Markets on edge ahead of pivotal events

US equities post new all-time highs

US equity indices posted another strong session on Monday, capitalizing on weekend developments and recording fresh all-time highs. Risk appetite remains supported, as the upcoming Fed gathering, the pivotal Trump-Xi meeting and key earnings releases from US tech giants have created a positive mood in equity markets, completely ignoring the continued US federal shutdown and its economic impact.

Investors are discounting risk-positive outcomes from these events, which means that any likely disappointment could prove market-moving. Specifically, the Fed is expected to cut rates by 25bps and keep the door wide open for a December rate cut, which is now seen as almost certain, with a 98% probability assigned to such an event.

Similarly, markets are anticipating a flamboyant meeting between presidents Trump and Xi, confirming the improvement in their trade relations by signing a basic agreement that is expected to address the rare earth disagreements for the foreseeable future. That said, given Trump’s explosive rhetoric and style and the two superpowers’ diverging interests, further flare-ups should not be excluded down the line.

Notably, Trump and Japan’s new Prime Minister Takaichi signed earlier today an agreement about the supply of rare earths metals, aiming to limit China’s dominance in the field and weaken its leverage in the current negotiating round.

Additionally, markets are preparing for the earnings releases from Microsoft, Alphabet and Meta after Wednesday’s market close. A strong set of results, with AI investment gradually boosting their profits, could prove a boon for equity markets.

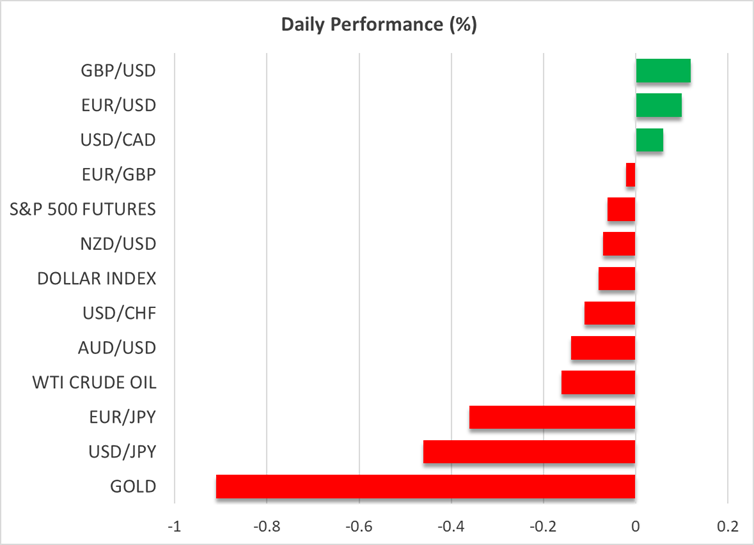

Gold correction persists, oil follows suit

The strong positive correlation between equities and gold has broken down, as the precious metal remains under selling pressure. It is trading above $3,900 at the time of writing, down 11% from its recent all-time high. Notably, the pace of the sell-off is almost identical to the pace of rally that led gold to the $4,381 high Hence, the key question is whether something has fundamentally changed for gold?

To be fair, this correction was long overdue, with the precious metal climbing around 27% since late August, when it broke out of its May-August range-trading. That said, central bank demand is expected to remain strong, with gold continuing to benefit from risk-off episodes. Investors, though, appear unwilling to catch a falling knife and are waiting for the first key battle between bulls and bears, which could take place in the $3,840-$3,880 zone.

Contrary to gold, the oil market is once again exhibiting a positive correlation with equities after months of moving in the opposite direction. That said, oil’s bounce higher after meeting strong support at the $56.50 area appears to have paused.

Oil is trading north of $60 as, like gold, the fundamental picture has not dramatically changed. Despite Ukrainian President Zelenskyy’s remarks about more actively targeting Russian oil refineries and infrastructure, the OPEC+ alliance’s intention to increase again its production quotas and the fragile economic outlook appears to keep a lid on oil prices.

Dollar is on the back foot again

Following a decent period of posting gains across the board, the greenback is under pressure again, with euro/dollar trading around 1.1650. The improved risk appetite is taking a toll on the dollar, losing ground particularly against the yen.

With US President Trump treated like a celebrity in Japan and Takaichi preparing to recommend him for the Nobel Peace Prize, along with a detailed discussion on the agreed Japanese $550bn investment in the US, the yen has managed to catch a break after strong selling pressure. Interestingly, a double top pattern appears to be forming in dollar/yen, but a drop below the 149.37 neckline, serving as confirmation, is necessary to validate this structure.

.jpg)