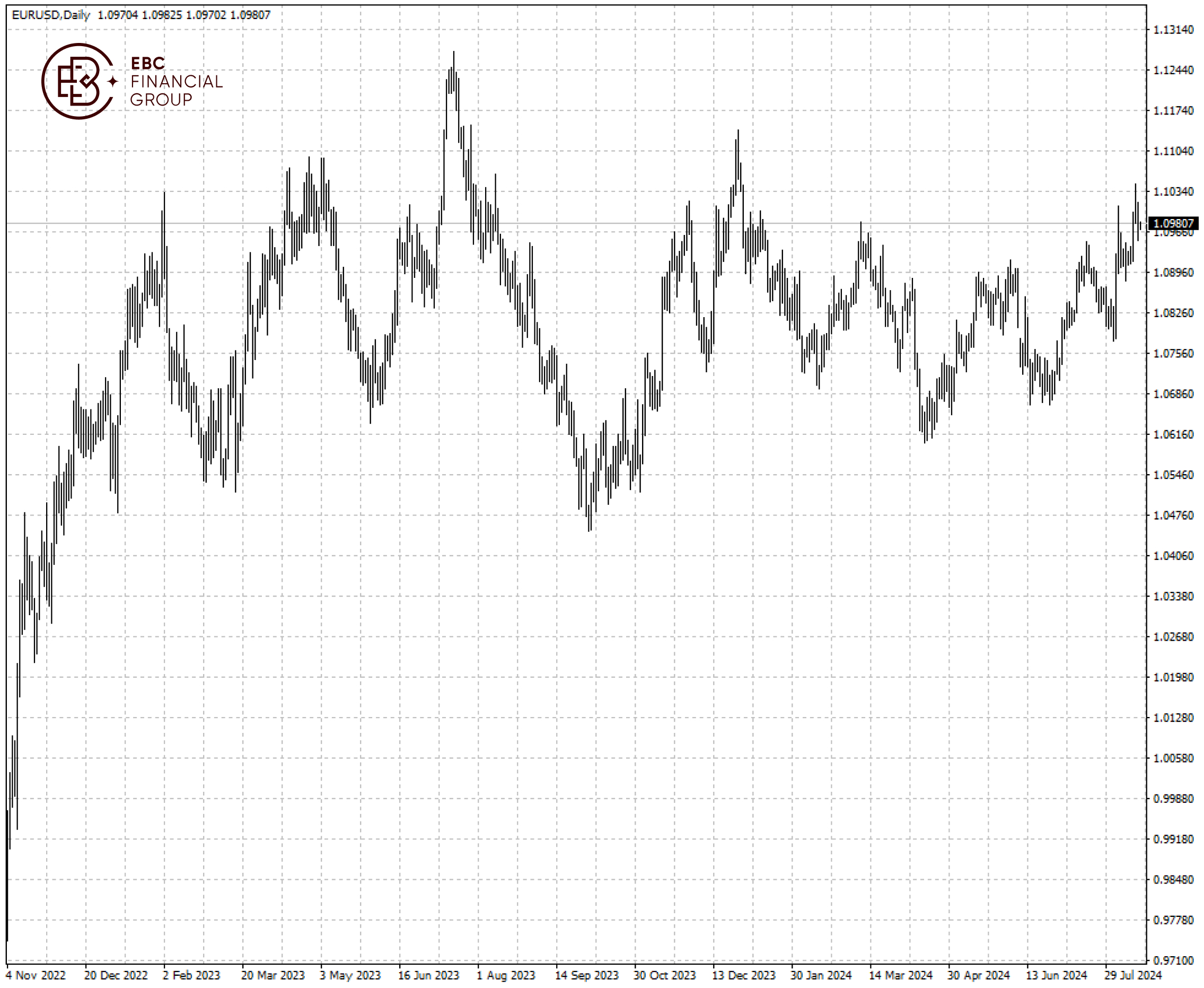

EBC Markets Briefing | Euro sits near yearly high with dollar under strain

The euro was flat on Friday, close to its highest level this year. The Fed is anticipated to ultimately being more aggressive on easing, possibly delivering a half-point reduction in September.

Money markets are currently pricing over 100 bps of cuts in the US by December, compared to 70 bps in the euro area. The new data may add to the growing bets on political divergence.

Euro-zone productivity barely improved in Q2 and again missed expectations – a blow for its efforts to bring inflation back to 2%. Labour productivity per person fell for a second straight quarter.

Christine Lagarde have highlighted the importance of “the nexus of profits, wages and productivity.” Should an adequate improvement fail to materialize, sustained cuts in interest rates may prove tricky.

The European Commission has published a new forecast, with a more upbeat scenario for consumers, that Inflation rates will continue to drop and the EU economy should gradually grow in 2024.

Some challenges remain. For instance, investment growth is slowing since fewer new homes are being built. As a result, it is expected that interest rates will drop more slowly than anticipated.

The euro retreated after reaching a multi-month high above 1.1040. The hurdle still lies around 1.1000 and a push below 1.0950 could put 1.0900 in sight.

EBC Fintech Development Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Brand Influence or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.