US and China agree to slash tariffs, dollar and stocks surge

US hails ‘substantial progress’ in China trade talks

Weekend talks between the United States and China in Switzerland ended with ‘substantial progress’, as both sides reached a deal to cut tariffs on each other’s goods for 90 days. The temporary reprieve comes as Washington and Beijing attempt to diffuse tensions over trade that’s roiled markets and stoked fears of a global recession.

The trade war reached a boiling point on ‘Liberation Day’ when the Trump administration announced reciprocal tariffs on all countries, with those on China rising to 145% in tit-for-tat moves. The weekend deal will lower the tariffs by 115%, meaning China will now charge 10% levies on US goods while Chinese imports coming into the US will be taxed at 30%, as the 20% fentanyl tariff still applies.

The agreement is far better than the reports prior to the talks that President Trump was willing to see tariffs come down to 80%. More importantly, the mood music from China following the talks has also vastly improved, allaying concerns that the optimism was one sided.

US Treasury Secretary Scott Bessent, who headed the US delegation together with trade representative Jamieson Greer, described the talks as “productive”. The question now is whether or not the two sides will be able to come to a more permanent agreement and if this can be done within the 90-day period.

Markets cheer trade war thaw

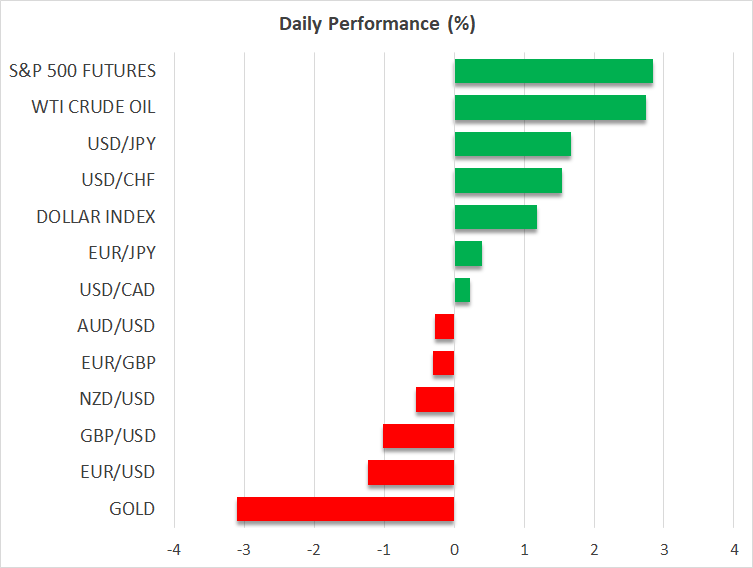

S&P 500 futures opened Monday’s session with a gap up, surging by about 2.5%, while Nasdaq futures are more than 3% higher. However, the gains across Asian and European markets are much more muted, as a selloff in pharmaceutical stocks is dragging global equities lower. It comes after Trump posted on social media that he will sign an executive order on Monday, forcing the drug giants to cut prescription prices by as much as 80%.

Potentially, though, there’s also likely to be some uncertainty as to the timeline of how quickly final deals not just with China, but also with other major trading partners such as the European Union and Japan, can be reached.

Moreover, following the US-UK deal that seemed to favour America much more than Britain, it’s doubtful if other nations will be willing to put pen to paper so readily. That doesn’t appear to be the case for Switzerland, as the country has agreed with the US to accelerate trade talks, putting it on course to reach a deal before the EU does.

Dollar fights back as Fed bets pared

The Swiss franc has been the preferred safe-haven currency of choice during the trade turmoil and its status could further be elevated if a deal can be struck swiftly. But today, there is only one star that is shining and that is the US dollar.

The greenback is enjoying its strongest day since November against a basket of currencies, rising the most versus the Japanese yen. The euro is back below $1.12 and sterling below $1.32.

With trade tensions continuing to de-escalate and the White House eyeing up trade deals with a number of countries, investors are paring back their bets of how many times the Fed will cut interest rates this year. At the height of the trade war in April, markets were expecting the Fed to slash rates by at least 100 basis points, but those odds have declined dramatically during May and now stand at just 57 bps.

Fed Chair Jerome Powell reaffirmed his wait-and-see stance at last week’s FOMC meeting. But following the deals with the UK and China since then, investors will be hoping for any signs that Powell is less worried about inflation when he speaks on Thursday. Ahead of that, the April CPI report will be watched on Tuesday.

Gold sinks on China progress

The growing optimism that the worst of the trade conflict is behind us hasn’t been too kind to gold, however. The precious metal has slumped by almost 3% today, hitting an intra-day low of $3,215.76. Interestingly, gold appears to be forming a double top pattern, possibly suggesting that prices have peaked as trade frictions only de-escalate from hereon.

The geopolitical headlines have also not been supportive of gold lately, as the US and its European allies are pressuring the Ukrainian and Russian leaders to hold direct talks to end the war in Ukraine. Meanwhile, India and Pakistan have agreed to a ceasefire amid the flare-up of fighting over Kashmir.

Oil futures, on the other hand, are rallying today on the back of the recovery in risk appetite.

.jpg)