EBC Markets Briefing | Tropical storm offers loonie a respite

The Canadian dollar rallied from its nearly 3-week low as oil prices steadied and the BOC said it is harder to consistently meet its 2% inflation target.

With globalization slowing, the cost of global goods might not decline to the same degree, and this could put more upward pressure on inflation, Governor Tiff Macklem said in a speech.

Still he left the door open to larger rate cuts if growth falls short of expectations. The central bank last week cut its benchmark rate for the third time since June, lowering it by 25 bps.

Both oil benchmark fell nearly 3 dollars on Tuesday as a weaker demand outlook and risks of oversupply weighed on the market. Tropical Storm Francine’s potential supply disruption heled ease the declines.

About 24% of crude production and 26% of natural gas output in the US Gulf of Mexico were offline due to the storm. Meanwhile China's daily crude oil imports rose last month to their highest in a year.

The OPEC cut its 2024 global demand growth estimate to 2.03 million bpd in a monthly report. But the EIA said global oil demand is set to grow to a bigger record this year while output growth will be smaller than prior forecasts.

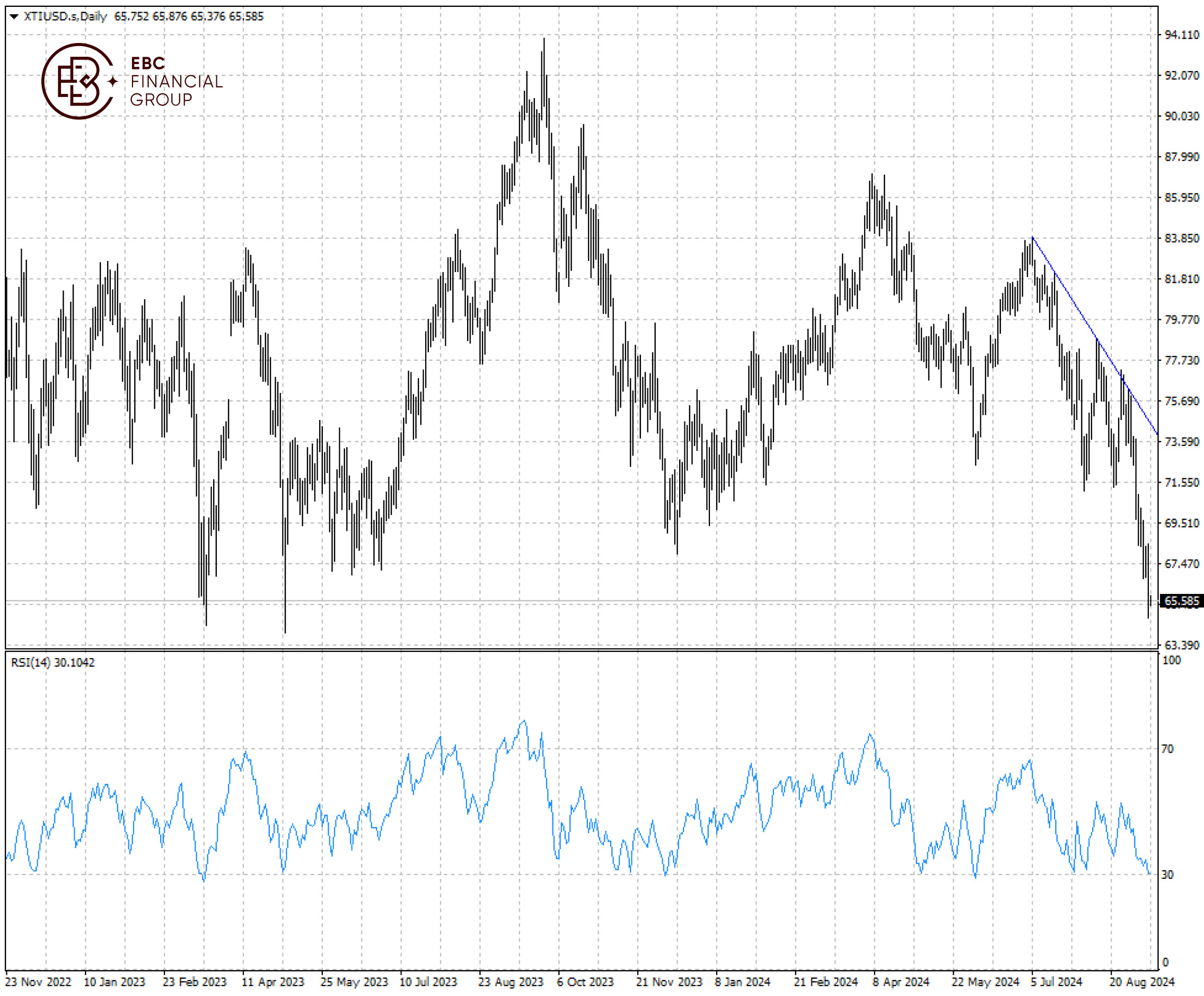

WTI crude could be on its course to fall to the support level of $64 where we see it bottom out given RSI within an inch of the oversold territory. But the descending trendline will put a lid on the expected rally.

EBC Institute Perspectives Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC International Business Expansion or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.