Why Oil prices might be a rollercoaster ride this summer

Summer’s here, and with it comes the usual buzz around oil markets. But this year, the vibe is less “sunshine and stability” and more “brace yourself”. Supply stories are heating up – think Chevron’s exit from Venezuela, Canadian wildfires, and OPEC+ sitting on its hands. Meanwhile, demand? Still nursing a lie-in, despite the arrival of peak driving season.

Geopolitics isn’t helping either. From nuclear deal whispers to trade chess games and sanctions smoke, there’s plenty to keep traders twitchy.

In short, the oil market isn’t giving us a clear signal. It’s poised to lurch - in any direction, at any moment. Time to strap in.

Supply disruptions: A bit of everything, all at once

In Venezuela, Chevron’s been shown the door and can no longer ship crude from the country. That’s a direct supply cut to the US, which now has to go barrel-hunting - most likely in the Middle East. That’s not just an inconvenient re-route; it’s a fresh layer of geopolitical risk.

Then there’s Canada. Wildfires are threatening oil sands output, and while it’s not critical yet, it wouldn’t take much for the situation to tighten significantly, especially if demand suddenly wakes up (spoiler: not quite there).

And OPEC+? They’ve turned up, smiled politely, and done… nothing. No cuts, no hikes, just a vague nod to “we’ll see about July”. There’s a follow-up meeting slated for Saturday 31 May, where a smaller group might agree to a modest increase. But given the group’s recent compliance struggles, any promise of more barrels is still very much up for debate.

Demand’s in no rush either

Now, over to demand or the lack of urgency on that front.

Summer usually means more fuel burn, especially in the US where cross-country drives and holiday flights spike petrol use. But so far? Not much to write home about. Stockpiles are still chunky, and early signs suggest this season might be a bit of a slow starter.

China’s not helping either. Hopes were high for a strong post-COVID comeback, but so far, it’s been more fizzle than fireworks. Patchy industrial activity and lukewarm growth are leaving a noticeable dent in global demand projections.

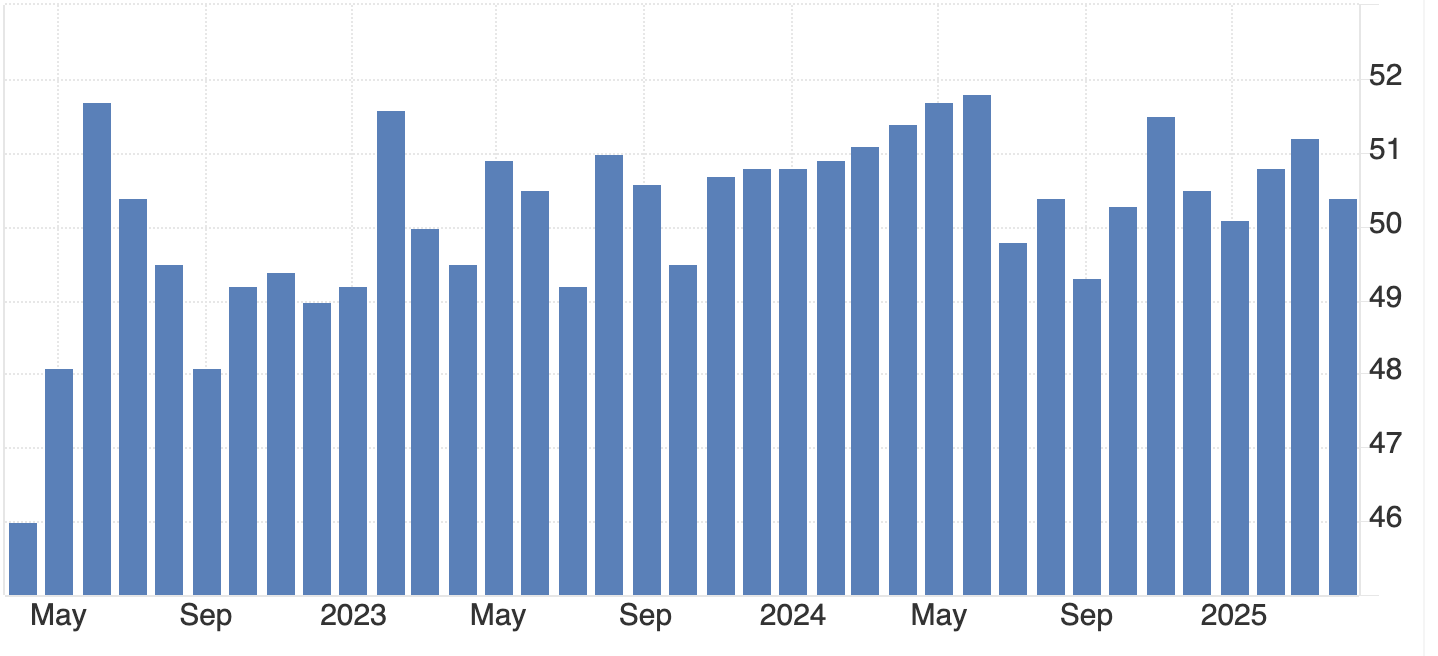

Source: S&P Global, Trading Economics

So yes, demand isn’t dead, but it’s hardly sprinting toward $90 oil either.

Politics, as usual, could steal the show

When the fundamentals are this fuzzy, oil markets tend to tune in to political noise. And right now, there’s plenty of it.

The US and Iran are flirting with a revived nuclear deal. If they actually sign on the dotted line, still a long shot, Iranian oil could flood back into the market fast - a potential game-changer.

Elsewhere, the EU and US seem to be patching things up. If that détente trickles into stronger trade and economic activity, we might see a modest boost to demand.

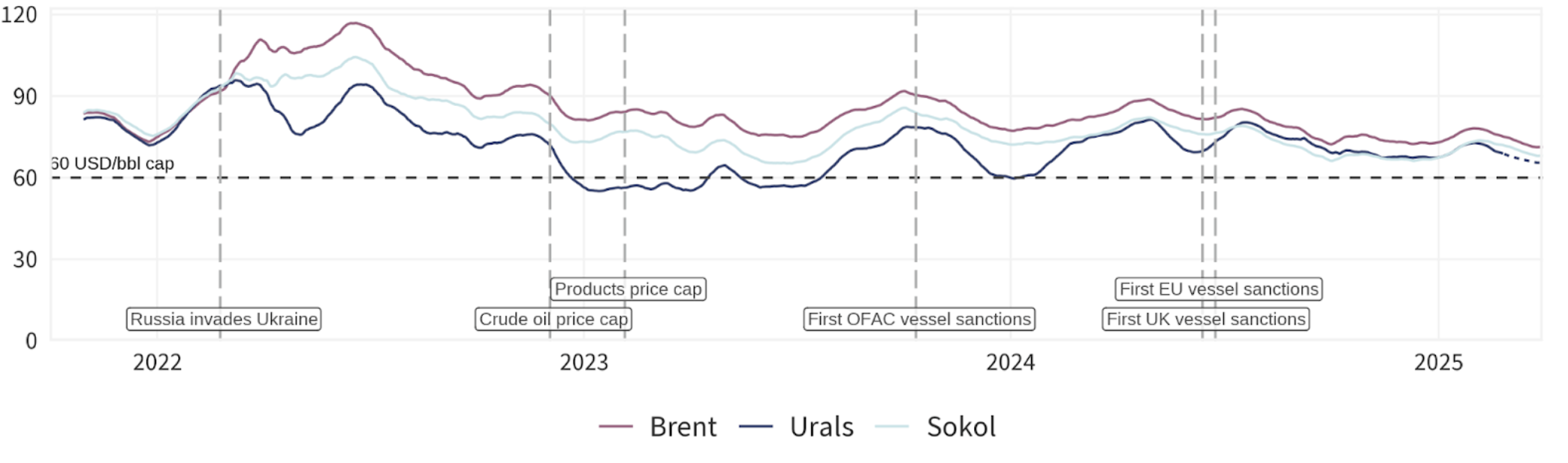

And let’s not forget the ever-complicated case of Russian oil. Despite sanctions and dramatic headlines, Russia’s exports have held up surprisingly well.

Source: CREA

But any new penalties or enforcement clampdowns could easily jolt supply all over again.

So… What should we expect?

In plain English: volatility.

Prices could spike on a supply shock, an OPEC+ surprise, or a geopolitical curveball. Just as easily, they could plunge if Iranian oil re-enters the mix, demand stays sluggish, or stockpiles swell.

This market isn’t shouting “bullish” or “bearish” - it’s whispering both, often at the same time. It’s emotional, reactive, and headline-prone.

This is why, if you’re watching oil this summer, don’t expect a tidy trend. Expect drama.

Oil technical insights

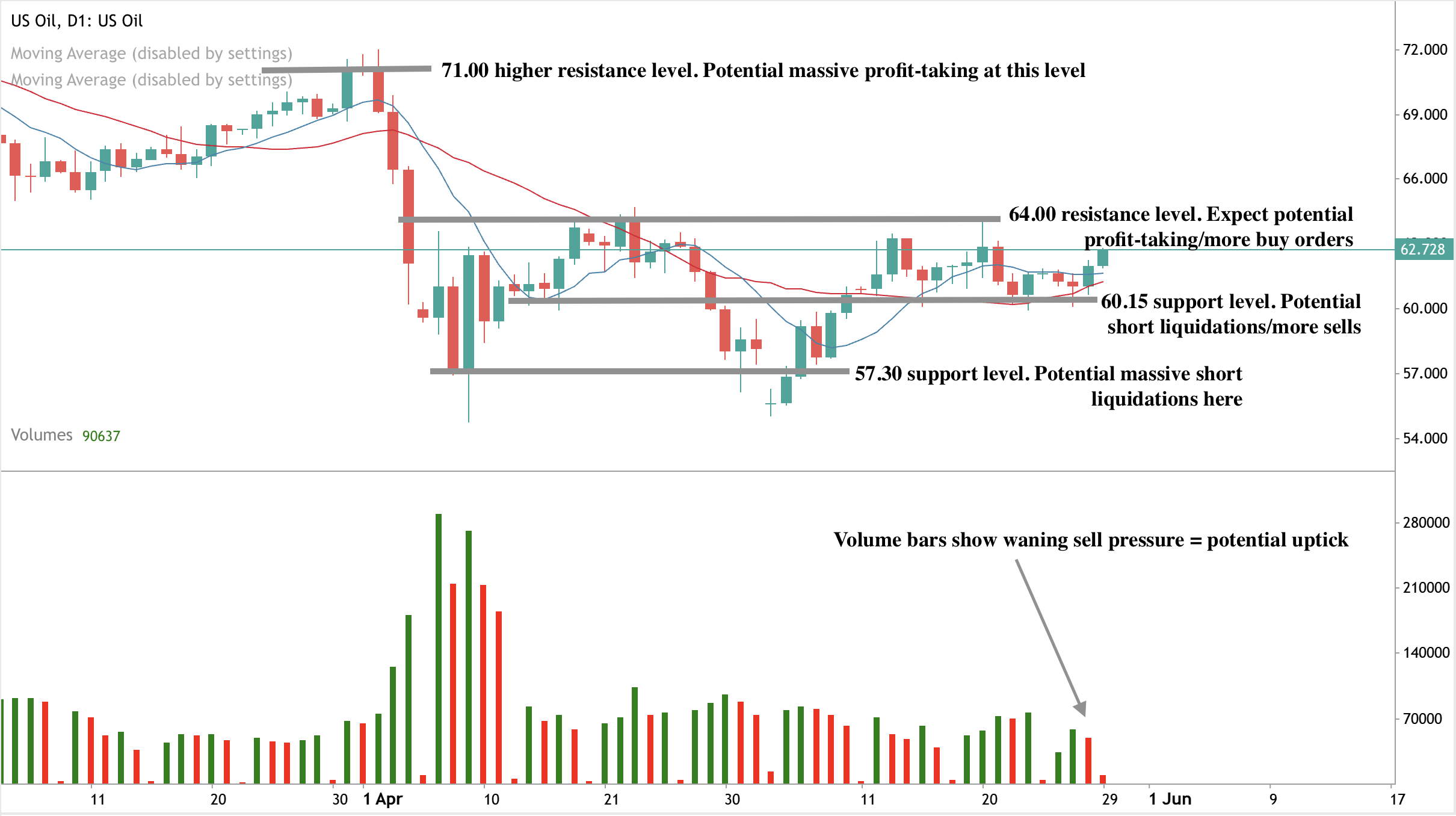

At the time of writing, we are seeing a significant surge in oil prices within a sell zone - hinting at a potential drawdown. However, the volume bars paint a picture of declining sell pressure, setting the stage for a potential price uptick. Should prices see a further uptick, we could see prices held at the $64.00 resistance wall.

A major uptick could see prices find a ceiling at the $71.00 price level. In contrast, if we see a slump within the sell zone, prices could find support floors at the $60.15 and $57.30 support levels.

Source: Deriv MT5

Disclaimer

The information contained within this article is for educational purposes only and is not intended as financial or investment advice. We recommend you do your own research before making any trading decisions.

This information is considered accurate and correct at the date of publication. Changes in circumstances after the time of publication may impact the accuracy of the information.

The performance figures quoted are not a guarantee of future performance.