EBC Markets Briefing | Norwegian krone’s freefall assails government

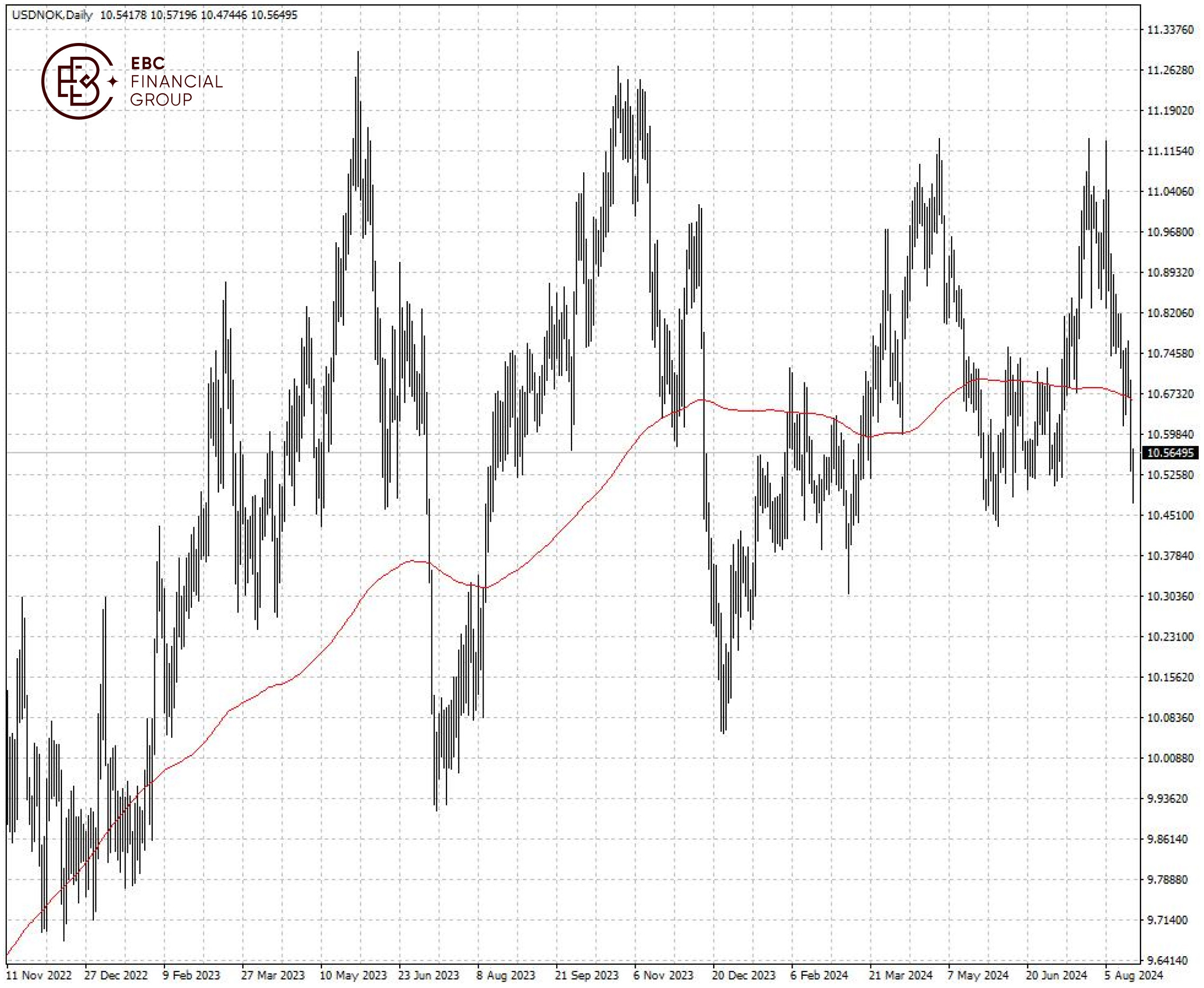

The Norwegian krone, one of the worst performing among top 10 most frequently traded this year, languished around its record low against the US dollar and the euro on Tuesday.

The decline in Norway’s currency has been so dramatic that a former government minister recently resorted to a radical proposal — pegging the krone to the euro. The Swiss franc was pegged to the euro until Jan 2015.

Another proposal was to establish a “krone commission” to look at what has happened to the currency. The weakness is causing consternation among businesses, with companies forced to raise the price of imports.

Inflation rate fell below 3% in June for the first time in three years. The Norwegian central bank left interest rates unchanged at its meeting last week and said they were likely to remain there “for some time ahead”.

The Swedish krona has also been ill-fated in recent years. Unlike the ECB, Sweden’s Riksbank and Norway’s central bank has yet to cut rates in this current cycle in order to prop up their currencies.

Economists and currency strategists believe there are rational explanations for the decline. The first leg down coincided with a drop in the oil price in 2014 and the second was due to the Fed kicking off rate hikes.

The pair looks set to challenge its 200 SMA after bottoming up around 10.48, but range trading might be intact for longer term.

EBC Fintech Development Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Brand Influence or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.