Important economic events next week

Important economic events next week

The new week will be packed with monetary policy news.

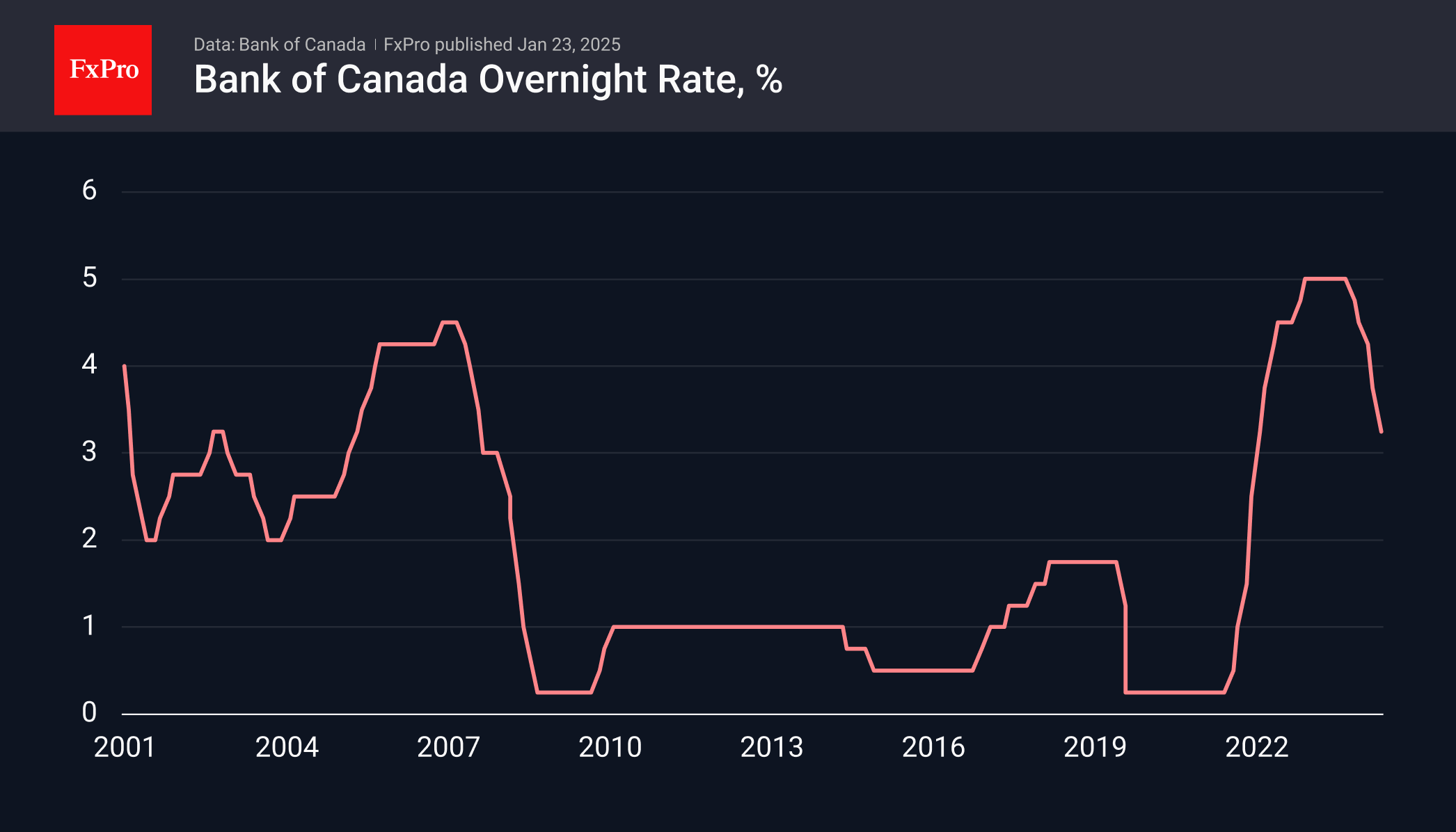

Most observers expect the Bank of Canada to cut its key rate by 25 points to 3.0% on Wednesday, 29 January. The previous two cuts have been 50 pips each, but traders can't completely rule out hints of a pause or even keeping the rate on hold.

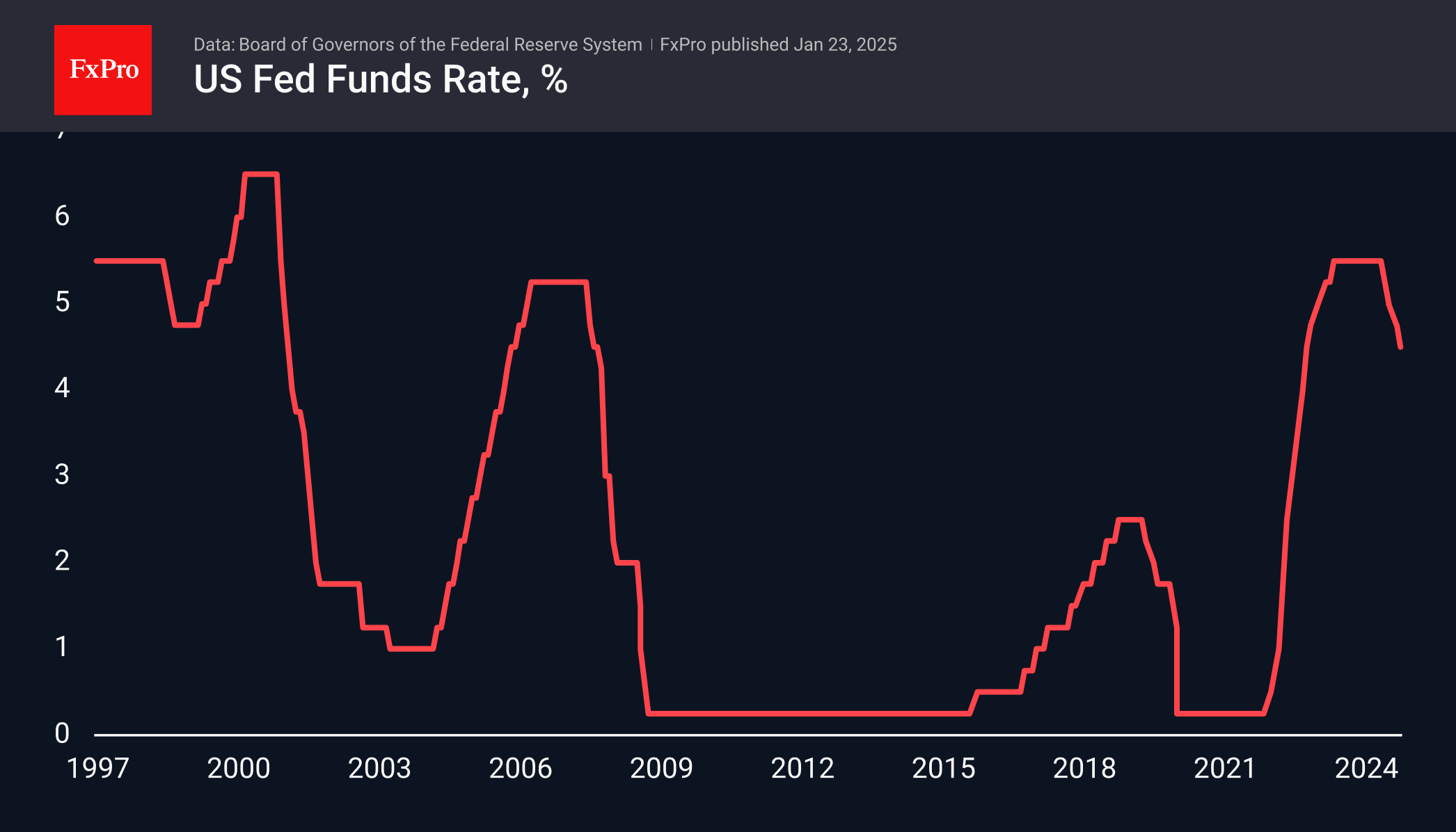

Next, the Fed will take the stage, where it is expected to keep the rate on hold after three rate cuts. The main intrigue is the Fed's view on inflation and the outlook of monetary policy for the rest of the year. Expectations of one or two rate cuts have been building again in recent days, which has halted the dollar's rise.

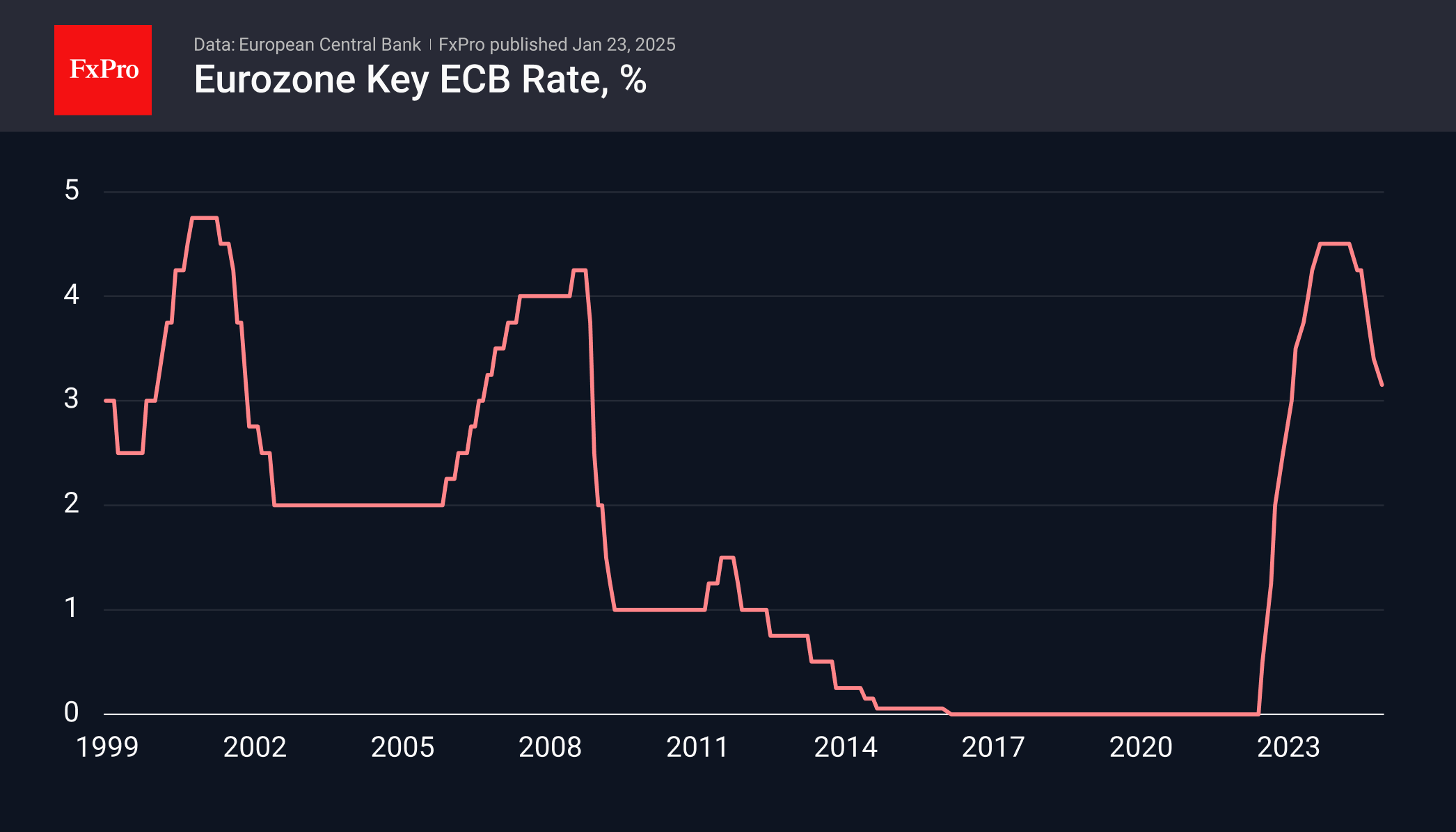

On Thursday, 30 January, the ECB is expected to cut its key rate by 25 points. This could be the first of four cuts expected from the eurozone this year. The approach is softer than its rivals', putting pressure on the euro.

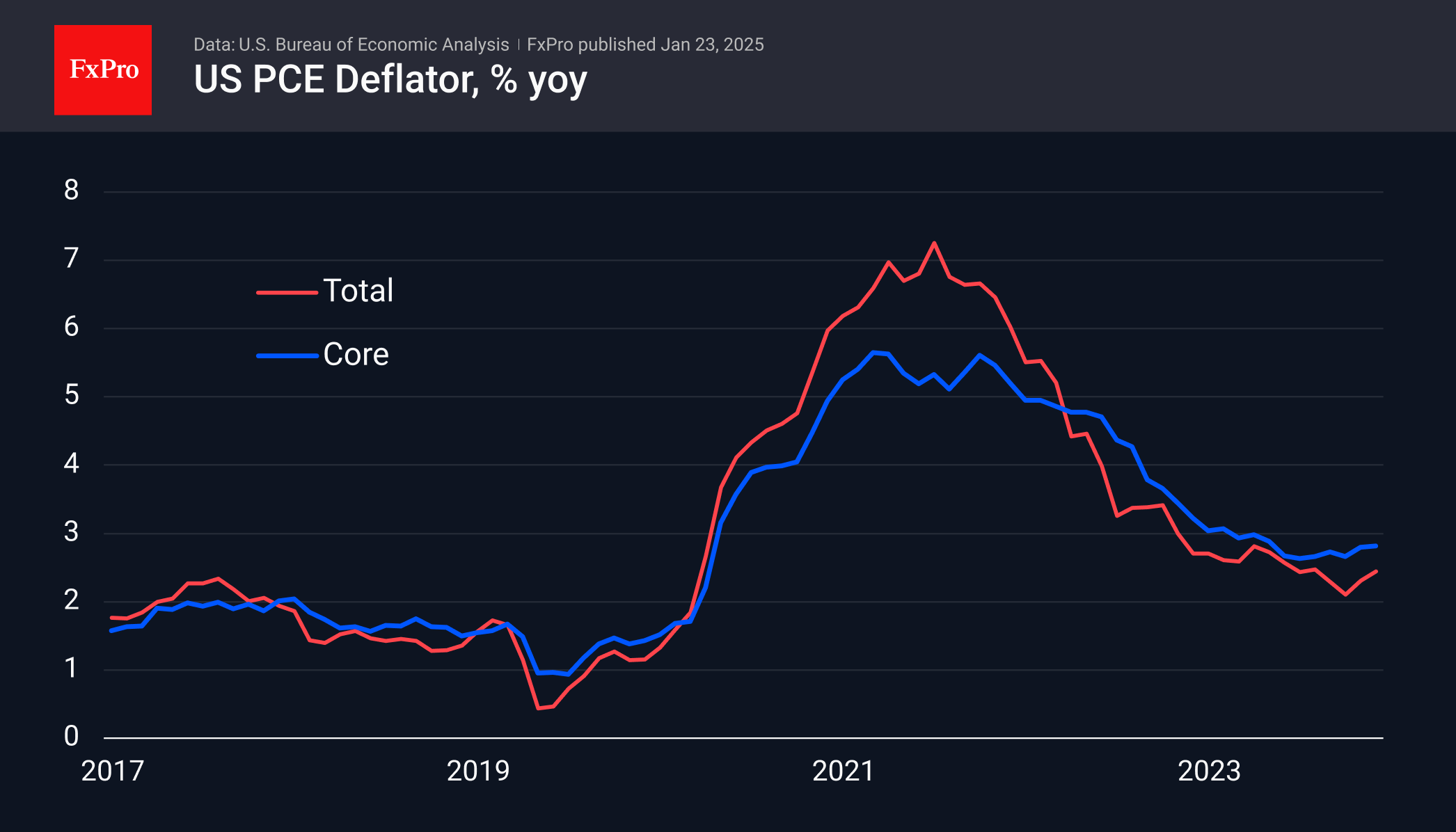

On Friday, 31 January, attention will turn to the US personal consumption price index data. This is the Fed's main inflation benchmark. And this metric shows an acceleration in price growth over the past six months. A slowdown is favourable for equities and negative for the dollar.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)