Fed’s hawkish pause, mixed earnings leave markets directionless

Powell signals scope for cuts but a pause for now

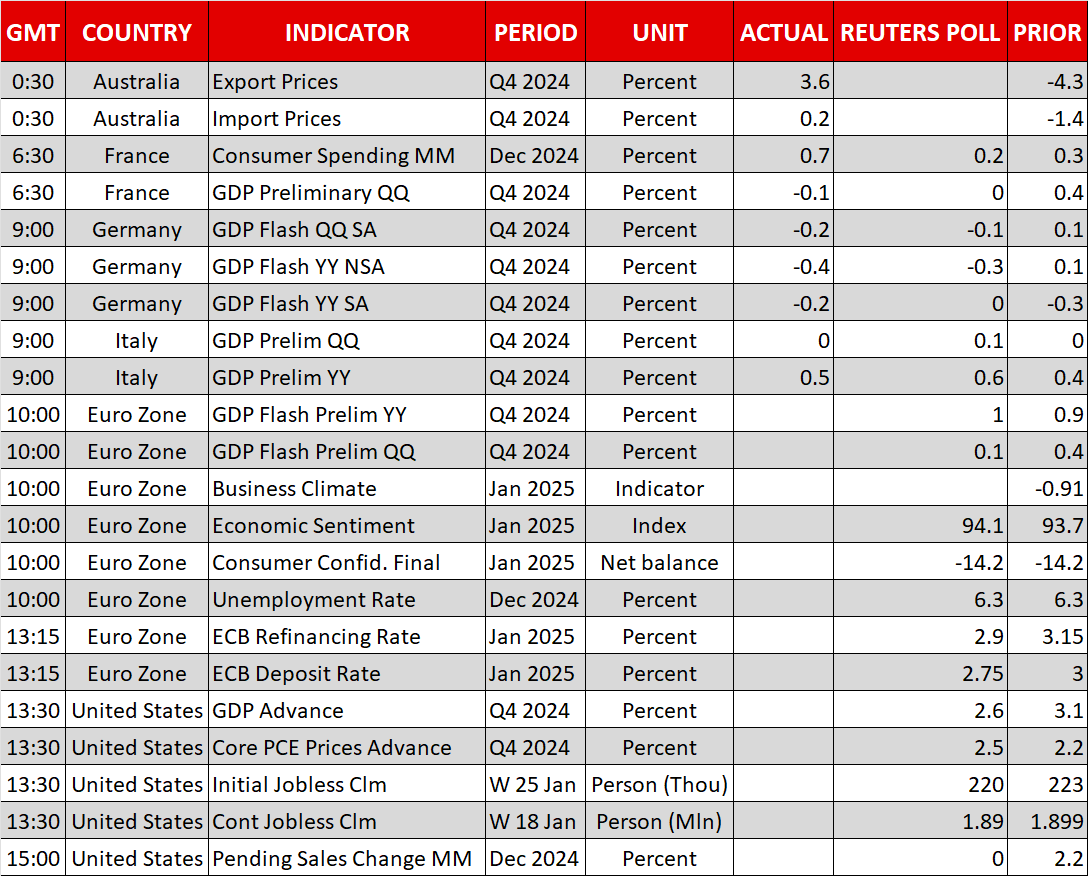

The Federal Reserve kept interest rates unchanged on Wednesday as expected but provided no clear guidance on the policy outlook amid all the uncertainty about tariffs. There had been some expectations that Jerome Powell would ease up on the Fed’s hawkish stance heading into the meeting following Governor Waller’s dovish remarks right before the blackout period. However, the Fed chief dashed hopes of a rate cut at the next meeting in March, when asked about it in his press conference.

Powell hinted that policymakers want to see several readings on inflation before cutting rates again. Yet he suggested that the Fed is some distance away from the neutral rate, leaving the door wide open to further easing down the line.

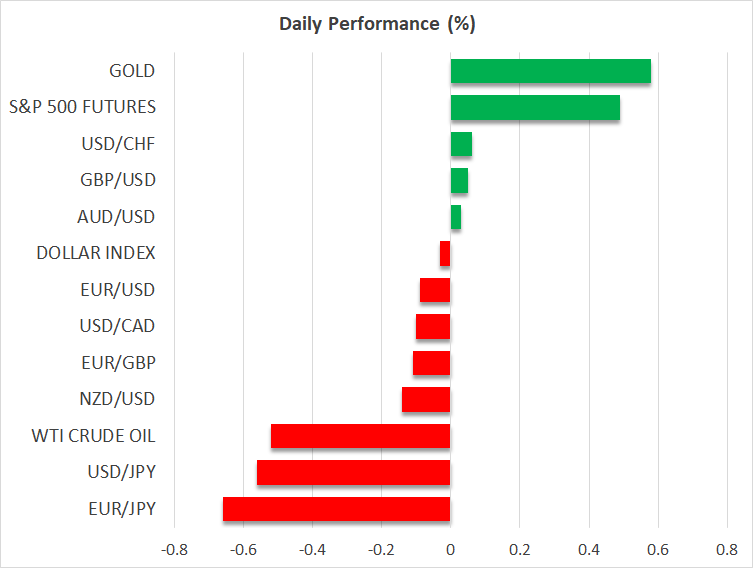

Money markets responded by pricing in one additional 25-bps cut by year-end, but there was little reaction in bond markets and the US dollar also struggled for direction in the aftermath of the decision and Powell’s briefing.

Will US data lift the fog for investors?

It doesn’t help that policymakers are just as in the dark as investors are about what shape and size the Trump administration’s tariffs will take. The Fed is unlikely to commit to any particular path until there is some clarity on the tariffs front or inflation is coming down again.

Hence, there is quite a bit of sideways choppiness in FX markets and the focus has quickly shifted to the impending data releases out of the US, namely today’s Q4 advance GDP print and tomorrow’s PCE inflation numbers.

It’s quite possible that GDP growth surprises to the upside and PCE inflation slightly to the downside, so it would be interesting to see how markets would digest that.

ECB decision up next

Also in the spotlight on Thursday is the European Central Bank’s policy decision. The ECB is widely anticipated to lower rates for a fifth time since last summer, bringing the deposit rate down to 2.75% from 3.00%. Like the Fed and Bank of Canada yesterday, the threat of tariffs by President Trump is hanging over the Eurozone’s growth and inflation outlook. However, with the major European economies already facing headwinds of their own, the ECB will probably flag further rate cuts for the next few meetings.

Preliminary GDP readings out of Germany and France today disappointed, pointing to a contraction in both economies in Q4. The euro is trading slightly lower against the US dollar and could deepen its losses if President Lagarde doesn’t sound very upbeat about the Eurozone’s growth prospects.

The Canadian dollar, meanwhile, is somewhat firmer today after sliding on Wednesday on the back of the Bank of Canada’s decision to trim rates by 25 bps and warn of a significant disruption to the economy if Trump goes ahead and imposes 25% tariffs on Canadian and Mexican imports on Saturday.

Mixed start to tech earnings

The Saturday deadline for Mexico and Canada to come up with proposals to appease Trump’s demand for the two countries to crack down on the flow of fentanyl into the US is also weighing on Wall Street. In addition, AI-linked stocks have taken a hammering this week amid rising competition in the sector from Chinese firms.

However, US futures are resuming their rebound today following mixed earnings by Microsoft, Tesla and Meta Platforms after yesterday’s market close. There were no blowout results from any of them, but there were some positives, so the recovery could gain traction over the next few sessions. That’s assuming, though, that Apple doesn’t spoil things when it publishes its results later today.

.jpg)