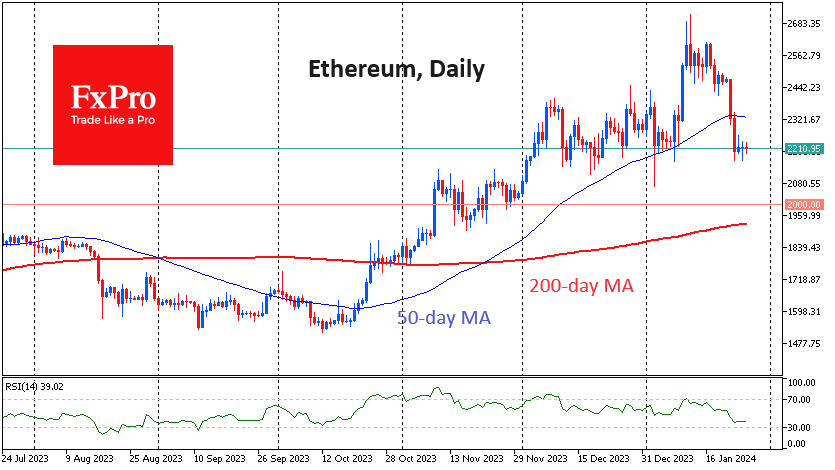

Ethereum could end consolidation with a dip towards $2000

Market picture

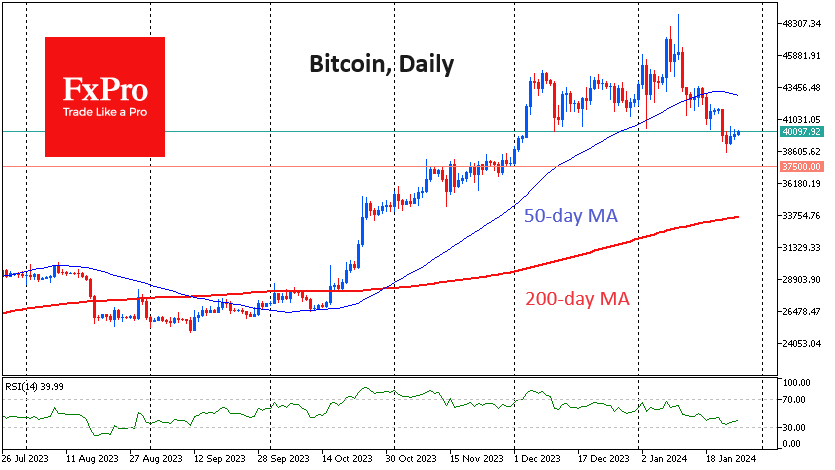

Volatility in the cryptocurrency market remains subdued, keeping the capitalisation near $1.56 trillion for the third day. Meanwhile, Bitcoin remains around $40K, and Ethereum looks pegged to $2200.

The drop in equity indices over the past 24 hours hasn't been too much of a concern for cryptocurrency investors so far, as it looks more like a series of individual corporate stories rather than a global shift in sentiment.

Bitcoin is benefiting from this consolidation as its share of all cryptocurrencies has once again surpassed 50%.

Meanwhile, Ethereum, the second most-capitalised coin, has returned to the lower end of the consolidation it spent most of December in, losing since the start of the day and threatening to fall a notch lower to the $2100 area, which was the upper end of the consolidation in November. A decline here would be as logical a move as a BTCUSD pullback to $37500, which remains the main scenario. At the same time, however, be prepared for a brief dip towards $2000 due to cryptocurrency volatility.

News background

The EC postponed the decision on BlackRock's application to launch a spot Ethereum ETF until 10 March. Optimistic experts expect the Ethereum ETF to be approved in May with a 50-70% probability, while sceptics point to regulatory resistance.

The emergence of spot bitcoin ETFs in the US has opened the door for the cryptocurrency to reach a wider audience. Now, for the first time, cryptocurrency could become mainstream, said the head of institutional at exchange Coinbase. New cryptocurrencies will attract a lot of capital, but it won't happen overnight. It will take "months and even years".

The G20’s Financial Stability Board in 2024 plans to focus on global regulations for the digital asset industry and the regulation of artificial intelligence.

Reuters confirmed the existence of a thriving underground crypto market in China. Investor interest in digital assets is growing against the backdrop of a troubled economy and a lack of value preservation tools. With Hong Kong's approval of digital assets in 2023, Hong Kong has become one of the opportunities for Chinese investors to access cryptocurrencies.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)