Gold opens week higher but not bullish yet

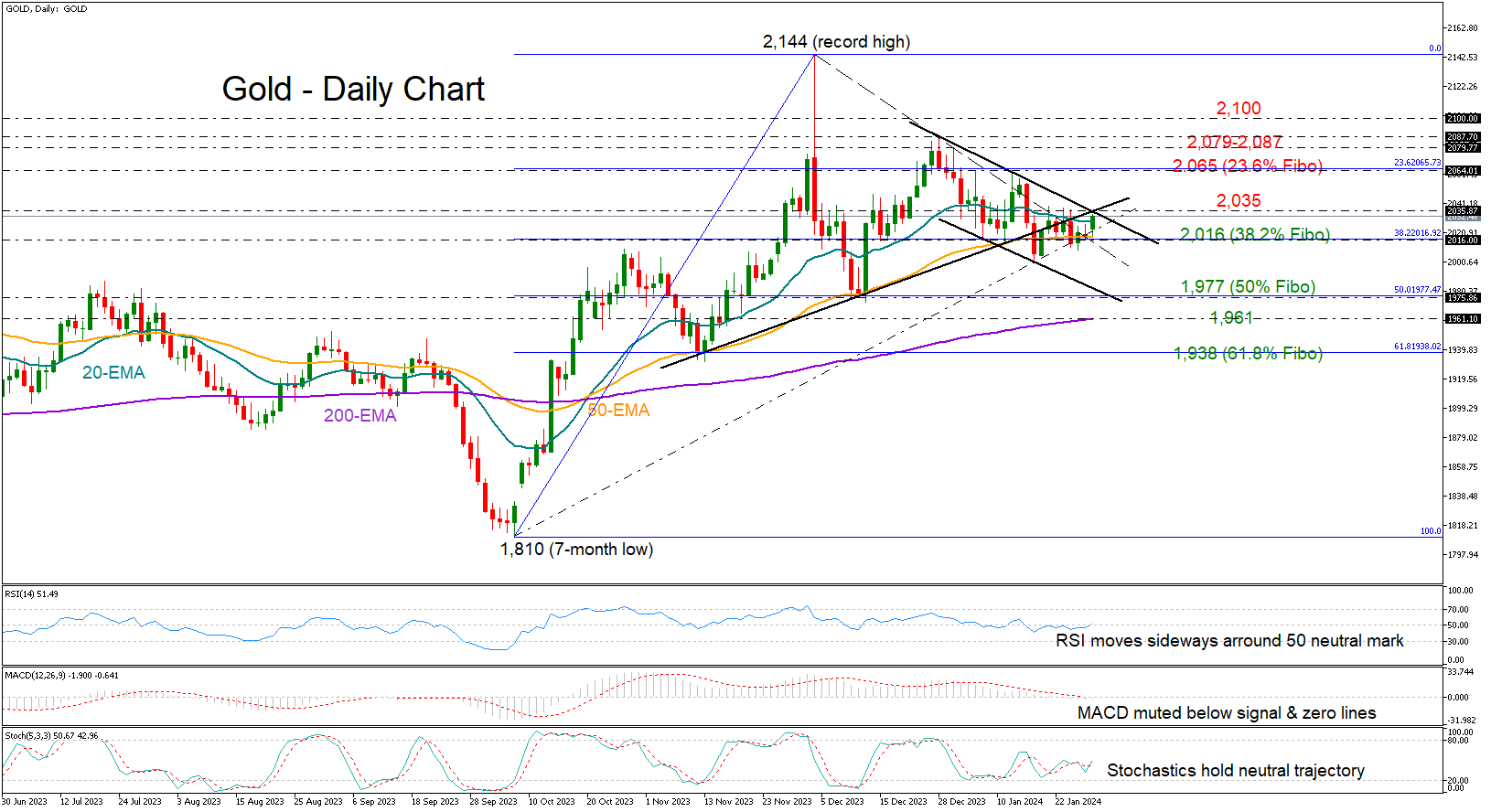

Gold started the week on a positive note, aiming to exit last week’s sideways trajectory above its 20-day exponential moving average (EMA) and the 2,035 trendline area after a couple of failed attempts.

Although the horizontal move in the RSI and the stochastic oscillators are balancing hopes for a bullish breakout, upside pressures could stay in play if the 2,016 floor stays intact.

A clear close above the 2,035 border and the short-term bearish channel could cheer buyers, lifting the price straight up to the key 2,065 region, which overlaps with the 23.6% Fibonacci retracement of the October-December upleg. Another success there could see a retest of December’s tough resistance region of 2,079-2,087 before the 2,100 psychological mark comes on the radar.

Otherwise, a slide beneath the 2,016 base, where the 50-day EMA is currently flattening, may cause a sharp decline towards the 50% Fibonacci of 1,977. The 200-day EMA is also in the neighborhood at 1,961. If the bears overpower that barricade, the door will open for the 61.8% Fibonacci level of 1,938 and November’s low of 1,931.

All in all, the precious metal keeps fluctuating within a well-defined area despite starting the week with positive momentum. An extension above 2,035 could confirm a new bullish wave, whereas a slide below 2,016 could activate fresh selling orders.