Nonfarm payrolls take center stage

Will a disappointing NFP print add to July cut bets

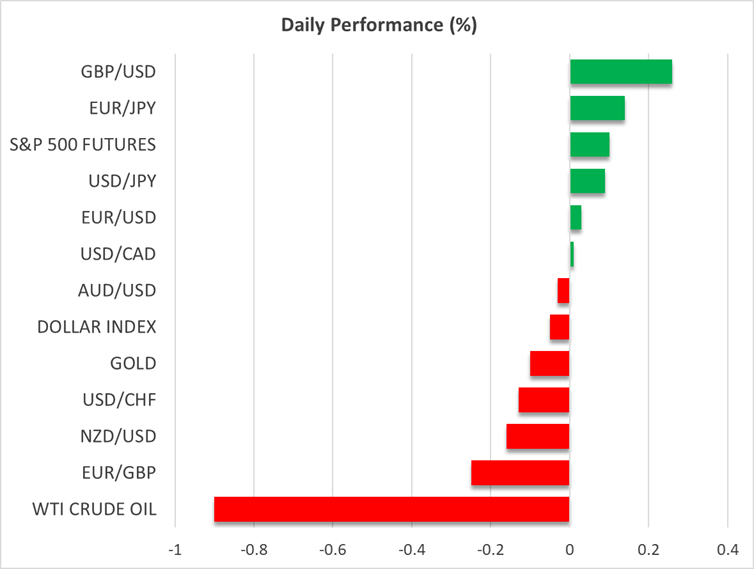

The US dollar traded slightly higher against most of the other major currencies on Wednesday. It gained the most ground against the pound, while it underperformed only against the aussie and the loonie. Today, the greenback is slightly higher or unchanged against most of its peers, with traders locking their gaze on the NFP report later today.

Yesterday, the ADP report revealed that private employment unexpectedly lost 33k jobs in June, marking the first slide since March 2023. This raised worries that today’s nonfarm payrolls may also disappoint, which could increase the probability of a rate cut by the Fed in July. According to Fed funds futures, investors are now penciling 67bps worth of reductions by the end of the year, with the probability of a July reduction rising to 25% from 20% ahead of the release.

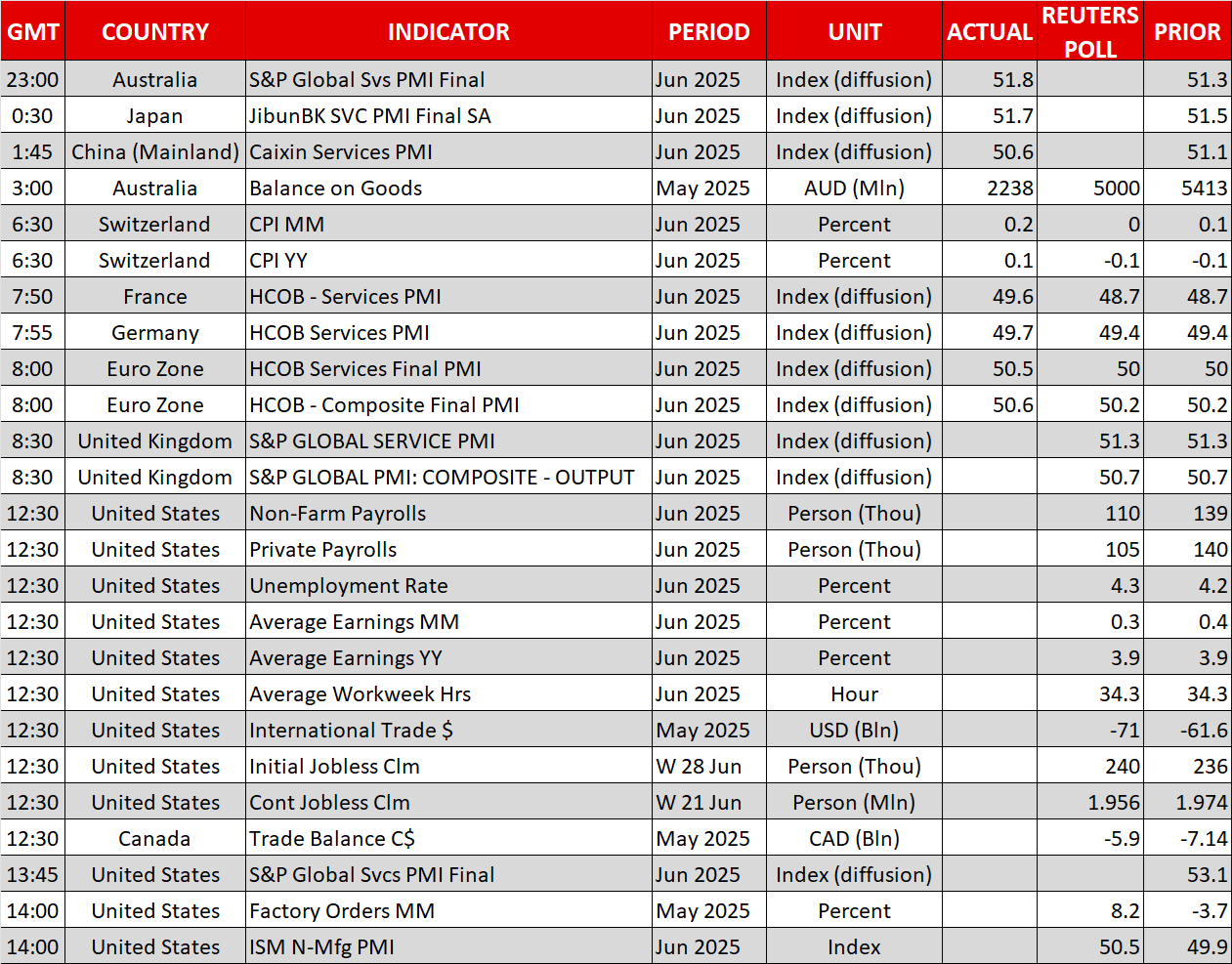

Nonfarm payrolls are expected to have further slowed to 111k from 139k, and the unemployment rate is seen ticking up to 4.3% from 4.2%. Given the uncertainty surrounding the inflation outlook, average hourly earnings may also be closely watched. Expectations suggest that the year-on-year rate of wage growth remained unchanged at 3.9%. Initial jobless claims for last week and the ISM non-manufacturing PMI for June are also scheduled to be released today.

US and Vietnam agree on trade, Trump’s bill struggles in the House

What may have also allowed investors to add to their rate cut bets may have been the trade deal between the US and Vietnam, which likely raised optimism over the potential of other agreements ahead of the July 9 deadline, when reciprocal tariffs are expected to kick in. However, the 20% duty agreed, or even a higher rate, could become the norm when the US attempts to strike deals with other trading allies, like Europe and Japan. That’s maybe why rate cut bets were not significantly bolstered by the deal, as higher tariff rates keep the upside risks of inflation elevated.

As far as Trump’s tax-cut and spending bill is concerned, the progress of the bill advancing in the House of Representatives stalled as a handful of Republicans refused to vote for it. However, this could still change as policymakers continue to negotiate.

Pound slides amid political instability

The British pound fell on Wednesday after the government managed to pass a welfare reform, but only after some Labour members of parliament opposed to the scale of cuts initially proposed. This could potentially create difficulties as it raises the risk of higher taxes or spending cuts elsewhere to fund a potential budget hole and balance the public finances.

UK Prime Minister Starmer’s lack of commitment to Chancellor Reeves raised concerns about her future and sparked speculation that her replacement may be looser with spending. That said, later in the day Starmer’s press secretary clarified that Reeves “has the prime minister’s full backing” and that she was going nowhere. Perhaps that’s why the pound is in a recovery mode today.

Stocks gain ahead of NFPs, gold could extend rebound

On Wall Street, both the Nasdaq and the S&P 500 closed in positive territory yesterday, with the latter hitting a fresh record high, while the Dow Jones finished the session virtually unchanged. Perhaps this was due to the relative optimism after the US-Vietnam trade deal, or due to the increasing likelihood of a July Fed rate cut.

Today, equity investors will pay close attention to the NFP report, but how they will choose to react remains unclear. Will a disappointing report prompt them to buy more stocks on speculation of lower borrowing costs, or will they decide to sell on concerns about the state of the US economy? It is also worth mentioning that Wall Street will close early today as tomorrow is Independence Day.

Gold’s reaction seems to be clearer in case the data points to a softening labor market. The prospect of lower borrowing costs could benefit the metal through the diminishing opportunity cost channel, or through safe-haven flows if investors become more worried about the economic outlook. In other words, if the data disappoints, gold is likely to extend its latest rebound and get closer to the high of June 16 at around $3,450.

.jpg)