Rate cut bets boosted by surprise dip in US retail sales

Early rate cut hopes thrown a lifeline

After a string of upbeat data on the US economy, investors almost breathed a sigh of relief on Thursday when the latest retail sales numbers disappointed, calming nerves about an overheating economy. Rate cut expectations have suffered several setbacks since January amid a pushback from Fed officials and the labour market and inflation not cooling fast enough.

The continuous resilience of the American economy has prompted a sharp rethink on how aggressively the Fed will slash rates this year, with investors pricing out almost three rate cuts. But perhaps the most surprising aspect in all this has been how well markets have adjusted to the first rate cut arriving no earlier than June.

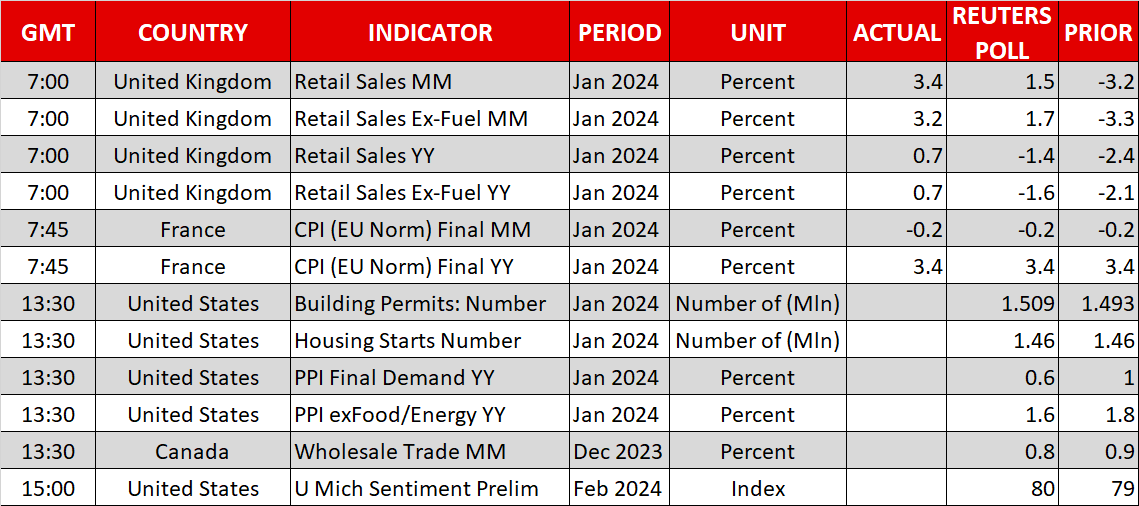

A stronger-than-expected rise in January retail sales had the potential to cast doubt on even a June cut, hence the positive reaction in stock markets to the 0.8% month-on-month slump in retail spending.

The data miss comes just hours after GDP estimates in Japan and the United Kingdom showed that the two G7 economies entered a technical recession in Q4. However, even if there are no upward revisions to the GDP data, the downturns appear to be shallow, so whilst they raise some red flags for central banks, they’re not terrible enough to spark panic.

Similarly in the US, the poor retail sales readings simply underscored that a Fed rate cut is coming at some point in 2024. Investors will next be watching the latest producer price index due later today for more clues on Fed policy.

Equity markets extend gains despite economic woes

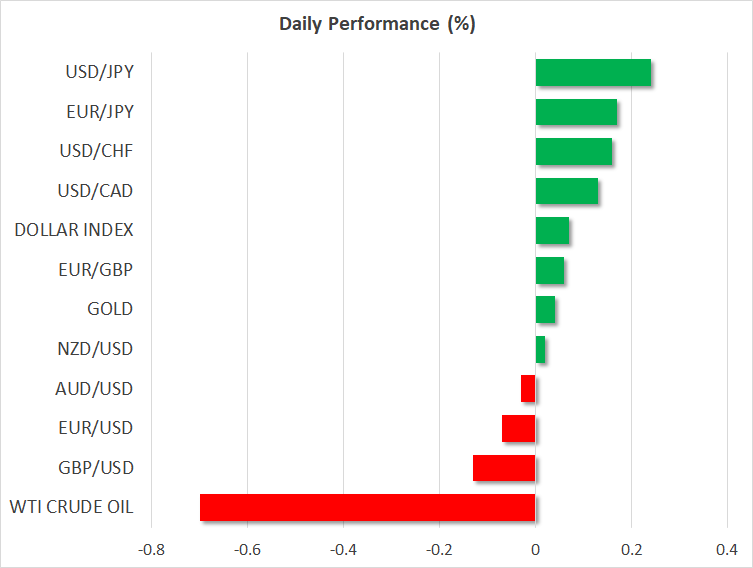

Treasury yields slipped in the wake of the retail sales report, weighing on the US dollar. But the moves were modest as Atlanta Fed President Raphael Bostic appeared unfazed by the weaker data, maintaining that it was too early to declare victory on inflation.

However, there was a stronger response in equity markets as shares on Wall Street extended their rebound from the selloff earlier in the week. The S&P 500 gained 0.6% to close at a new all-time high, but the Nasdaq lagged as tech stocks underperformed.

Nevertheless, European and Asian markets were buoyed on Friday on fresh hopes that the European Central Bank will soon cut rates while the Bank of Japan might delay a rate hike.

The Nikkei 225 index in Tokyo edged ever closer to setting a new all time high and shares in Hong Kong also jumped on local reports that there was a surge in the number of people travelling in China during the Lunar New Year holiday, pointing to an improvement in consumer sentiment.

Yen and pound slide, but euro fights off rate cut speculation

In the currency market, the Japanese yen was on the backfoot again, weakening past 150 per dollar. The yen found temporary support after yesterday’s GDP release from the latest round of intervention warnings by Japanese officials. But it likely came under pressure from comments today from BoJ Governor Ueda, as he repeated that policy would remain accommodative even after ending negative interest rates.

The pound was also down against the US dollar, failing to receive much of a lift from much stronger-than-expected retail sales figures out of the UK for January. This probably suggests that investors want to see more evidence that the economy turned a corner at the start of the year and that the recession will be a short one.

The euro, meanwhile, was only marginally lower against the greenback despite some dovish rhetoric from ECB policymakers today. Governing Council member Edward Scicluna left the door open to a rate cut before June, warning that waiting too long could choke the economy, while France’s Villeroy also upped the pressure on his hawkish counterparts by arguing against a long delay.

Even rumours that the ECB might adjust its policy statement in March to set a clear timeline for a rate cut failed to knock the euro, which last stood at $1.0764.

.jpg)