Gold hits new records, but runs out of fuel

Gold shines bright

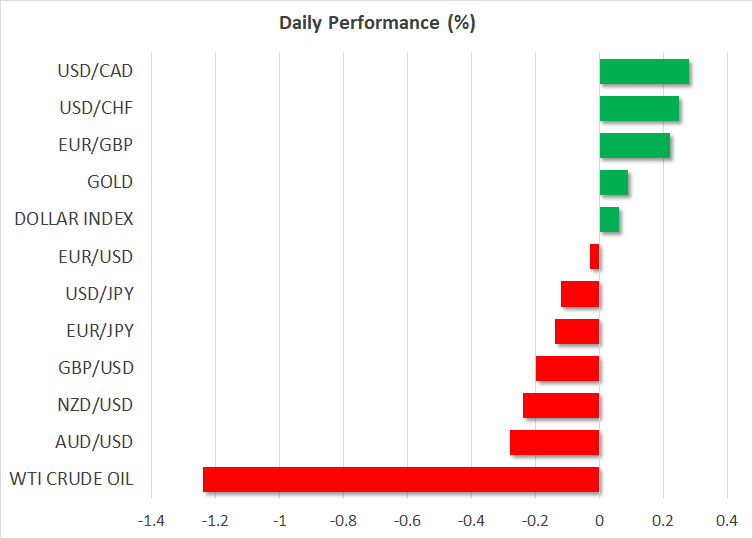

The meteoric rally in gold prices came to a crescendo early on Monday, with the precious metal hitting a new record high above $2,100 per ounce, before running into a wave of profit-taking and subsequently retreating.

With the global economy losing steam and inflation cooling off, bond yields have declined substantially as markets brought forward the anticipated timing of Fed rate cuts, which in turn has served as rocket fuel for gold prices.

Geopolitical demand has been another driving force behind this blistering rally. Tensions in the Middle East have fueled demand for gold as a hedge, while direct purchases from China and other central banks to diversify their reserves amid a ‘new Cold War’ climate have also played a crucial role in lifting prices this year.

The fact that the breakout today happened in a thin liquidity environment during early Asian trading complicates matters, and perhaps explains why gold got hammered back down so quickly.

That said, the broader landscape for gold seems favorable heading into next year, with the world economy staring down the barrel of a mild recession and central banks anticipated to slash interest rates significantly to cushion the blow.

Oil keeps sinking despite ‘good news’

Meanwhile, oil prices have been unable to capitalize on a series of 'encouraging' developments lately. An extraordinary decision by OPEC+ last week that saw the cartel announce deeper cuts to oil production was met with skepticism from traders, who doubted whether all OPEC nations would adhere to these "voluntary" production cuts.

Similarly, some missile attacks against commercial ships in the Red Sea over the weekend were not enough to spur buying appetite in energy markets either. The Pentagon said a US warship shot down three drones in response, with Yemen’s Iran-backed Houthi rebels claiming responsibility for these attacks in an escalation of the regional conflict.

Oil prices dropped further on Monday despite the prospect of reduced supply, which underscores that the market is more concerned about weakening demand and views the OPEC+ supply cuts as insufficient to balance things out, especially with US production at record levels and rising.

All quiet on the FX front, RBA decision next

Trading activity was more quiet in the FX arena, with economic news flow being light and most major currency pairs staying close to their opening levels. The US dollar chopped around with no clear direction, as traders weighed some hawkish remarks from the Fed chief that it is ‘premature’ to speculate on rate cuts against a softer ISM manufacturing survey on Friday.

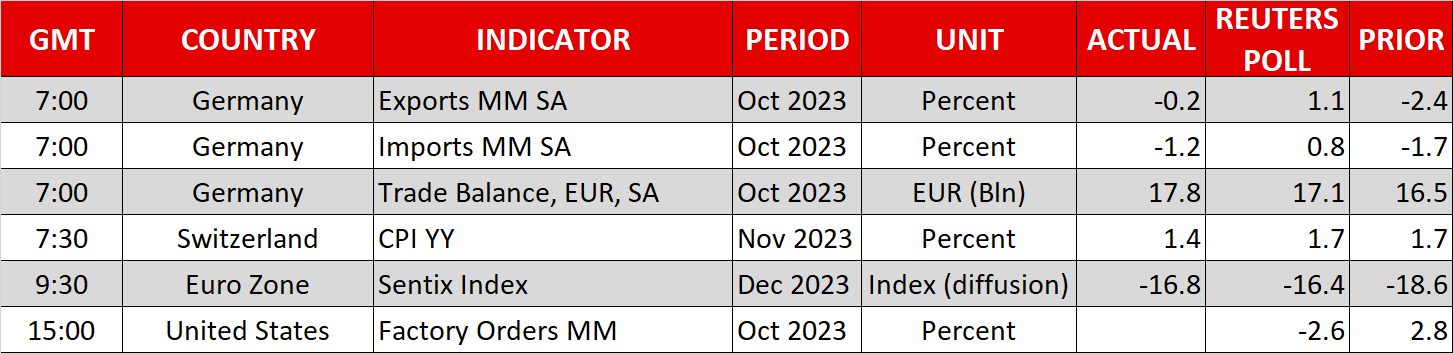

Last week, a spell of euro weakness was one of the dominant trading themes. Euro/sterling fell particularly sharply, as cratering inflation in the Eurozone reinforced speculation that the ECB will be the first major central bank to cut rates next year, whereas the sanguine mood in equity markets bolstered the risk-sensitive British pound.

Looking ahead, the next event for FX traders will be the Reserve Bank of Australia rate decision early on Tuesday. Markets assign only a 5% probability for a rate increase, so the market reaction will come down mostly to whether the RBA keeps the door open for further action in February.

As for the rest of the week, there is also a Bank of Canada rate decision scheduled for Wednesday, ahead of the latest edition of US nonfarm payrolls on Friday.

.jpg)