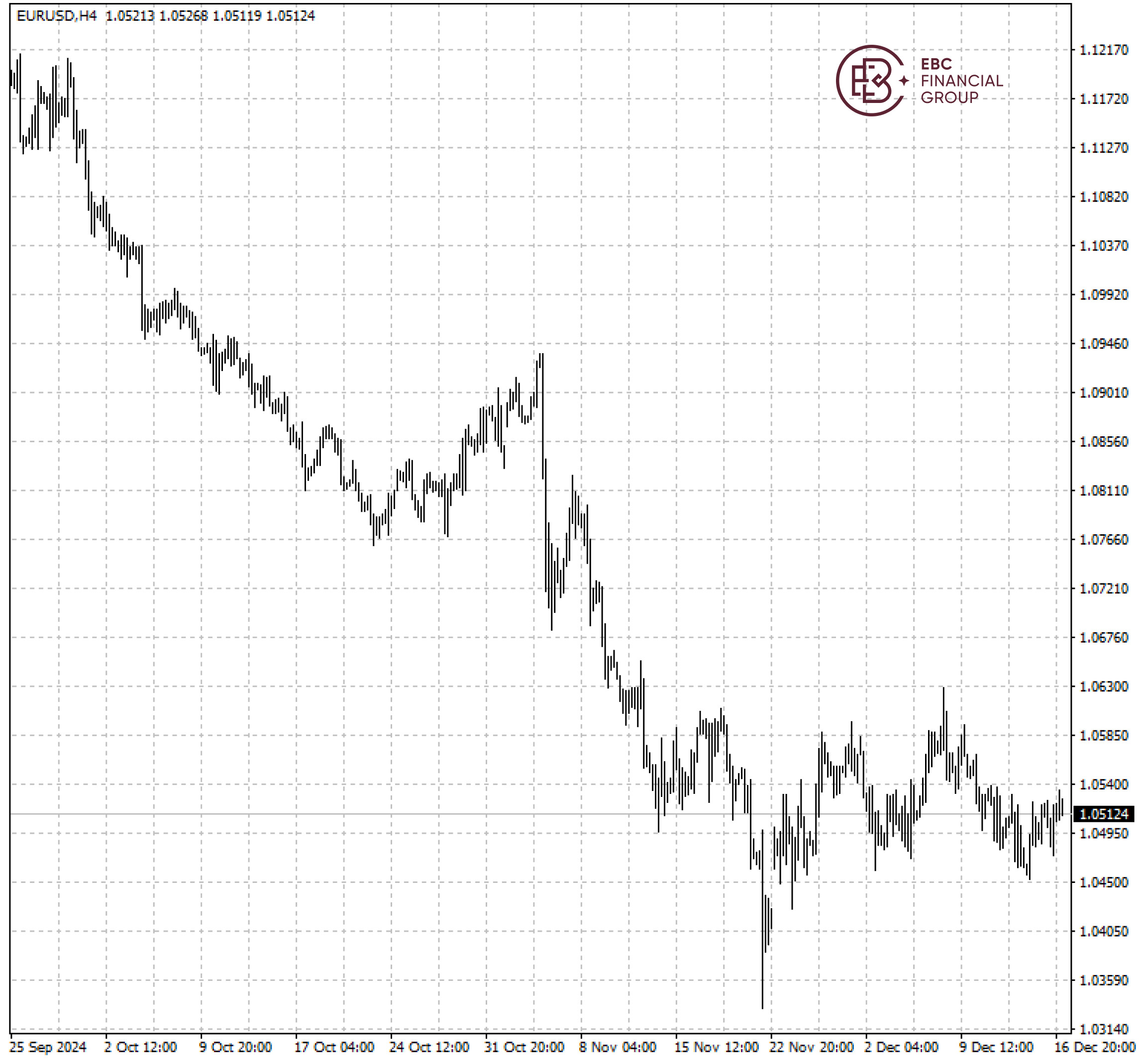

The single currency was stuck in the tight range and the path of least resistance is a moderate rally towards 1.0540. But cues on direction will not be available until a breakout occurs.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.