Weaker Yen helped Japan return to a trade surplus

Weaker Yen helped Japan return to a trade surplus

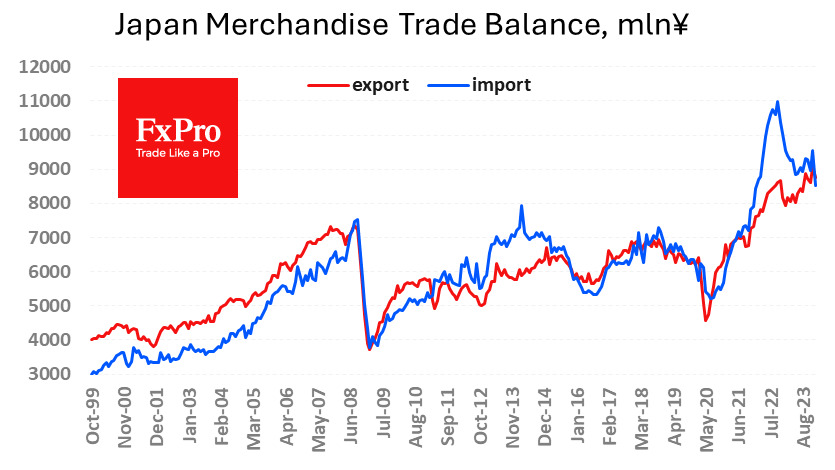

The impact of the Yen's fluctuations was evident in the country's latest external trade report.

On a seasonally adjusted basis, January recorded the highest surplus in three years. The 235B yen ($1.57B) surplus of exports over imports represents 1.3% of total turnover - a fraction of the 11% the country enjoyed 20 years ago.

Yen's demise started in March 2022, and in the following year, there was a twist in trends when a decline in imports accompanied growth in exports. The first half of this dynamic is less dependent on Japan, as imports are largely commodities and energy, which are driven by global trends.

Exports, on the other hand, have been rising steadily since last January. The latest data show an 11.9% y/y increase in exports, while imports fell by 9.6% y/y.

The trade surplus is a supportive factor for the Yen. However, traders must also factor in the Bank of Japan's ultra-loose monetary policy, which makes the Yen attractive to the carry trade that weighs on the exchange rate during periods of economic growth.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)