Equity Weakness Dampens Crypto Investment Appetite

Equity Weakness Dampens Crypto Investment Appetite

Market Picture

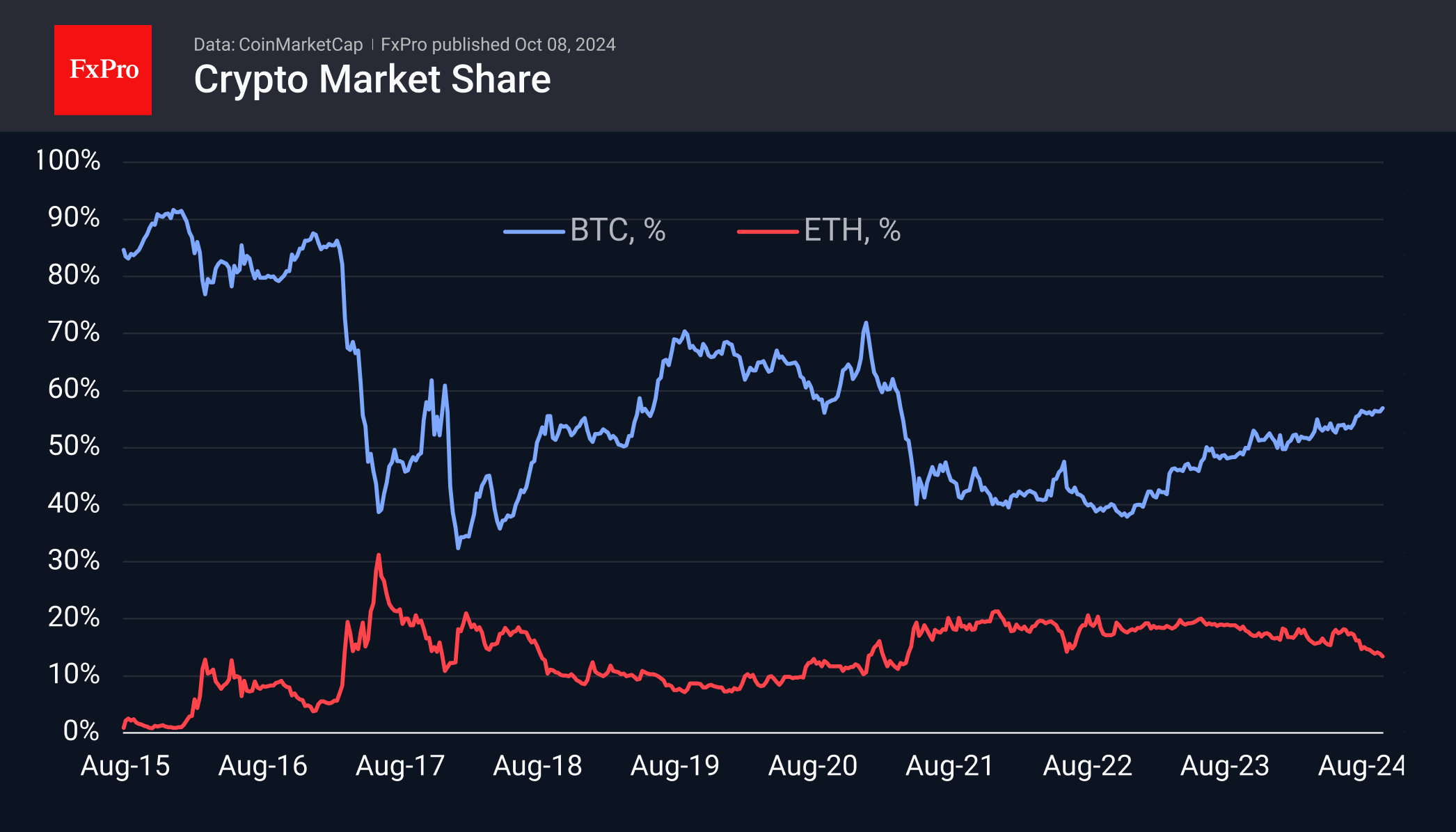

The cryptocurrency market rolled back 1.8% in 24 hours to $2.17 trillion due to a reduction in risk appetite among investors, sparking a sell-off in bonds and equities. That said, as the less risky of the cryptocurrencies, bitcoin has been gaining ground relative to the overall market during similar periods, now holding 56.9% of the capitalisation of all currencies - its highest since April 2021. That share is largely taken away from Ethereum, which now weighs in at 13.5% of the entire market, which was also last seen three and a half years ago.

Technically, bitcoin sold off to consolidate above its 200-day moving average, a demonstration of bearish strength. But we're still inclined to see this as more of a short-term correction for now, as the latest episode of risk-off is driven by strong data. While this is a formal reason to sell, strong employment is still a positive factor, promising more demand for final consumption and investment. The threat to cryptocurrencies so far is a combination of a new round of rising prices with signs of a weakening economy. Perhaps they'll be found in economic reports this week and next. But that's nothing more than a risk.

News background

According to CoinShares, crypto fund investments fell $147 million last week after three weeks of inflows. Bitcoin investments were down $159 million; Ethereum was down $29 million, and Solana was up $5 million. Investments in funds with multiple crypto assets were up $29 million, recording their 16th week of inflows. Since June, such products have become favourites among investors who prefer to invest in a diversified basket of assets rather than individual assets.

Despite the previous week's difficult start, the options market points to bullish sentiment in the fourth quarter. QCP Capital is optimistic for a strong October, given the projected rate cuts and bitcoin's correlation with equities. UBS forecasts China's announcement of a new stimulus package from 8-18 October for 1.5-2 trillion yuan ($213-285 billion) with an additional 8 trillion yuan ($1.14 trillion) in 2025.

Crypto Insights noted ‘one of the highest levels of crypto optimism’ for the year among investment fund managers. The number of funds invested in cryptocurrencies topped 1,600.

PwC notes that the UAE has abolished VAT on all crypto transactions, putting digital assets on par with traditional finance (TradFi).

Pavel Durov said Telegram users bought up to 600,000 ‘rare’ gifts in a few hours on the day of their launch. The developers promise that in the future, ‘rare’ gifts can be converted into NFTs on the TON blockchain and traded as tokenised assets.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)