Tesla’s great identity shift: Car company or AI powerhouse?

For years, Tesla has been the face of the electric vehicle revolution. But lately, things have taken an interesting turn. The company isn’t just about making cool cars anymore-it’s making big moves in artificial intelligence and robotics. So, the big question is: Is Tesla still an automaker, or is it transforming into something entirely different?

From EV king to AI visionary?Tesla’s latest earnings report wasn’t exactly a home run. Car sales are slowing, profits are getting squeezed, and price cuts are putting pressure on margins. Yet, despite all this, Tesla’s stock keeps climbing. That’s got analysts scratching their heads. Traditionally, car companies rise and fall based on how many vehicles they sell and how efficiently they make them. But Tesla seems to be playing by a different set of rules-one that values the company more for its AI ambitions than for its actual cars.

Elon Musk has made it clear: Tesla’s future is all about artificial intelligence, self-driving tech, and even humanoid robots. He’s pushing Full Self-Driving (FSD) software as a game-changer and hyping up the Optimus robot as a future workforce revolution. Sounds futuristic, right?

The problem is, neither of these things are fully operational yet. Self-driving technology still faces major hurdles, and Optimus is more of a concept than a real product at this stage.

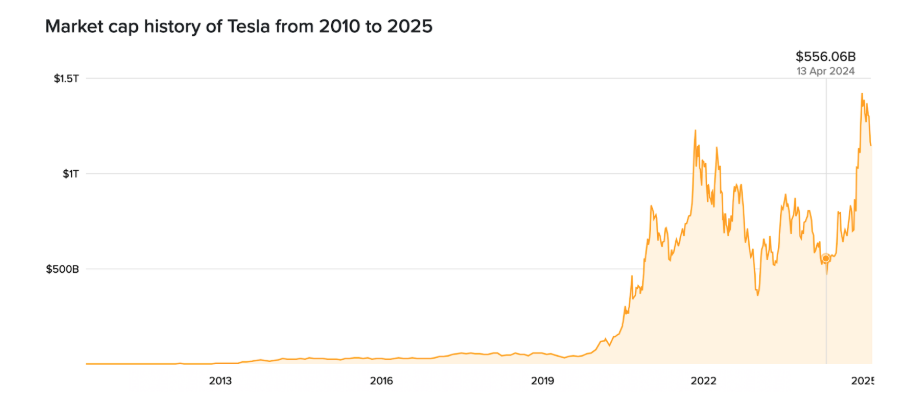

A $1.3 trillion bet on the futureDespite all the uncertainty, Tesla’s market value sits at a jaw-dropping $1.3 trillion, up from $556 billion early last year . To put that in perspective, old-school automakers like General Motors and Ford generate way more car sales, but their valuations are just a fraction of Tesla’s.

Source: Companiesmarketcap

Why? Investors aren’t just buying Tesla for its cars-they’re betting big on its AI-driven future. RBC Capital even predicts Tesla’s robo-taxi business could be worth $900 billion by 2040. That’s a bold claim, especially considering we’re still waiting for full autonomy to become a reality.

Of course, there’s always the risk that Tesla’s AI dreams won’t pan out as quickly as expected. If self-driving tech keeps stalling or if the Optimus robot doesn’t become the sci-fi miracle Musk envisions, Tesla’s stock could take a serious hit. But right now, investors are willing to play the long game.

So, where does that leave Tesla? It’s at a fascinating crossroads. It’s still an automaker, but it’s trying to become something much bigger. Whether it actually makes that leap or gets stuck in transition is the trillion-dollar question.

Technical outlook: A lasting upside?The stock is making a bounce after days of lower lows, currently hovering around the $354 price level. Upside pressure is evident with prices now towering past the 100-day moving average- a bullish signal. RSI edging up sharply around the midline adds to the bullish narrative.

The key areas to watch for buyers will be the $371 price level, a level that has held before. The next price to watch should prices breach that level will be the $400 psychological resistance level. On the downside, sellers could be held at the $320 psychological level.

Source: Deriv X

Disclaimer:

The information contained within this blog article is for educational purposes only and is not intended as financial or investment advice. We recommend you do your own research before making any trading decisions.

This information is considered accurate and correct at the date of publication. Changes in circumstances after the time of publication may impact the accuracy of the information.

The performance figures quoted refer to the past, and past performance is not a guarantee of future performance or a reliable guide to future performance.