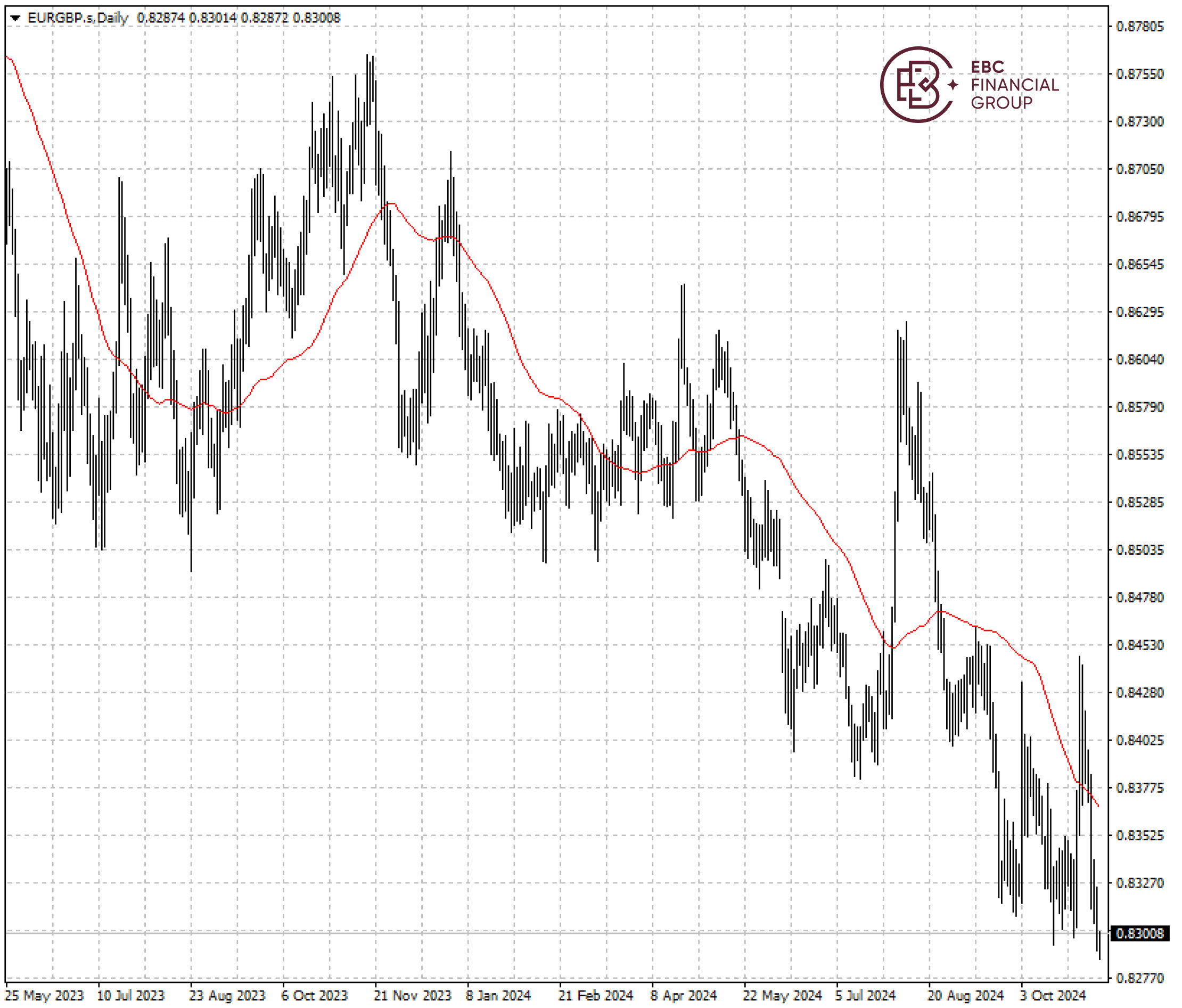

EBC Markets Briefing | Sterling drifts higher against euro on policy rate bets

Sterling perched at its highest level in more than 2 years against the euro on Monday as investors bet the ECB would follow a faster monetary easing path than the BOE.

The BOE cut interest rates last week for the second time within the year and said future reductions were likely to be gradual, as it predicted government's first budget would lead to higher inflation and economic growth.

British companies are locking in currency hedges for longer in October, driven by the pound’s surge and concerns that global geopolitical uncertainty will spur more volatility.

Chancellor Rachel Reeves announced one of the biggest fiscal loosenings in decades, unveiling a borrowing splurge that is likely to force the BOE to expect higher inflation in the years ahead.

The eurozone economy is likely to be hit harder than the UK's if Donald Trump implements higher tariffs when he takes office on 20 Jan.

That could push the ECB to cut rates faster than predicted. Former ECB President Mario Draghi urges EU reforms to bridge the tech gap and calls for a united stance in trade talks with the US.

The euro traded below 50 SMA against the pound with few signs of strengthening. A major support level to watch is the low around 0.8202 hit in March 2022.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.