The Crude Oil Market Relies on Demand

By RoboForex Analytical Department

As the new week in July kicks off, the commodities market is in high spirits. The price of Brent crude oil has surged to 81.00 USD per barrel. The oil sector is responding to rising global tensions, which may have adverse effects on the supply of energy resources. However, demand expectations are stable, and are driving prices upward.

There are growing concerns about the potential displacement of a portion of biofuels by oil and its derivatives, particularly amidst complications with the extension of the "grain deal." This further supports the upward trend in commodity prices.

According to Baker Hughes data, drilling activity in the US has decreased. The number of oil rigs fell by 7 units to 530, and the number of gas rigs decreased by 2 units to 131.

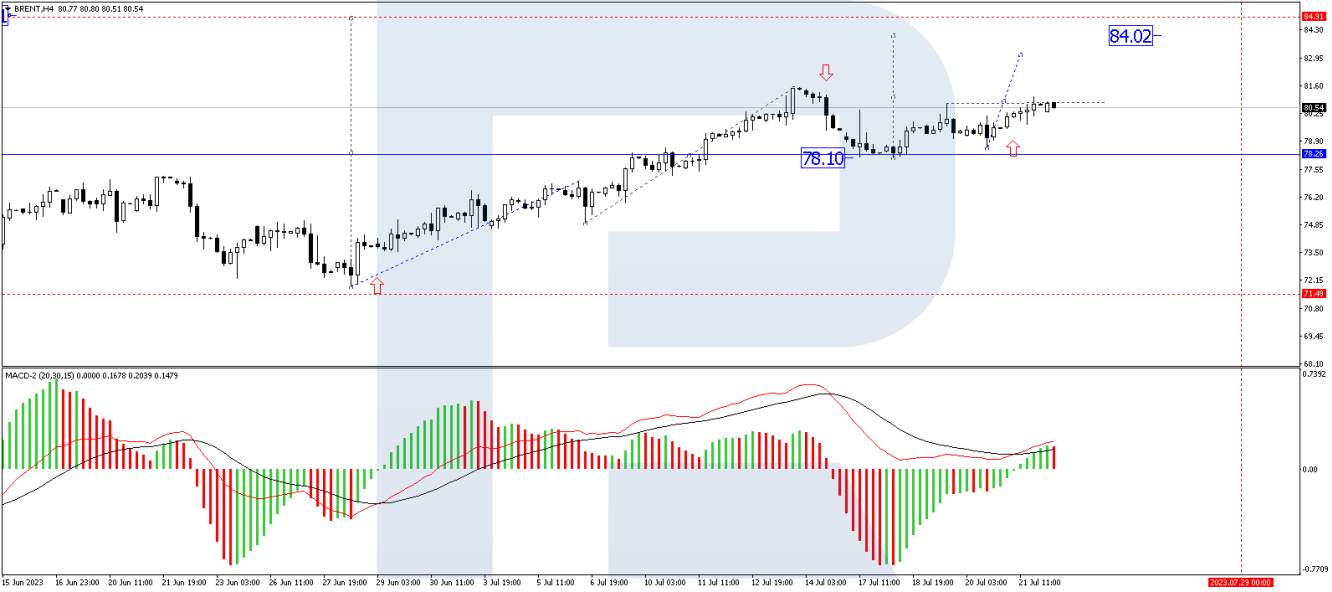

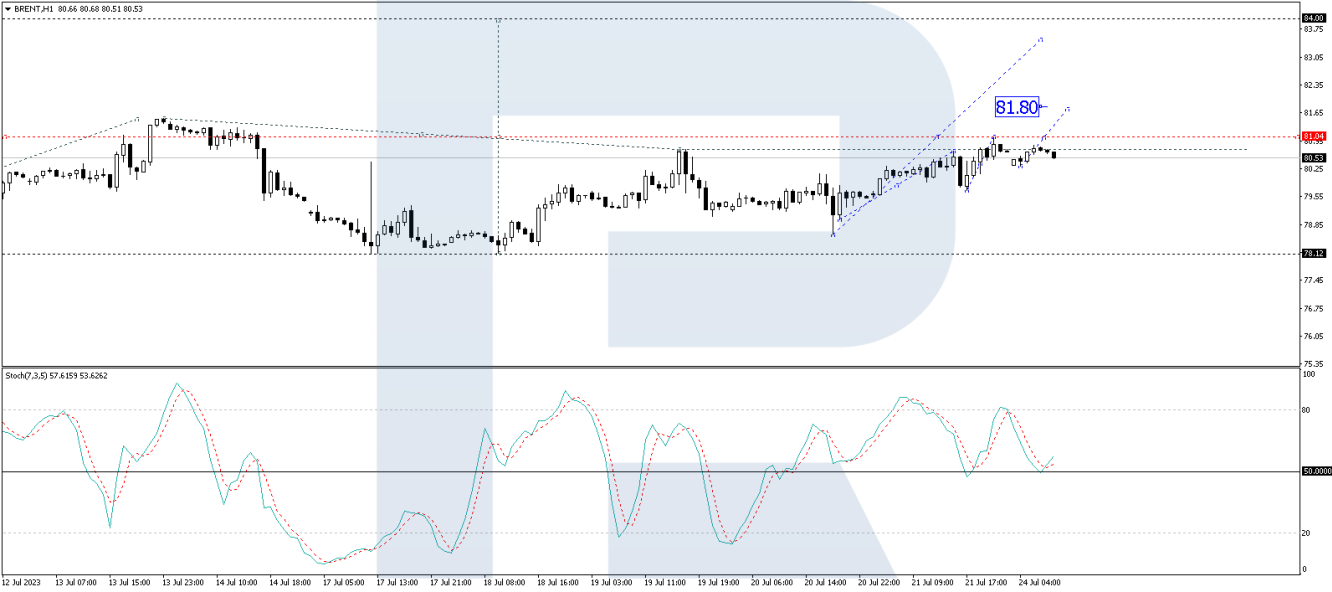

Technical Analysis of the Brent oil price chart:

On the H4 chart, Brent is currently developing a third wave of growth. Having reached 81.40 USD, a consolidation range is expected to form just below this level. A breakout above this range would likely lead to the continuation of the upward wave, targeting 81.81 USD. Surpassing this level could open the potential for further growth towards 84.00 USD, with the possibility of continuing the upward trend to 85.00 USD. Technically, the MACD indicator confirms this scenario; with its signal line above the zero mark, it is showing a clear upward direction, indicating potential new highs.

On the H1 chart, Brent completed an upward wave to 81.04 USD, followed by a correction to 80.30 USD. After the correction, an upward wave is anticipated to begin targeting 81.80 USD. This target is local. Technically, the Stochastic oscillator also supports this outlook, with its signal line above the 50 mark, indicating a readiness to continue rising towards the 80 mark.

Disclaimer Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.