S&P 500 hits 5,000 milestone as US CPI awaited

Tech boom leads S&P 500 to new record

Shares on Wall Street extended their record streak last week as upbeat earnings as well as relief that the annual review of the US consumer price index left the inflation trend largely unchanged offset worries about the Fed keeping policy restrictive for too long.

The S&P 500 finished the week with gains of 1.4%, closing above the 5,000 mark for the first time in yet another historic milestone for the benchmark index. The Nasdaq 100, meanwhile, is about to reach a milestone of its own as it closes in on the 18,000 level.

Much of the gains in Wall Street indices are being spearheaded by the never-ending surge in Big Tech stocks, with Nvidia and Meta being the latest champions. The AI revolution has revived the post-pandemic bull market, eclipsing growing doubts about how soon the Fed will be able to start cutting rates.

With just over two thirds of companies in the S&P 500 having reported their earnings, about 75% have beaten their EPS estimates according to FactSet. Whilst this is only marginally above the 10-year average of 74%, it comes at a time when firms are battling high inflation and borrowing costs that are at more than a decade high, geopolitical tensions are elevated, and globalization has gone into reverse.

This notion that Big Tech can ride out any storm is likely what’s keeping the rally alive even as Fed officials dampen the prospect of an imminent rate cut.

Will Fed remarks and CPI data keep the positive tone intact?

That’s not to say, however, that investors have stopped paying attention to the data. Another reason why stocks have been so bullish is that a rate cut is coming at some point later this year. Hence, there was relief on Friday when the US Bureau of Labor Statistics didn’t make any significant revisions to its CPI readings in its annual review of the series.

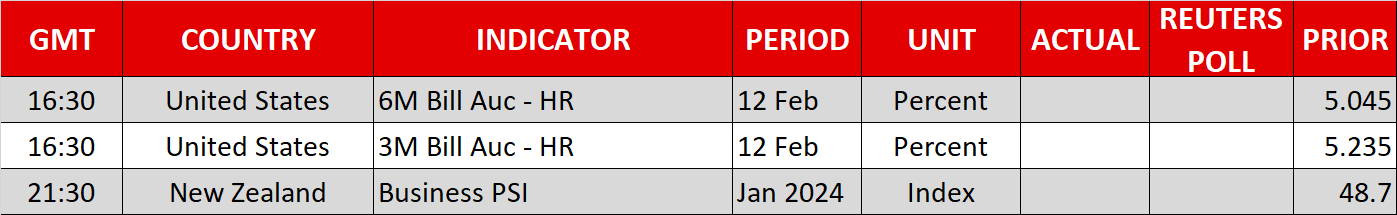

Core CPI rose by an annualized rate of 3.3% in Q4, unchanged from the previous estimate, while the month-on-month increase in December's headline figure was revised slightly lower to 0.2%. This raises hopes that there won’t be any upside surprises in tomorrow’s CPI report for January where headline inflation is expected to ease from 3.3% to 3.0% y/y.

Ahead of that, Fed officials will grab the limelight, with Governor Bowman and Richmond Fed President Barkin due to speak later today.

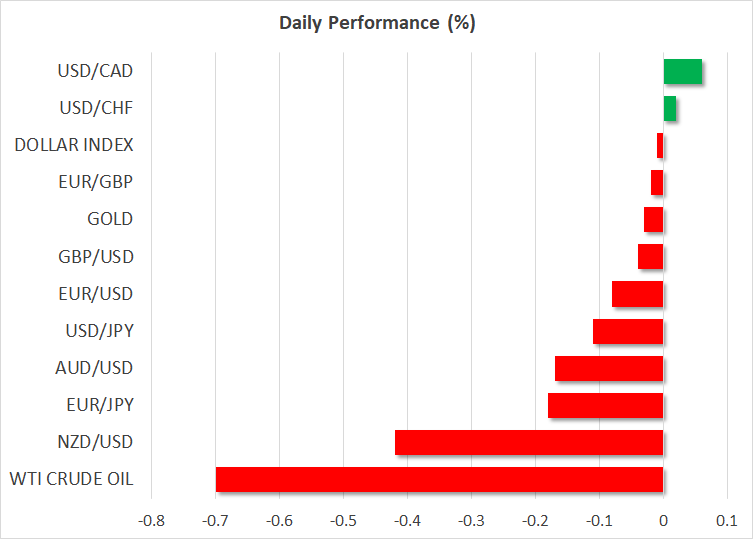

Dollar flat as yen stabilizes, pound awaits data; gold and oil slip

In the FX sphere, it’s a muted start to the week as many markets in Asia are shut today for a holiday, with those in China closed for the entire week for the Lunar New Year celebrations. The US dollar is flat against a basket of currencies after slipping earlier in the session. It seems that the rebound on the back of the repricing in Fed rate cut bets from more than six to about four and a half has run its course, at least for now.

The yen is somewhat firmer today, likely aided by a fresh warning from Japan’s Finance Minister Suzuki that he’s “watching FX moves carefully” after the currency came under pressure last week when BoJ Governor Ueda suggested that an exit from negative rates won’t necessarily mean the start of a rate hiking cycle.

The pound was steady around $1.2620 ahead of what is expected to be a very busy week for UK data releases, starting with the employment report on Tuesday.

Gold remained on the backfoot despite the bounce back in Treasury yields pausing for breath, while oil futures also slipped. It’s possible that investors still see some chance of a truce between Israel and Hamas amid the ongoing talks despite the latest attacks in Rafah by Israeli forces, and this is slightly weighing on both commodities.

.jpg)