Oil shows weakness

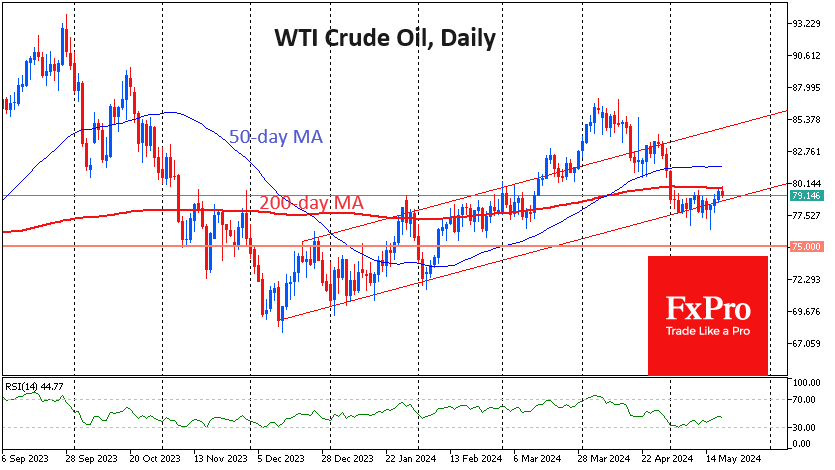

Oil is losing about ¾% of its peak on Monday, having hit a strengthening sell-off as it attempts to climb above $80/bbl WTI and $84/bbl Brent.

Interestingly, oil is declining despite the death of Iran's president, which should reinforce the risk premium, and despite a strong rally in metals and other commodities in response to China's stimulus measures.

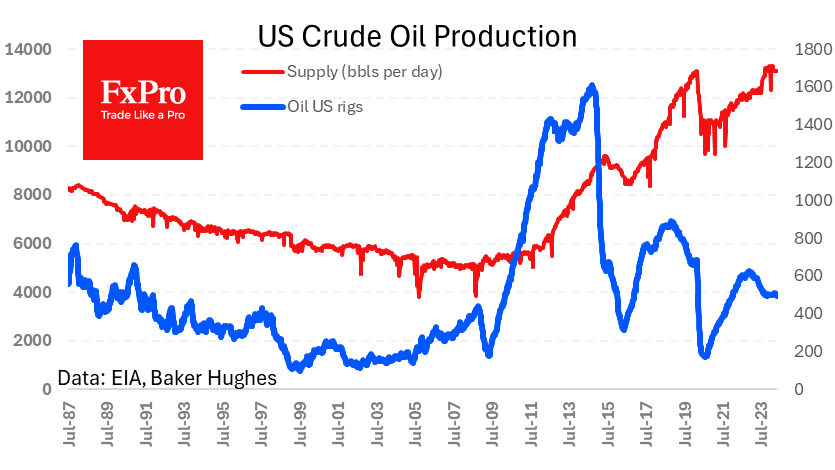

News on the US oil industry points to relative stagnation. According to Friday's report from Baker Hughes, the total number of Oil rigs in the US was 497 compared to 496 and 499 in the last two weeks. We have been seeing fluctuations around the 500 since last October.

The official weekly report from the US Energy Information Administration last week also pointed to stagnant production at 13.1 million bpd over the last ten weeks. This volume also is the average over the period since mid-September.

The conclusion is that current prices are neutral for the industry, not creating incentives to increase production but not causing it to decline either.

The price chart also shows a clear balance of power for more than two weeks now. Since December, the price has been moving in an ascending channel. Oil briefly fell out of this range last week but found buyers in the second half of last week, rising from $76.4 to $79.8 in less than three days.

The bulls are also not yet able to unequivocally retake the lead, as an attempt to exceed the 200-day moving average on Monday was met with increased selling. This may be a signal that the bears are still in control of the situation and are now gathering strength for a new downward impulse. We will get confirmation of this hypothesis only in case of consolidation under $76.5. It is also relatively easy for oil to roll back to $75, where the 200-week moving average lies. However, a failure below $70-$71 could start a real corkscrew in oil with a potential first target at $50 and a final target at $30.

The ability to get back above $80 would be a sign of a bullish recovery and set the mood for a quick exit to $85 within weeks and above $92 by mid-summer.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)