Stalled European recovery

Investor confidence and retail sales data released on Tuesday beat average market forecasts but showed no improvement over recent months.

The Sentix investor confidence index rose from -11.1 to -8.7 in April. This is roughly where the index was in February. However, it has been in negative territory for 13 months and has shown no positive trend in the last three months.

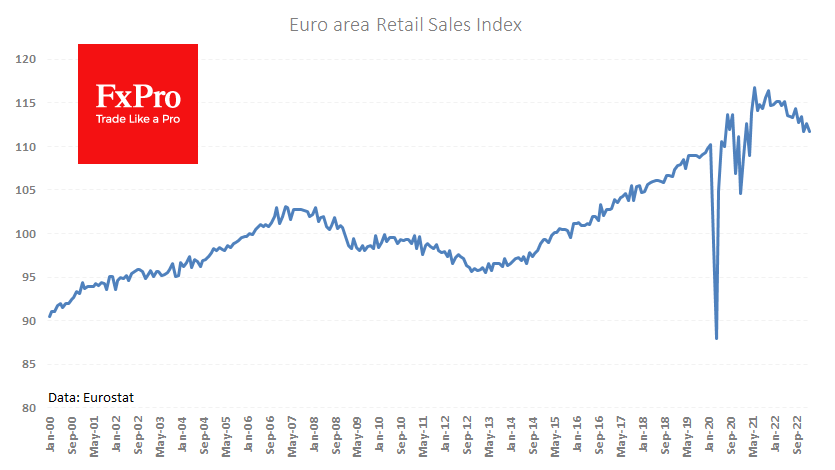

Eurostat reported that retail sales fell by 0.8% in February, after the same increase in the previous month. On a yearly basis, sales are down by 3%. The retail sales index has been downward since November 2021, breaking the long-term upward trend that began around ten years ago.

Melting retail sales and investor pessimism cast doubt on whether the ECB still needs to raise interest rates. However, everything is relative in the currency market, and expectations are now much higher that the Fed will end its hikes sooner and be the first to start easing, supporting the euro's rise against the dollar.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)