EBC Markets Briefing | Yen strengthens amid trade deal uncertainty

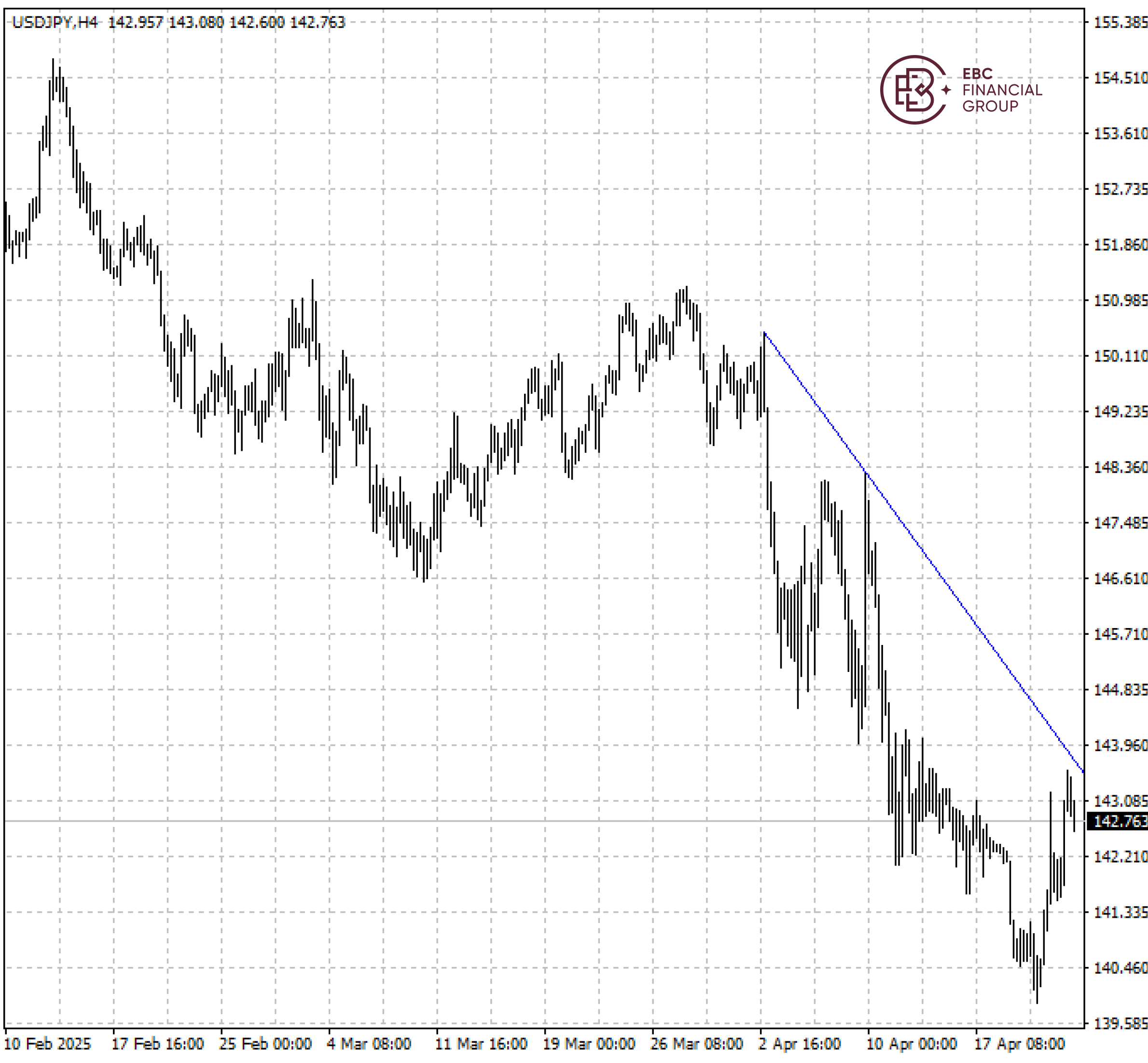

The yen which traded above143 per dollar on Thursday is shaping up to be a major topic of discussion between Japan and the US though sources say Tokyo will push back against any request to boost its currency.

The BOJ is likely to push back the timing of further interest rate hikes as uncertainty triggered by US tariffs has heightened downside risks to growth and inflation, a senior IMF official said on Wednesday.

The agency still expects inflation will converge to the BOJ's 2% target, though that will happen in 2027 rather than in 2026. Markets have priced in a 65% chance of increase in short-term rate by 25 bps by year-end.

Core inflation in Japan accelerated in March due to persistent rises in food costs. BOJ Governor Kazuo Ueda recently told parliament that such cost-push price pressure will likely dissipate.

A Reuters survey of economists also showed the central bank is likely to hold its key interest rate through June. But most of the respondents did not expect Japan to fall into a recession.

The yen's recent rebound may also ease inflationary pressure by moderating rises in import costs, some analysts say. Imports grew 2% in March from a year earlier, compared with market forecasts for a 3.1% increase.

The yen stays above the upside trendline that has been formed since 2 April. A break below it is needed to reverse the short-term trend, otherwise the currency could head back to 140 per dollar.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.