US indices: Is Bad News Still Good News?

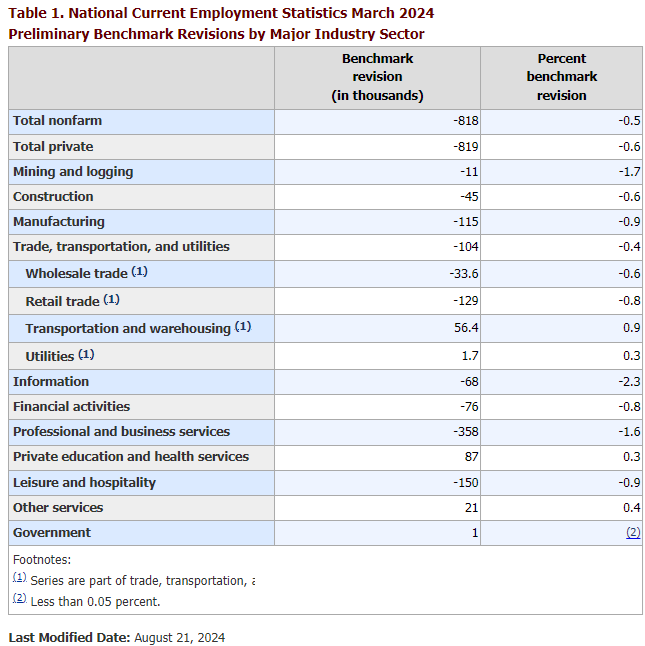

The US Bureau of Labour Statistics (BLS) revised its employment data for the 12 months to March, cutting its estimate of the number of people employed by 818K or 0.5%. Investment bank forecasts had predicted a drop of 600-1000K. This revision led to a mixed reaction from the market and commentators.

Over the past year, weak economic data, be it inflation or the labour market, has led to optimism in equity markets and brought the starting point for monetary policy closer. However, this pattern changed in July, first with a weak inflation report and then a weak employment report raised fears of an economic slowdown.

Now, the labour market picture (although the official data has not changed yet) looks even weaker, which should increase market participants' fears. However, they prefer to rely on how the Fed will take this information, especially during the Jackson Hole speech on Friday.

We tend to think that the positive reaction to weak data is not a permanent anomaly. The expectation of lower rates due to slowing demand and a weak labour market is bad news for markets, although, on the surface, it produces the same result as lower rates due to normalising inflation.

The dollar's reaction is less questionable. The dollar tends to fall six months before and six months after the start of an easing cycle. The peak in the dollar index in April, with an expected decline in September, fits well with the historical pattern.

However, this pattern works under normal conditions. The financial meltdown brings back interest in the dollar as a safe haven. This requires a 'black swan' event, which has not yet occurred. It seems that only buybacks are providing demand in the equity market while real demand for risk is waning.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)