The crypto market is climbing out of the hole but slowly

Market picture

The crypto market cap has fallen by 0.5% over the past 24 hours to $1.156 trillion, as it pulled back from the extremes at the start of trading on Monday. However, the market has remained positive for the past five days. Top altcoin prices ranged from a 1.7% decline (Tron) to a 4% gain (XRP) over the day.

Bitcoin failed to break above its 50-day moving average after being under pressure for most of the day on Monday. After correcting to $27.5K, the first cryptocurrency began to attract local buyers. This is a local support area in March and April, and a move higher shows the strength of the buyers.

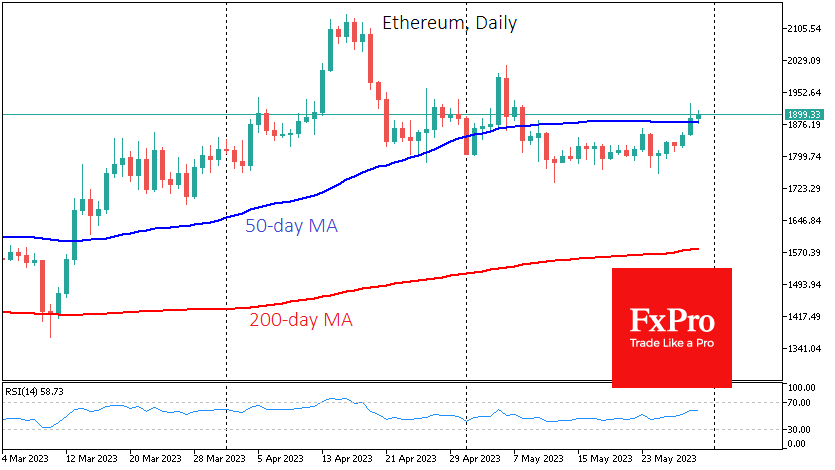

Ethereum broke through yesterday and is trying to hold the $1900 level today, also managing to stay above its 50-day average. Digital silver is coming out of the hole after a long consolidation, but only a consolidation above $2000 or even $2100 will allow further upside to be discussed.

News background

Former BitMEX CEO Arthur Hayes predicted a new Bitcoin rally by 2024 with a renewal of historic highs, which is unlikely to happen this year. He believes the 2024 halving will primarily drive BTC's growth.

Asset management firm VanEck predicts that Ethereum will reach $11,850 by 2030, and with favourable development, ETH will be worth $51K. The forecast assumes that Ethereum will become the dominant global network for large corporate payments.

The bill agreed in the US to raise the national debt ceiling makes no mention of a 30% tax on mining. The initiative, proposed in early May, was positioned as a measure to minimise the impact of climate change.

The European Commission will prepare legislation for the digital euro in June 2023, ECB Governing Council member Fabio Panetta said. The document will only be given final approval by the ECB's Governing Council in October, after which preparations will begin for the introduction and initial testing of the technology.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)