EBC Markets Briefing | Oil prices higher on peace deal uncertainty

Oil prices edged higher on Friday but were on track for a weekly loss as a potential OPEC+ output increase and a possible ceasefire in the Russia-Ukraine war may raise supply.

The US and Russia are moving in the right direction to end the war in Ukraine, but some specific elements of a deal remain to be agreed, Russian Foreign Minister Sergey Lavrov said in an interview with CBS News.

Iran Foreign Minister was ready to travel to Europe for talks on Tehran's nuclear programme. The US could likely lift of sanctions on Iranian oil exports if some progress is made.

Reuters reported on Wednesday that several OPEC+ members had suggested the group accelerate oil output increases for a second month in June despite cloudy demand outlook.

US crude oil stockpiles rose unexpectedly last week as imports jumped, while both gasoline and distillate inventories fell more than expected, the EIA said.

Goldman Sachs expects Brent and WTI oil prices to edge down, averaging $63 and $59 a barrel, respectively, for the remainder of 2025, and $58 and $55 in 2026.

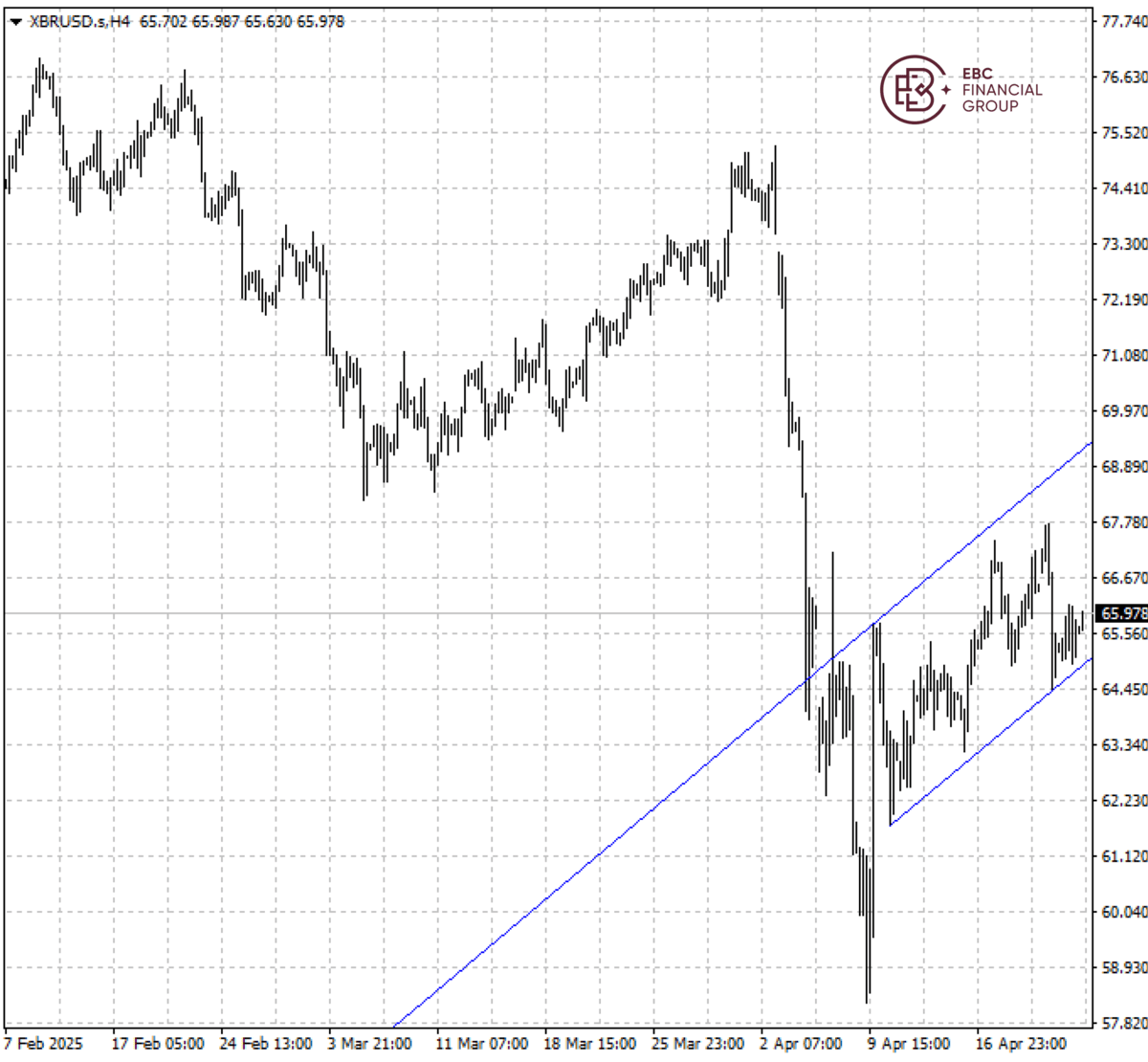

Brent crude is set to rise further as the upside channel remains intact. The resistance lies around $68.2.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.