Nonfarm payrolls take center stage

US jobs growth to slow due to fires and cold weather

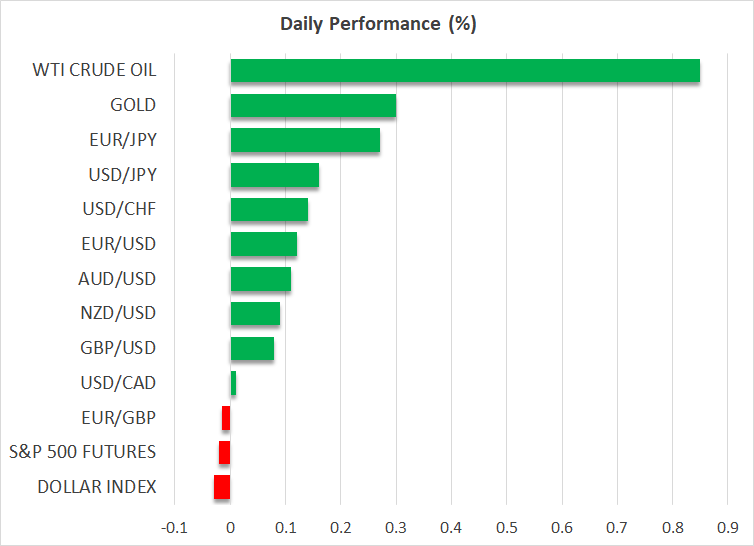

The US dollar rebounded somewhat against most of its major peers on Thursday, extending its losses only against the turbocharged yen, which continued to gain on the hawkish rhetoric by BoJ officials.

With the US jobs data on today’s agenda, sellers of the dollar may have decided to cover some of their positions and re-evaluate the outlook when they get the data. The forecasts are pointing to 170k new jobs and a steady unemployment rate at 4.1%. Average hourly earnings are expected to have slowed somewhat, but to have remained elevated near the 4% mark.

With the unemployment rate holding steady and wage growth remaining strong, the expected slowdown is unlikely to tempt Fed policymakers to resume rate cuts before summer. After all, the slowdown may be attributed once again to temporary factors like the wildfires in California and the cold weather across the US. On top of that, annual revision and new population weights could make it even more challenging to draw reliable conclusions.

Having said that though, should the general message from the data be that the labor market continues to perform well, market participants are likely to remain convinced that the Fed could hold rates steady for a while longer. Estimates suggest that the wildfires cost as many as 25k jobs and another 15k were cut off by the cold weather and snowstorms. So, if by adjusting to that, the actual NFP number points to healthy growth, the dollar is likely to extend yesterday’s timid recovery.

BoE cuts rates, super-hawk turns dovish

In the UK, the BoE decided to cut interest rates by 25bps, as was broadly expected, revising down its growth projections and lifting up its inflation forecasts.

The direction of the revisions was also largely anticipated. What came as a surprise was the unanimous vote in favor of a rate cut, with two members preferring a 50bps reduction. What was even more striking was that the super-hawk Cathrine Mann, who was the sole advocate for keeping rates steady in November, voted for a double reduction this time.

Investors may have interpreted Mann’s shift as a dovish tilt for the whole Committee and thereby added some more basis points worth of reductions for the rest of the year. From expecting two more quarter-point cuts, market participants are now seeing borrowing costs being lowered by another 60bps.

The pound has already been drifting south ahead of the decision and fell even more at the time of the release. That said, sterling quickly stabilized and rebounded, covering all the announcement-related losses.

Loonie traders await Canadian jobs report

Today, at the same time as the US NFP release, Canada will publish its own jobs report. Last week, the BoC trimmed interest rates by 25bps and revised down its growth forecasts, noting that they are concerned about US tariffs. However, they also added that tariffs could stoke persistently high inflation, allowing some market participants to bet on a pause at the next policy gathering. Thus, the jobs report may help tilt the scale towards a pause or another rate cut, depending on whether it will come in strong or soft.

Amazon slips as cloud revenue falls short

On Wall Street, both the S&P 500 and the Nasdaq eked out some gains, while the Dow Jones slid somewhat. That said, futures are in the red today, perhaps driven by Amazon’s after-hour slide. The king of online retail tumbled in extended trading after its earnings results revealed weakness in cloud computing and lower-than-expected forecasts for Q1. Today, equity traders are likely to lock their gaze on the US NFP report.

.jpg)