UK Chancellor Hunt and BoE Governor Bailey to speak at Mansion House dinner

OVERNIGHT

Stocks across the Asia-Pacific region are trading soft following signs that China’s economy may be set to experience a bout of deflation. The latest CPI inflation report showed 0.0% annual inflation in June, while PPI data – a gauge of pipeline price pressures – moved further into deflationary territory, -5.4% y/y from -4.6% y/y previously.

THE DAY AHEAD

Over the past week, market expectations for central bank policy rates continued to move higher. In particular, UK interest rates are predicted to reach 6.5% by early 2024, while US interest rates are also forecast to peak at a higher level. The release of a hawkish set of Minutes to the US Federal Reserve’s last policy meeting reinforced the message that June’s pause in US interest rates is likely to prove very short-lived. Meanwhile, a further drop in the unemployment rate alongside a stronger-than-expected rise in pay growth in the latest US labour market report are likely to have done little to ease concerns about inflationary pressures despite the rise in payrolls being less than expected. While a 25bp rise at the July meeting is viewed as almost a done deal by markets, they are sceptical as to whether the Fed will follow up with a successive rise at the September meeting. Over the course of today, a number of Fed officials are due to speak – including Barr, Daly, Bostic and Mester – and a lot of attention will be on whether they signal any potential concern to recent data that may indicate a greater risk of the Fed hiking at the September meeting.

There is a dearth of key data releases today with only the Eurozone Sentix investor confidence survey due. Domestically, UK Chancellor Hunt and Bank of England Governor Bailey will address business leaders at the annual Mansion House dinner this evening. The text of Governor Bailey’s speech will be published at 16:00 BST, but it is not clear how much he will focus on the monetary policy outlook.

As the next Bank of England policy meeting draws near, key UK data releases are likely to play a crucial role in determining what action is taken. Early tomorrow morning, the final UK labour market report before the August MPC meeting is released. In tomorrow’s release, we forecast a further acceleration in the rate of overall pay growth, from 6.5% to 6.8%, while regular pay growth is forecast to remain above 7% for a second successive month. Those numbers will probably still be seen as uncomfortably high by most Bank of England policymakers. We do expect a moderation in the pace of employment growth to provide more tentative evidence that the labour market may be starting to roll over. But with the unemployment rate expected to be unchanged at 3.8%, the labour market still looks uncomfortably tight.

MARKETS

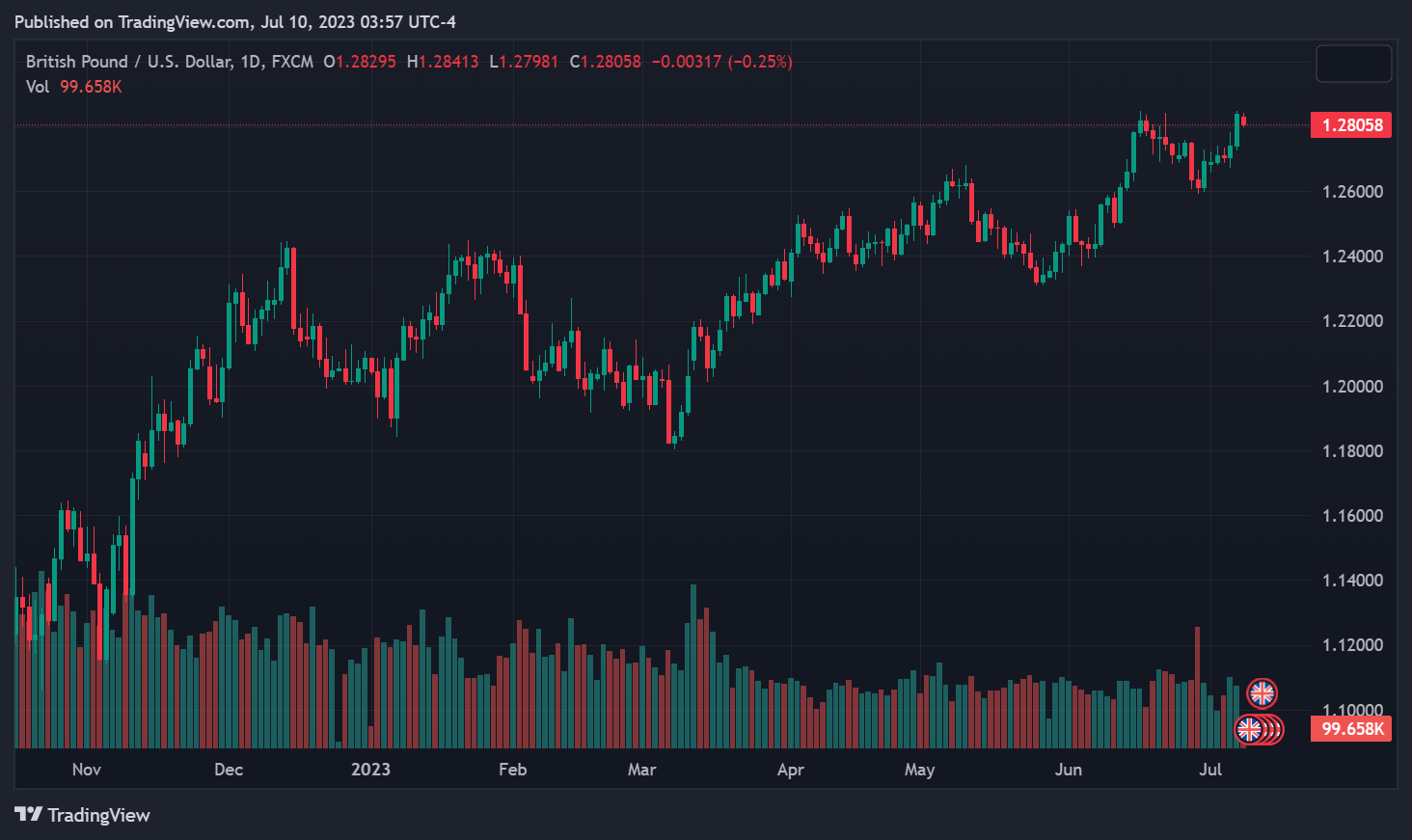

The US dollar is trading stronger across most of its major peers, reversing some of the moves seen on Friday post the ‘mixed’ US labour market report. GBP/USD and GBP/EUR, however, remains above 1.28 and 1.09 respectively.