Volatility returns with a vengeance ahead of key US events

Month-end pushes stock indices in the red

The recent, relatively quiet, market sessions were interrupted yesterday, with a strong correction recorded in both equities and gold. Profit-taking, month-end reallocations and concerns about AI investments, despite both Microsoft and Meta Platforms beating earnings expectations, resulted in a sea of red.

It was the first negative monthly performance for US indices since April. It is also the first time since early August that both the S&P 500 and Dow Jones indices are close to recording two consecutive weeks in the red. However, equity bulls could try to take advantage of this weakness and prepare for the customary Santa rally into year-end.

In the meantime, gold quickly lost $50 yesterday before recovering around the $2,750 level. Apart from the headlines that Israel is discussing a US-proposed ceasefire with Lebanon, there has not been a development that could fully justify this reaction, particularly with the US presidential election and the next Fed meeting being around the corner. Gold continues to enjoy a 33% rally in 2024, its strongest yearly performance since the 31% increase of 2007.

Yesterday’s market reaction was also a wake-up call for the big events on our radar. Volatility is expected to rise further, making trading a bit more adventurous and challenging than usual, starting with today’s crucial US jobs report.

US jobs report in the spotlight

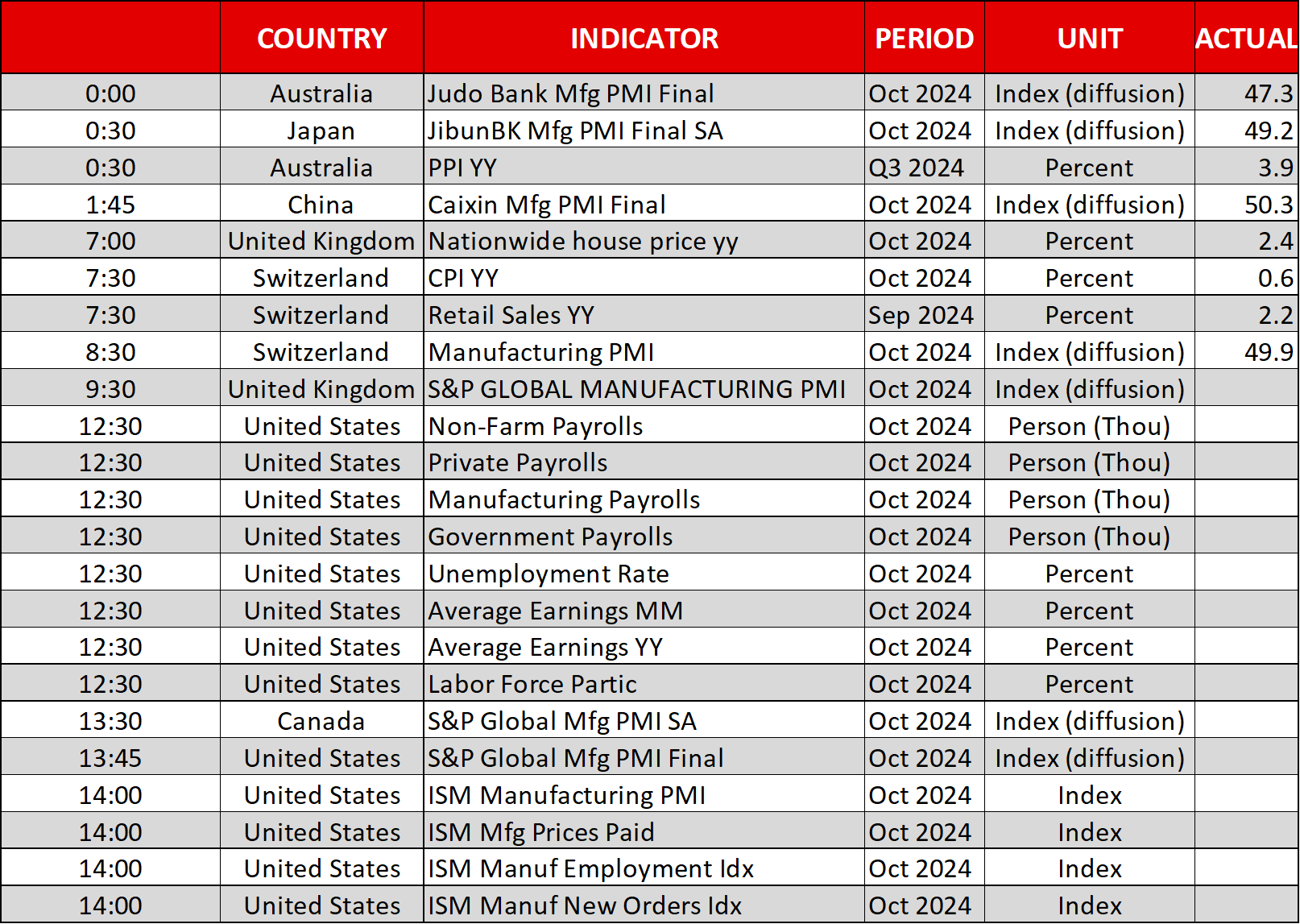

At 12:30 GMT, the non-farm payrolls figure is forecast to show a 113k increase, following the sizeable 254k rise in September, with both the unemployment rate and average earnings growth expected to remain stable at 4.1% and 4% respectively. There is a small possibility of this data being affected by the recent Hurricane Helene, with decent revisions announced in early December.

The Fed is meeting on November 7, and, assuming an eventless election process on Tuesday, Chairman Powell et al will debate on the progress made since mid-September. Another 25bps rate cut looks secure at this stage, but, considering the mid-October commentary from certain Fed hawks, a non-farm payrolls print above 250k could really complicate next Thursday’s discussion.

The dollar did not benefit from the month-end reaction

Quite oddly, the US dollar did not benefit from Thursday’s market reaction. Euro/dollar is currently trading a tad below 1.0900, as the euro bulls are desperately trying to maintain their post-CPI gains. The ECB's rates outlook has not changed much, but the market is less confident that a 50bps rate cut could be an option in December.

November is usually a strong month for the dollar, particularly against the yen. Yesterday's slightly more hawkish appearance from BoJ Governor Ueda has apparently played a key role in pausing the recent dollar/yen rally. The market is assigning a 73% probability for a 10bps rate hike in December, but the political instability following the recent general election could potentially force the BoJ to further postpone its next rate hike until January.

Meanwhile, the positive Caixin Manufacturing print from China has not helped the aussie against the dollar. The bearish trend from the September 30 peak remains firmly in place, even though the RBA is not expected to cut rates soon. This means that another hawkish show by the RBA on Tuesday, ahead of the US election, could provide a small boost to the aussie.